Nejistota v oblasti politiky a regulace nadále tíží sektor zdravotní péče, řekl investorům na konferenci RBC Capital Global Healthcare Conference bývalý ministr zdravotnictví a sociálních služeb Alex Azar.

RBC Capital pozvala Azara jako hlavního řečníka a poznamenala, že ačkoli odvětví čelí mnoha překážkám, „příběhy s jasnými diferenciačními strategiemi, silnými fundamenty a dobrými obchodními příležitostmi by měly i nadále převážit nad tlakem na pokles“.

RBC vysvětlila, že Azar uvedl, že nedávné výkonné příkazy a reformy, například v oblasti cen léků v rámci programu Medicare a schvalovacích postupů FDA, zůstanou pravděpodobně nestabilní a politicky citlivé.

„Republikánská strana se jasně vzdálila od svého historicky příznivějšího postoje k průmyslu a biotechnologický farmaceutický průmysl má nyní mnohem méně zastánců,“ uvedl Azar, což představuje výzvu pro společnosti, které se snaží ovlivnit politiku cen léků.

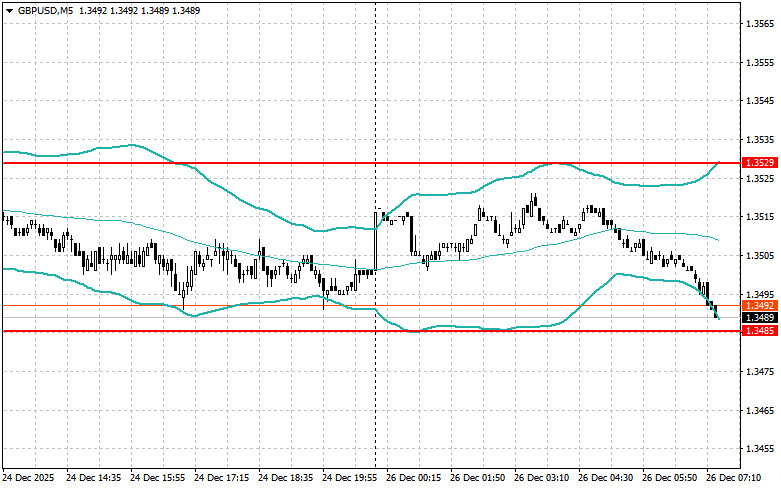

The euro and British pound have maintained their strength; however, trading for these instruments continues within a range. The USD/JPY pair has also stabilized, and by the end of the week, significant changes are unlikely.

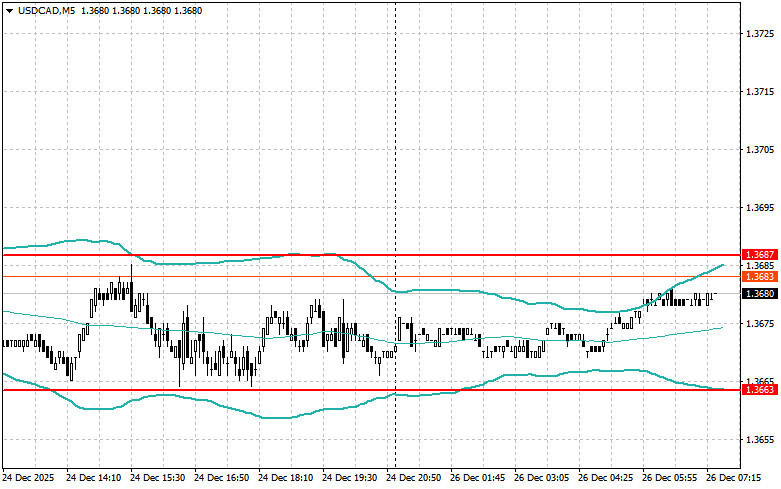

On Wednesday, the pre-holiday lull in economic data led to slight instability in currency trading. Trading across many pairs was conducted within a limited corridor, although it displayed sharp shifts, attributed to a liquidity shortage. It is expected that after the New Year holidays, trading in the currency market will gradually intensify. With the return of market participants and the release of new statistical data, sharp, uncontrollable movements may subside, and price dynamics will become more predictable.

Today promises to be relatively calm, as buyers of EUR/USD are unlikely to make their presence felt after Christmas. Liquidity will remain low, making the market vulnerable to sudden spikes and drops, so traders should exercise particular caution. In the absence of significant drivers, attention will be focused on technical levels and local news.

I'd like to remind you that, currently, in the lead-up to the New Year, a wait-and-see position prevails. Many market participants have already closed their annual positions and prefer not to take risks, fearing unpredictable fluctuations. Trading volumes have significantly decreased, creating additional difficulties for those trying to trade actively.

There are no news releases from the UK today, so a similar situation awaits the British pound.

If the data corresponds with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data comes in significantly above or below expectations, the Momentum strategy is the best approach.

QUICK LINKS