On Wednesday during the North American session, the GBP/USD pair rose sharply, breaking above the 1.3300 level. This growth was driven by market expectations of a more "dovish" Federal Reserve policy amid intensifying rumors that Kevin Hassett, a White House economic adviser, could be appointed as the new Fed Chair in place of Jerome Powell.

The British pound strengthened significantly as the U.S. dollar weakened, pressured by speculation surrounding the potential new Fed leadership and weak U.S. labor market data. The dollar also continues to decline following the release of today's disappointing U.S. economic data.

Specifically, the U.S. ISM Services PMI for November and employment indicators exerted downward pressure. The ADP employment report showed a decline of 32,000 private-sector jobs, which broadly aligns with expectations — especially given the previous increase of 42,000 versus a forecast of a modest 10,000 decrease. Employment figures remain weak, while there is a persistent trend of rising input prices.

Domestic market data indicate a high probability of a Federal Reserve rate cut at the upcoming meeting. According to Capital Edge, market pricing reflects roughly an 85% chance of a 25-basis-point rate cut on December 18, and by 2026 rates are expected to be around 2.99%, suggesting continued accommodative monetary policy.

Meanwhile, an OECD report indicates that the UK economy is performing better than expected and points to a potential slowdown in the pace of Bank of England rate cuts. Market expectations currently imply about a 90% probability of a rate cut by the Bank of England at the upcoming meeting on December 18.

Given the current interest rate differential between the U.S. and the UK, continued GBP/USD growth appears likely—barring unexpected negative news that could trigger risk aversion in financial markets.

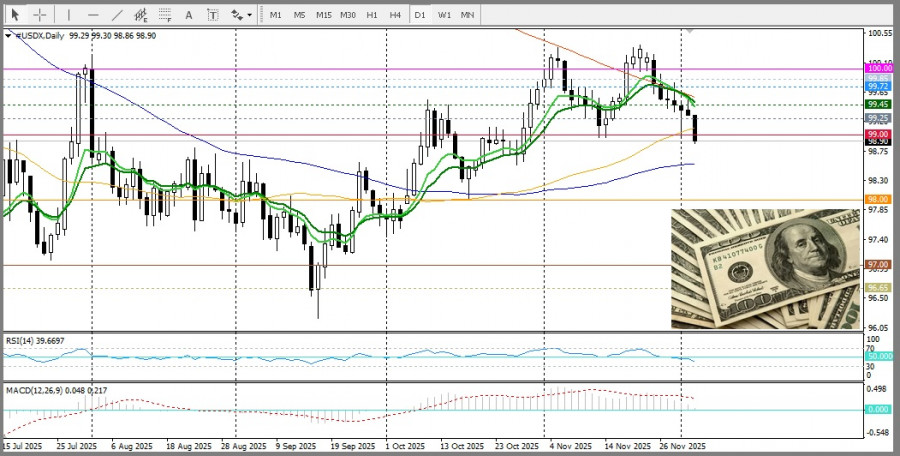

From a technical standpoint, the pair has broken above the 50-day Simple Moving Average (SMA) at 1.3265. It has also breached the 1.3300 level and is currently breaking above the 200-day SMA. All of this favors the bulls. However, it is worth noting that daily chart oscillators are mixed, although the Relative Strength Index has moved into positive territory. If the pair consolidates above the 200-day SMA, the next resistance will be at the 100-day SMA.

QUICK LINKS