The EUR/USD currency pair traded with relatively low volatility on Thursday. Overall, this week can be summarized as follows: expectations were not met. We anticipated that the strong fundamental and macroeconomic backdrop, important reports, and global events would lead the pair out of its six-month flat trend. However, that did not occur. There weren't even any interesting movements, trend shifts, or reinforcement of the current trends. The most significant events elicited emotional spikes in the market, but as seen in the illustration above, the pair is trading roughly where it began this week. Thus, it has been a continuous disappointment.

The European Central Bank meeting had the least chance of moving the market off its "dead center." Recall that the monetary policy of nearly all central banks around the world (at least the largest ones) in recent years has been tied to inflation. The ECB is one of the few central banks that has succeeded in slowing inflation down to 2%. Thus, it was the first of the "big three" (ECB, Bank of England, and Federal Reserve) to lower the key rate to a "neutral level" and is now reaping the rewards of its actions. Therefore, yesterday's meeting was somewhat "bland," and Christine Lagarde did not make any statements the market could not ignore. We saw another formal emotional spike, but nothing more.

On the other hand, it is actually very good that the pair remained roughly at the same levels as before this block of super-important events. If the dollar had started to rise again, it would definitely mean the continuation of the flat trend for several more months. If the pair showed a substantial increase, that would be justified, but strong movements during important events always carry unstable prospects. Recall that very often after Fed meetings, the price rockets in one direction and then returns to its starting position. Global fundamental events are more important for determining a long-term trend than for short-term trading.

Thus, the euro now faces the task of overcoming the 1.1800-1.1830 area, which can be considered the upper limit of the sideways channel on the daily timeframe. When/if this happens, the euro's growth will reasonably continue, as the fundamental and macroeconomic conditions support not the dollar but the euro. Over the past six months, bears have failed to form a trend. The U.S. labor market remains unsatisfactory, and from May next year the Fed's key rate could drop rapidly, even without any economic justification. The Fed may lose its independence, and it could be led by Donald Trump. Meanwhile, the Eurozone remains relatively stable, and the euro does not dominate the current situation. The dollar pulls the strings.

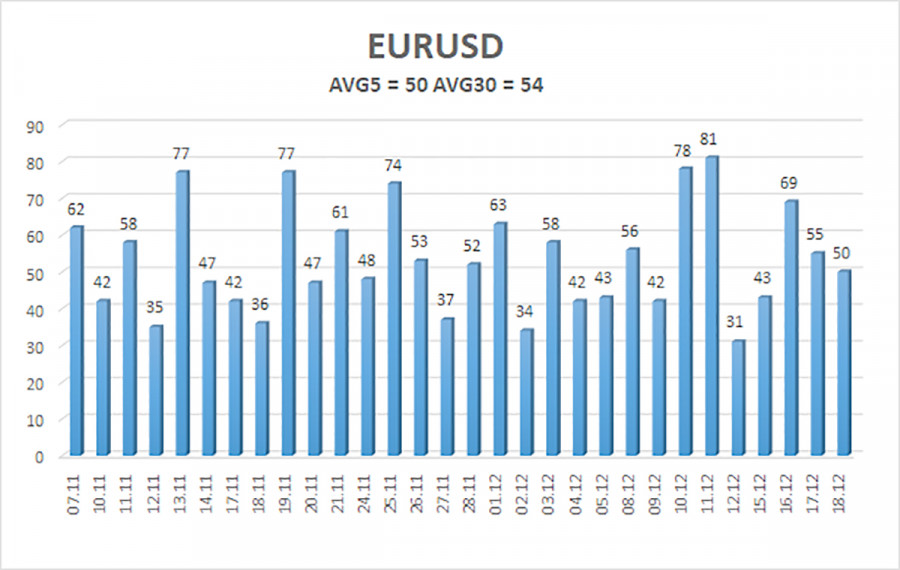

The average volatility of the EUR/USD pair over the last five trading days as of December 19 is 50 pips, which is considered "average." We expect the pair to trade between 1.1682 and 1.1782 on Friday. The upper linear regression channel is directed downward, signaling a bearish trend, but the flat trend continues on the daily timeframe. The CCI indicator entered oversold territory twice in October (!!!) but visited the overbought area last week. A downward retracement is possible.

The EUR/USD pair is above the moving average line, maintaining an upward trend across all higher timeframes, while the daily timeframe has been flat for several months. The global fundamental backdrop remains an essential factor for the market, and it remains negative for the dollar. In the past six months, the dollar has shown weak growth only sporadically, but exclusively within the sideways channel. It has no fundamental basis for long-term strengthening. If the price is below the moving average, small short positions can be considered, with targets at 1.1658 and 1.1597, based solely on technical grounds. Above the moving average line, long positions remain relevant with targets at 1.1780 and 1.1830 (the upper line of the flat on the daily timeframe), which have essentially already been reached. Now, we need the flat to conclude.

QUICK LINKS