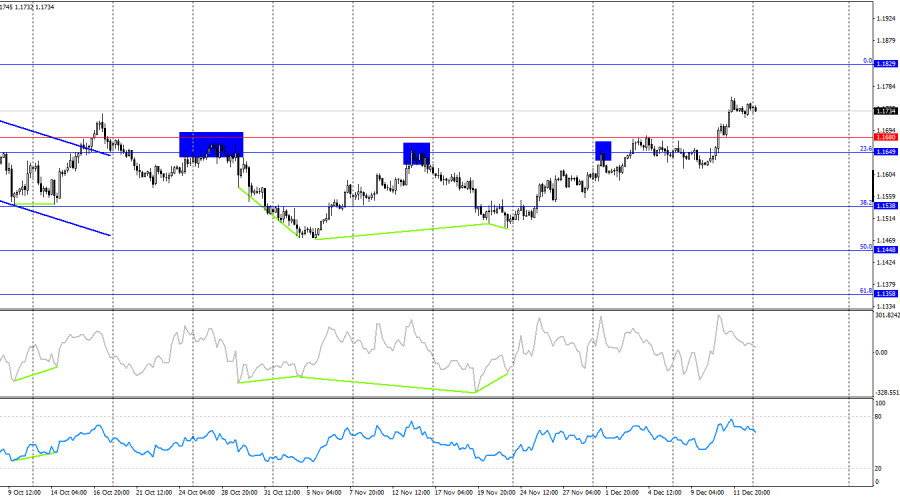

On Friday, the EUR/USD pair continued to trade above the 38.2% corrective level at 1.1718, while also rebounding from it. This rebound allows traders to expect a continuation of the rise toward the next Fibonacci level of 23.6% – 1.1795. A consolidation of the pair below 1.1718 would favor the U.S. dollar and a modest decline toward the support level of 1.1645–1.1656.

The wave structure on the hourly chart remains simple and clear. The most recently completed downward wave failed to break the low of the previous wave, while the latest upward wave (which is still forming) has broken the previous high. Thus, the trend has officially shifted to bullish. It would be hard to call it strong, but in recent weeks the bulls have regained confidence and resumed their attacks with renewed strength. The Fed's easing of monetary policy supports further growth of the European currency, and the ECB is unlikely to create any problems for the euro in the near term.

On Friday, the news background was virtually absent, but traders were not particularly upset and simply took the day off. Trading activity was at a minimum, and it is unlikely to be higher today. The news calendar is almost empty on Monday as well, but throughout the week traders will have enough information to trade. I will note only the most important events. First and foremost are U.S. economic data on unemployment, the labor market, and inflation. Second is the European Central Bank meeting. The ECB meeting is unlikely to bring any surprises, so the main focus will be on the U.S. reports mentioned above. These reports will not be released on the same day, so market activity may remain high for most of the week. Of course, the direction of the EUR/USD pair will depend on the reports themselves, both in the U.S. and in the euro area. I do not venture to predict in advance who will attack more aggressively this week—bulls or bears.

On the 4-hour chart, the pair consolidated above the resistance level of 1.1649–1.1680. Thus, the growth process may continue toward the next Fibonacci level of 0.0% – 1.1829. A consolidation of the pair below the 1.1649–1.1680 level would again favor the U.S. currency and a modest decline toward the 38.2% corrective level at 1.1538. No emerging divergences are observed on any indicators today.

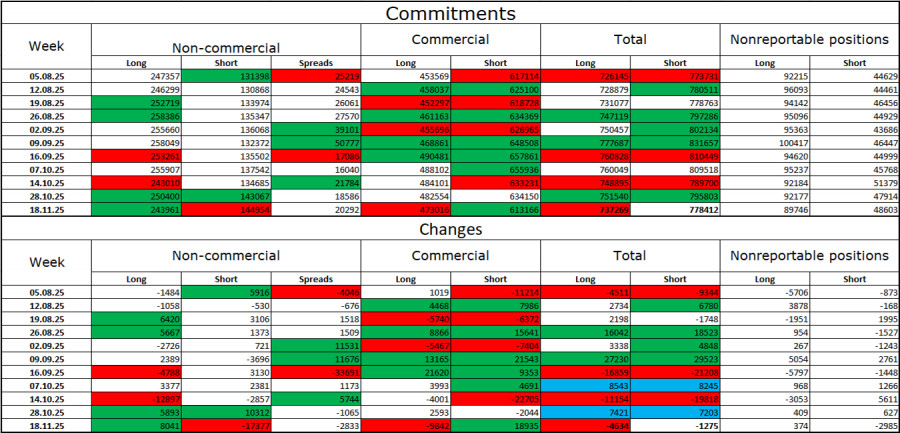

Commitments of Traders (COT) report:

During the last reporting week, professional players opened 8,041 long positions and closed 17,377 short positions. COT reports have resumed publication after the shutdown, but for now the data being released are already outdated—covering October and November. Sentiment among the "Non-commercial" group remains bullish thanks to Donald Trump and continues to strengthen over time. The total number of long contracts held by speculators now stands at 243,000, while short positions total 145,000.

For thirty-three consecutive weeks, large players have been reducing short positions and increasing long ones. Donald Trump's policies remain the most significant factor for traders, as they could cause numerous problems of a long-term and structural nature for the U.S. Despite the signing of several important trade agreements, analysts fear a recession in the U.S. economy, as well as a loss of Fed independence under pressure from Trump and against the backdrop of Jerome Powell's resignation expected in May next year.

News calendar for the U.S. and the euro area:

Euro area – Change in industrial production volumes (10:00 UTC).

On December 15, the economic calendar contains just one entry that does not generate much interest. The impact of the news background on market sentiment on Monday will be weak and limited to the morning.

EUR/USD forecast and trading advice:

Selling the pair may become possible today after a close below the 1.1718 level on the hourly chart, with a target at 1.1656. Buy trades could be opened on a rebound from the 1.1718 level, and today they can be kept open with targets at 1.1795–1.1802.

Fibonacci grids are built from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.

QUICK LINKS