Trade Analysis and Tips for the Japanese Yen

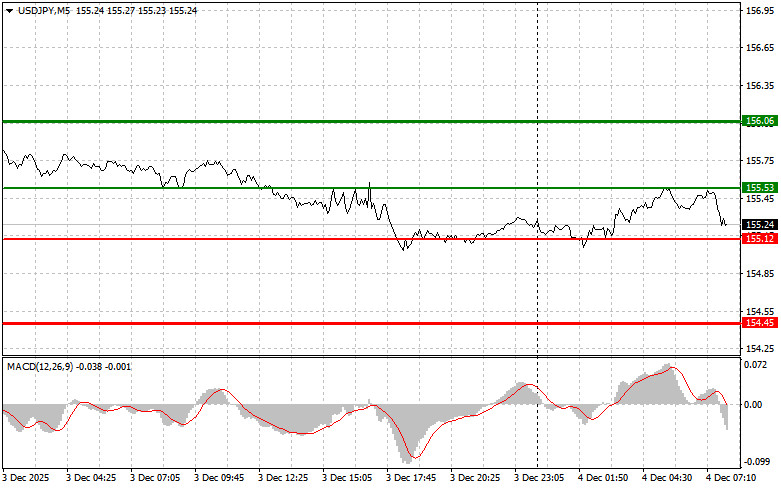

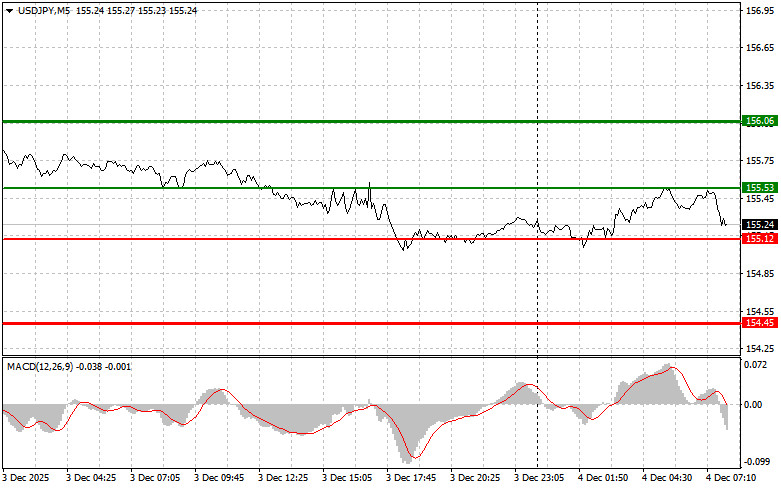

The test of the price at 155.45 coincided with the moment when the MACD indicator was just beginning to move down from the zero mark, confirming a valid entry point for selling the dollar. As a result, the pair dropped by 40 pips.

The dollar declined against the Japanese yen following news of a sharp drop in U.S. ADP employment for November, a figure economists had been expecting to rise. This only reinforced market expectations of further interest rate cuts in the U.S. this December, while many economists anticipate the opposite actions leaning toward tightening from the Bank of Japan.

The market reaction was immediate: the yen strengthened, and the dollar weakened. Investors actively revised their portfolios, betting on a more accommodative monetary policy from the Fed. At the same time, talks of a possible tightening of monetary policy by the BOJ continue to support the yen. Many economists believe the BOJ may return to raising interest rates as early as next week. Such a move could further strengthen the yen against the U.S. dollar.

Regarding the intraday strategy, I will primarily focus on implementing Scenarios #1 and #2.

Buy Scenarios

- Scenario #1: I plan to buy USD/JPY today when it reaches an entry point around 155.53 (the green line on the chart), targeting a move to 156.06 (the thicker green line on the chart). Around 156.06, I aim to exit my long positions and sell back, expecting a 30-35-pip move in the opposite direction from the level. It is best to resume buying the pair on corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from there.

- Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price at 155.12 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposite levels of 155.53 and 156.06 can be expected.

Sell Scenarios

- Scenario #1: I plan to sell USD/JPY today only after the price reaches 155.12 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 154.45 level, where I plan to exit my shorts and also buy back immediately (aiming for a 20-25-pip move in the opposite direction from the level). It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting its decline from there.

- Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of 155.53 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decrease to the opposite levels of 155.12 and 154.45 can be expected.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or take profit yourself, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or take profit yourself, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.