Yesterday, equity indices finished sharply lower. The S&P 500 fell by 1.57%, the Nasdaq 100 dropped by 2.03%. The industrial Dow Jones tumbled by 1.34%.

Indices remained under pressure as sentiment deteriorated after AI-related fears triggered a sell?off in US technology stocks. Gold and silver recovered amid choppy trading.

Today, US equity futures were down about 0.2%, while Asian shares plunged by 1.4%, marking the first decline in six sessions. Chinese tech stocks also fell as investors reduced risk ahead of Lunar New Year holidays in mainland China and Hong Kong.

As volatility spiked, gold and silver, which had risen alongside equities this year, recovered after yesterday's decline. Treasuries partially unwound gains recorded on Thursday, when the drop in risk appetite pushed investors into the perceived safety of US government bonds. The yield on the benchmark 10-year note rose by one basis point to 4.11% ahead of US inflation data due Friday.

As I noted above, the sharp swings in US equities reflect rising stakes around the AI boom and unpredictable spillover effects across sectors, regions, and asset classes. Those moves also highlight how quickly shifts in AI sentiment can spread well beyond the tech sector.

"Software stocks are now trading like banks in 2008," Vantage Point Asset Management said, referring to the global financial crisis. "Asia has performed well so far this year, but I am concerned about correlation to global markets and a tactical unwind." By comparison, the MSCI Asia Pacific index is up roughly 12% year-to-date versus US indices. It is clear to many that, unlike the AI-driven volatility in US markets, the impact on Asian markets so far remains relatively contained, which preserves demand for Asian names.

In commodity markets, oil is posting a second consecutive weekly decline for the first time this year as risk appetite falls.

The key event today will be the US inflation release for January. Core CPI is expected to rise by 2.5% year-on-year.

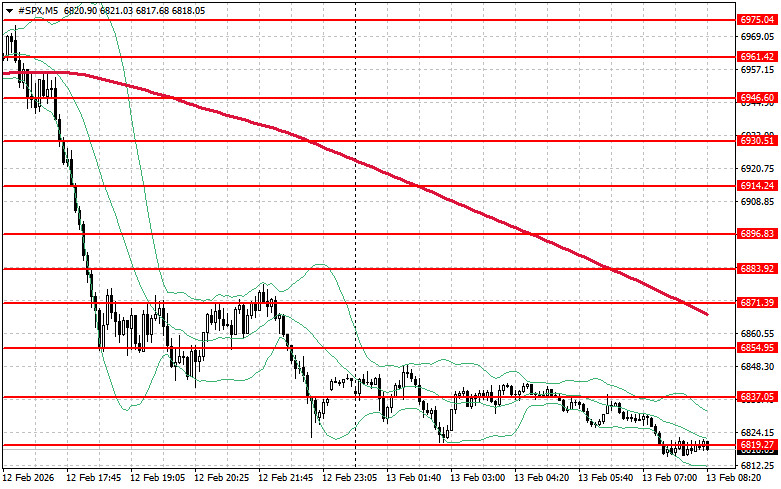

As for the S&P 500 technical picture, the primary task for buyers today is to overcome the nearest resistance level of $6,819. That would help the index gain upside momentum and could also pave the way for a push to a new level at $6,837. An equally important priority for bulls will be control above $6,854, which would strengthen buyers' positions. In the event of a downside move amid waning risk appetite, buyers must reassert themselves around $6,801. A break below that level would quickly push the instrument back to $6,784 and open the path to $6,769.

QUICK LINKS