Praha – Společnost EP Energy Transition (EPETr), která je dceřinou firmou skupiny EP Group českého miliardáře Daniela Křetínského, koupí padesátiprocentní podíl v hnědouhelné elektrárně Lippendorf v Německu. Podíl od společnosti Energie Baden-Württemberg AG (EnBW), který zahrnuje jeden z bloků, převezme na začátku příštího roku, akvizici ještě musí schválit regulační orgány. Druhý blok už nyní vlastní dceřiná firma EPETr podnik LEAG, skupina tak ovládne celou elektrárnu. ČTK to sdělil mluvčí EP Group Daniel Častvaj. Cenu transakce firmy nebudou zveřejňovat.

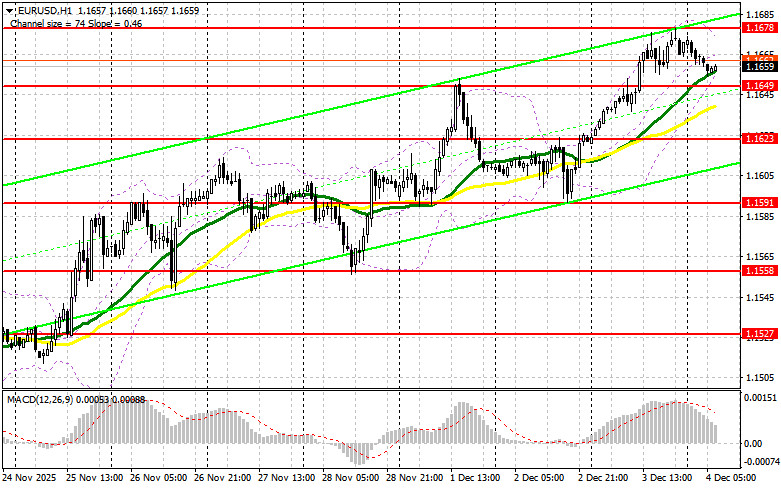

Yesterday, several entry points into the market were formed. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I focused on the 1.1651 level and planned to make entry decisions based on it. The rise and formation of a false breakout around 1.1651 provided a good entry point to sell the euro, but after the pair declined by 15 pips, the pressure eased. In the second half of the day, active bearish actions at the level of 1.1678 once again led to the opening of short positions, with the pair moving down another 15 pips.

The dollar fell against the euro following news that ADP employment in the U.S. decreased by 32,000 in November, while economists had expected an increase. This only reinforced market expectations of further U.S. interest rate cuts this December. Today, retail sales figures for the Eurozone for October are expected in the first half of the day. It is forecast that this indicator will remain unchanged from September. In the case of weak figures and a correction of the EUR/USD pair, I expect the initial manifestation of euro buyers around the support level of 1.1649, which acted as resistance just yesterday. The formation of a false breakout there will provide an entry point for long positions targeting a recovery of the pair to the resistance level of 1.1678, which is the peak for this month. A breakout and reversal test of this range will confirm the correct action on buying the euro, anticipating a larger spike to 1.1703. The furthest target will be the high of 1.1726, where I will lock in profits. Testing this level will strengthen the bullish market for the euro. In the event of a decline in EUR/USD and a lack of activity around 1.1649, pressure on the pair will return. Sellers will likely reach the next interesting level of 1.1623. Only the formation of a false breakout there will be a suitable condition for buying the euro. Long positions will be opened immediately on the rebound from 1.1591 with a target upward correction of 30-35 pips intraday.

Euro buyers currently control the market, which is not surprising—especially following such U.S. data. The bullish market continues to develop, so be extremely cautious when selling. Only the formation of a false breakout near the resistance level of 1.1678 will provide an entry point for short positions targeting a move toward the support level of 1.1649, where moving averages are aligned with the bulls. A breakout and consolidation below this range against the backdrop of very weak retail sales data, along with a reverse test from bottom to top, will also provide another suitable scenario for opening short positions targeting the area of 1.1623. The furthest target will be around 1.1591, where I will lock in profits. If EUR/USD continues to rise and there is no active bearish action around 1.1678, buyers will have a good opportunity to continue developing the bullish market. In this case, it would be best to postpone short positions until the larger level of 1.1703. Selling there will only occur after a failed consolidation. I plan to open short positions immediately on the rebound from 1.1726 with a target downward correction of 30-35 pips.

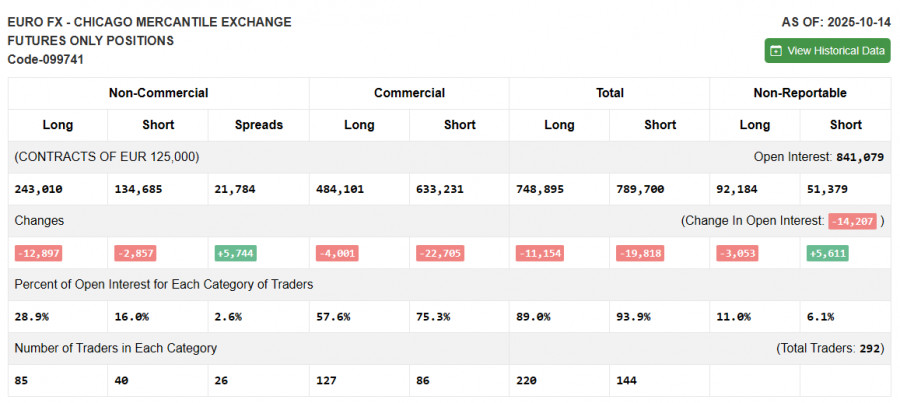

Due to the U.S. government shutdown, fresh Commitment of Traders (COT) data is not being published. As soon as the current report is prepared, we will publish it immediately. The latest relevant data is only from October 14.

In the COT report, there was a reduction in both long and short positions. Expectations of further Federal Reserve rate cuts continue to put pressure on the U.S. dollar. The COT report indicated that long non-commercial positions decreased by 12,897 to 243,010, while short non-commercial positions fell by 2,857 to 134,685. As a result, the spread between long and short positions increased by 5,744.

QUICK LINKS