Trade analysis and trading tips for the Japanese yen

The test of the 142.51 price level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I didn't sell the dollar. Shortly afterward, another test of 142.51 occurred while the MACD was in oversold territory, allowing Buy Scenario #2 for the dollar to play out. As a result, the pair rose by 30 points before pressure returned. Only by mid-U.S. session did another test of 142.51 coincide with the MACD beginning to move down from the zero line — confirming a valid sell signal, which led to a drop of more than 80 points.

Yesterday's strong U.S. retail sales data didn't provide much support for the dollar, nor did Powell's comments that the Trump administration's actions might hinder the Fed's ability to meet its targets. Powell also stated that rate cuts may stop before the end of the year and did not rule out the possibility of further hikes. He emphasized the uncertainty and complexity of the current environment. Clearly, the dollar is still facing difficulties, meaning the bullish trend for the yen remains in place.

As for today's intraday strategy, I'll rely on the implementation of Scenarios #1 and #2.

Buy Scenarios

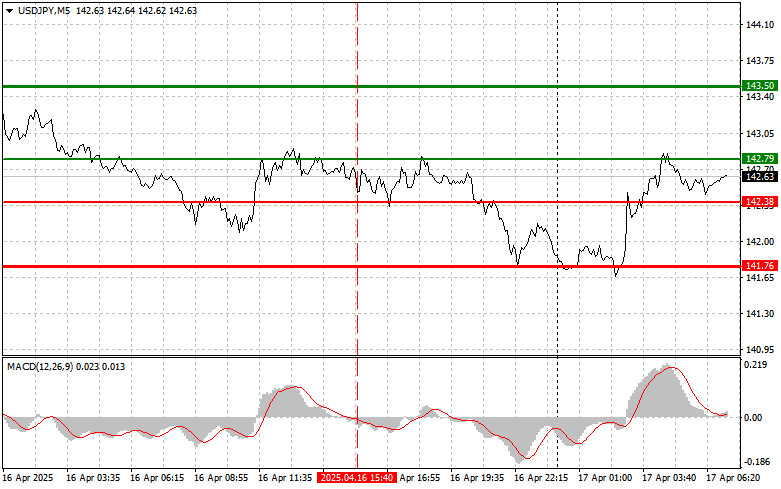

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point near 142.79 (green line on the chart), aiming for a rise to 143.50 (thicker green line). Around 143.50, I intend to exit my long positions and open short positions in the opposite direction (targeting a 30–35 point retracement). It's best to buy the pair on corrections and significant dips. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today if the 142.38 level is tested twice in a row while MACD is in the oversold zone. This would limit the pair's downward potential and could lead to a reversal upward. A move toward the 142.79 and 143.50 levels is likely.

Sell Scenarios

Scenario #1: I plan to sell USD/JPY only after a break below the 142.38 level (red line on the chart), which would likely trigger a quick drop. The primary target for sellers will be 141.76, where I plan to exit my short position and immediately open long trades (expecting a 20–25 point rebound). Downward pressure could return at any moment. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell USD/JPY if the 142.79 level is tested twice in a row while MACD is in the overbought zone. This would cap the upward potential and could trigger a reversal. Expect a decline toward the opposite levels of 142.38 and 141.76.

Chart Notes:

Important: Beginner Forex traders should be extremely cautious when entering the market. It's best to stay out before the release of important economic reports to avoid sharp price fluctuations. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you don't practice proper money management and trade with large volumes.

And remember: to trade successfully, you need a clear trading plan, like the one I've outlined above. Spontaneous decisions based on the current market situation are inherently a losing strategy for intraday traders.

QUICK LINKS