The price test at 1.3469 occurred when the MACD indicator had moved well above the zero mark, limiting the pair's upside potential. For this reason, I did not buy the pound.

Despite U.S. actions in Venezuela and the capture of President Maduro, this did not exert significant pressure on the British pound. These events caused only a small reaction in the pair, as some investors hurried to safeguard their assets. The impact of these events on the global economy as a whole is likely to be limited. Venezuela is not a key player on the world market, and the consequences will be localized. Nevertheless, they serve as a reminder of how geopolitical risks can quickly affect financial markets and entire countries.

This morning, data will be published on approved mortgage applications in the United Kingdom, the volume of consumer lending to individuals, and changes in the M4 money supply. The interrelation of these indicators will create a picture of the state of the national financial system and consumer confidence. In particular, analysis of M4 dynamics is important. A significant increase in M4, in the absence of comparable economic growth, can warn of looming inflationary pressures. The Bank of England closely monitors these data as an additional guide when setting rate policy.

As for the intraday strategy, I will mainly rely on the execution of scenarios No. 1 and No. 2.

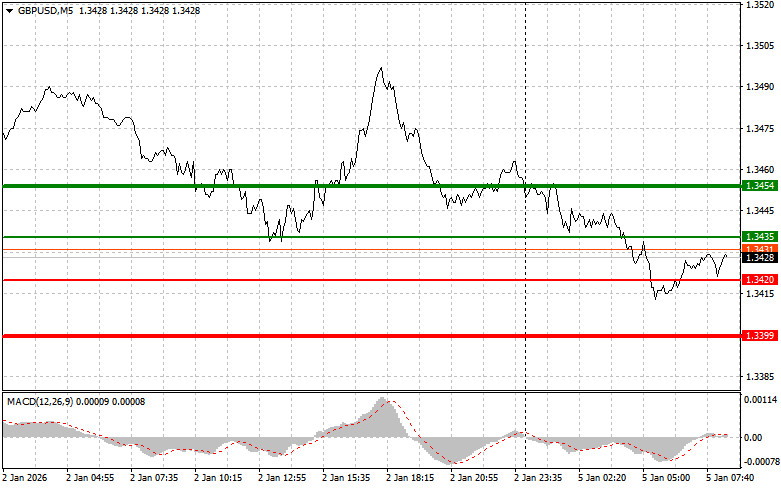

Scenario No. 1: I plan to buy the pound today when the price reaches around 1.3435 (green line on the chart) with a target to rise to 1.3454 (thicker green line on the chart). Around 1.3454, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35-pip reversal from that level). Strong pound growth today is unlikely. Important: before buying, ensure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in case of two consecutive tests of 1.3420 when the MACD is in the oversold area. This will limit the pair's downside potential and trigger an upward reversal. Expect rises toward the opposite levels 1.3435 and 1.3454.

Scenario No. 1: I plan to sell the pound today after a break below 1.3420 (red line on the chart), which should lead to a rapid decline. Sellers' key target will be 1.3399, where I plan to exit shorts and immediately open longs in the opposite direction (expecting a 20–25 pip reversal from that level). Pound sellers may appear after weak data. Important: before selling, ensure the MACD indicator is below the zero mark and just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today if there are two consecutive tests of 1.3435 while the MACD is in the overbought area. This will limit the pair's upside potential and cause a reversal downward. Expect declines to the opposite levels 1.3420 and 1.3399.

Important. Beginner Forex traders must be very cautious when making entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid being caught in sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, as outlined above. Spontaneous trading decisions based solely on the current market situation are, from the outset, a losing strategy for an intraday trader.

QUICK LINKS