C&C Group se v fiskálním roce 2025 vrátila do zisku díky rostoucí poptávce po pivu Tennent’s a cideru Bulmers.

Irská nápojová společnost ve středu oznámila, že její zisk před zdaněním za rok končící 28. únorem činil 19,6 milionu eur, zatímco v fiskálním roce 2024 zaznamenala ztrátu před zdaněním ve výši 111,6 milionu eur.

Čisté tržby za dané období vzrostly z 1,65 miliardy eur na 1,665 miliardy eur.

Upravený zisk před úroky, daněmi, odpisy a amortizací – preferovaný ukazatel ziskovosti skupiny – vzrostl na 112 milionů eur z 93,7 milionů eur v předchozím roce.

Dvě značky C&C, Tennent’s a Bulmers, získaly podíl na trhu, zatímco Matthew Clark Bibendum získal zpět zákazníky, jejichž počet vzrostl o 8 %, uvedla skupina.

Výsledky za aktuální fiskální rok jsou povzbudivé a skupina neočekává pokles, dodala.

Společnost kótovaná na londýnské burze zaúčtovala mimořádný náklad před zdaněním ve výši 36,3 milionu eur, který podle ní pochází převážně z jednorázových nákladů na restrukturalizaci a reorganizaci a z odborných poplatků souvisejících s nesprávnými údaji v účetnictví zjištěnými ve fiskálním roce 2024.

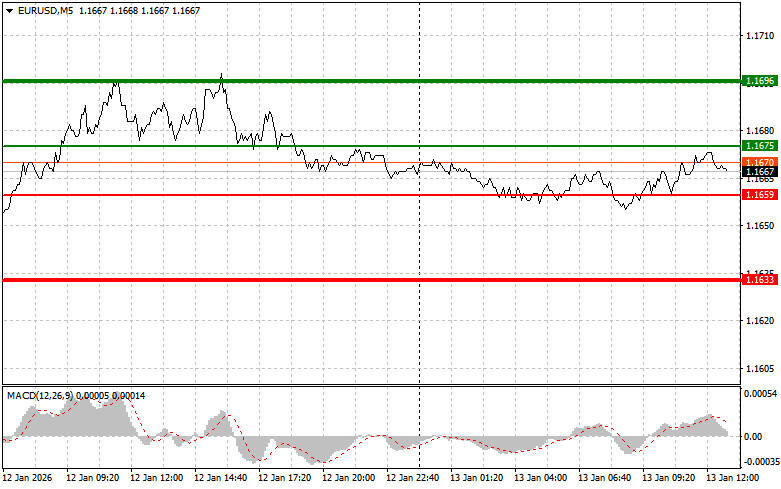

Trade Review and Trading Advice for the Euro

The test of the 1.1668 level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's further upward potential. For this reason, I did not buy the euro. A second test of 1.1668, when the MACD was already in overbought territory, allowed Sell Scenario No. 2 to play out. However, as you can see on the chart, the pair ultimately failed to post a significant decline.

The lack of statistical data from the eurozone had a noticeable impact on EUR/USD price fluctuations and prevented the euro-selling scenario from fully materializing. In the absence of key economic indicators, market participants shifted their focus to news from the United States. Later today, US Consumer Price Index (CPI) data for December will be released, including core CPI, which excludes food and energy prices. These indicators are closely monitored by the market, as they provide important signals about inflation levels. A rise in CPI could prompt the Federal Reserve to maintain a more restrictive stance, while softer readings could ease pressure and give the regulator more room for further rate cuts.

In addition, a speech by FOMC member Alberto Musalem is scheduled. The market will carefully analyze his comments regarding the current economic situation, inflation outlook, and the Fed's next steps. Any hints of a policy shift could trigger volatility in the financial markets.

As for intraday trading, I will primarily rely on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

Today, buying the euro is possible near the 1.1675 level (green line on the chart), targeting a move toward 1.1696. At 1.1696, I plan to exit the market and also consider opening short positions in the opposite direction, aiming for a 30–35 point move from the entry point. A strong upward movement in the euro is more likely if US inflation declines.

Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

I also plan to buy the euro today if there are two consecutive tests of the 1.1659 level while the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal to the upside. In this case, growth toward the opposite levels of 1.1675 and 1.1696 can be expected.

Sell Signal

I plan to sell the euro after the price reaches the 1.1659 level (red line on the chart). The target will be 1.1633, where I intend to exit the market and immediately open long positions in the opposite direction, aiming for a 20–25 point rebound from that level. Selling pressure is likely to return if inflation increases.

Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

I also plan to sell the euro today if there are two consecutive tests of the 1.1675 level while the MACD is in overbought territory. This would cap the pair's upward potential and trigger a reversal to the downside. A decline toward the opposite levels of 1.1659 and 1.1633 can be expected.

Chart Explanation

Important Notice for Beginner Traders

Beginner forex traders should be extremely cautious when making market-entry decisions. Ahead of major fundamental releases, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss protection, you can lose your entire deposit very quickly—especially if you do not apply proper money management and trade large position sizes.

Finally, remember that successful trading requires a clear trading plan, such as the one outlined above. Making spontaneous trading decisions based solely on current market conditions is an inherently losing strategy for an intraday trader.

QUICK LINKS