The EUR/USD currency pair showed significant volatility and good growth on Monday. Recall that we warned of a high probability of a "boring Monday," since no scheduled macroeconomic releases or fundamental events were on the calendar. However, an unscheduled speech by Jerome Powell took place overnight, against whom a criminal case had been opened a short time earlier...

So, the story about overspending on the reconstruction of the Fed buildings, which took place 4 years ago, has nonetheless developed. Donald Trump, for a long time, threatened to sue Powell, whom he himself appointed 8 years ago as chairman of the US central bank, and has finally moved from words to action. Although if you look at the issue a bit more seriously, the picture is somewhat different.

Last summer, Powell faced accusations of giving false testimony before the US Congress (perjury). According to Republicans, Powell did not mention expensive marble or a VIP dining room during the discussion of the Fed's reconstruction budget before Congress. The initial estimate rose from $600 million to $2.5 billion, but Congress approved it. Now, when Trump is doing everything he can to remove Powell (although there is little point in this anymore), senators and congressmen suddenly decided that Powell spent too much money. Let me remind you that this is not about Powell repairing his own residence at public expense. It concerns Fed buildings, and what personal interest could Powell have in spending as much money as possible on something that does not belong to him? What exactly is his guilt? There are surely official documents that itemize all expenditures with the materials used and the work performed. Congress surely saw that estimate. And if it did not see it, the question arises — why? It is unlikely that Powell hid it.

In general, the theater of American absurdity continues. The most interesting thing is that, in fact, a criminal case has not yet been opened. Powell was only summoned to testify before a "grand jury." This is not an official court hearing; it has the character of voluntary witness testimony. Simply put, Powell must provide documents showing how the money was spent. Then the Department of Justice will decide whether there was overspending of state funds and whether Powell made false statements to Congress 4 years ago.

In short, no sanctions will be applied to Powell in the near future, and he will leave his post as Fed chair before a court issues a verdict (if the case even goes to trial). Essentially, there is no point for Trump to keep fighting Powell, since Powell's term expires in May. But this is, so to speak, a show punishment. So that other members of the FOMC will be more compliant and obedient when the US president demands a rate cut. The dollar clearly did not like that development...

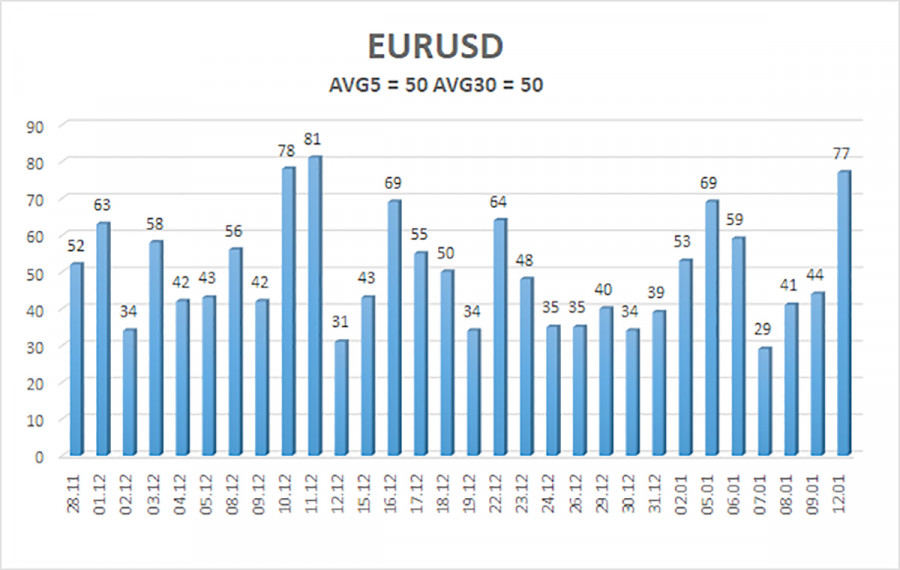

The average volatility of the EUR/USD pair over the past 5 trading days as of January 13 is 50 pips, which is characterized as "low." We expect the pair to move between 1.1624 and 1.1724 on Tuesday. The higher linear regression channel is upward, but in fact, the daily TF is still flat. The CCI indicator recently formed another "bullish" divergence, pointing to the resumption of the upward trend. However, the key point remains the flat on the daily TF.

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

The EUR/USD pair remains below the moving average, but on all higher TFs the uptrend is preserved, and on the daily TF a flat continues for the sixth month in a row. The global fundamental background still matters greatly to the market, and it remains negative for the dollar. Over the past six months, the dollar has occasionally shown weak gains, but exclusively within a side channel. It has no fundamental basis for long-term strengthening. With the price below the moving average, small shorts can be considered, with targets at 1.1624 and 1.1597 on purely technical grounds. Above the moving average line, long positions remain relevant, with a target of 1.1830 (the upper line of the flat on the daily TF), which has already been reached and not overcome.

QUICK LINKS