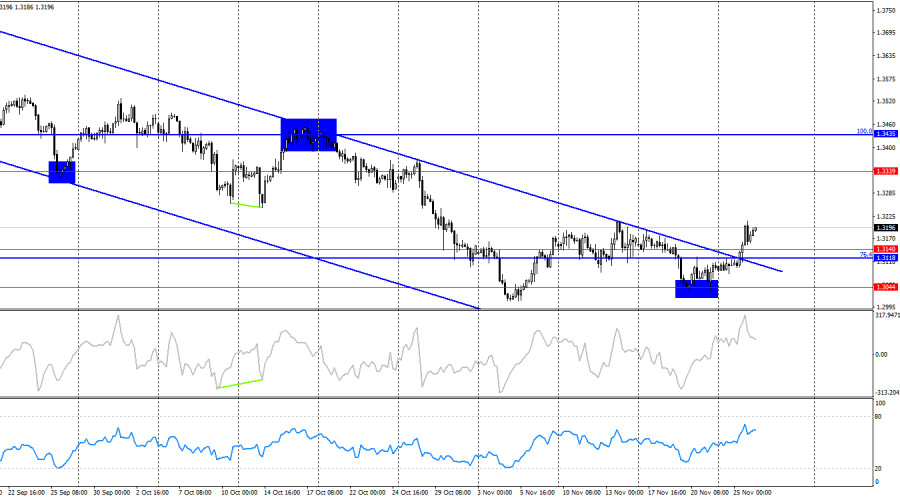

On the hourly chart, the GBP/USD pair on Tuesday consolidated above the resistance level of 1.3119–1.3139 and rose toward the resistance level of 1.3186–1.3214. A rebound of the quotes from this zone—and especially from the level of 1.3214—will work in favor of the US currency and lead to some decline toward the 1.3119–1.3139 level. Consolidation of the pair above the 1.3186–1.3214 level will increase the likelihood of further growth toward 1.3240 and 1.3294.

The wave situation remains entirely bearish. The last upward wave did not break the previous peak, and the last completed downward wave did not break the previous low. Unfortunately for the pound, the news background has deteriorated for it over the recent weeks, and now the bulls find it extremely difficult to launch attacks—which were weak even before. However, the bears are also beginning to retreat, since the US fundamental backdrop is also far from ideal. To complete the bearish trend, growth above the 1.3214 level is required.

Tuesday's news background provided strong support to the bulls, as two out of three US reports showed results much worse than traders expected. The bulls launched a sharp rally in the second half of the day but ran into graphical resistance at 1.3214. Thus, this level is now the key one. With positive fundamentals, it will be easier to overcome, but, for example, today the bulls can rely only on a weak report on durable goods orders. If this report fails to support them, GBP/USD may pull back toward the 1.3119–1.3139 level. I continue to expect the US dollar to decline, as a third round of FOMC monetary easing is anticipated in December. At the same time, the US labor market remains in poor condition, which may also put pressure on the dollar at the beginning of December.

On the 4-hour chart, the pair consolidated above the descending trend channel and above the 1.3118–1.3140 level. Thus, the upward movement may continue toward the 1.3339 level, and the bulls may begin forming a trend. No potential divergences are observed today on any indicator. I remind you about the 1.3214 level on the hourly chart.

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more bullish over the last reporting week, but this reporting week dates back a month and a half — October 7. The number of long positions held by speculators increased by 13,871, while the number of short positions increased by 9,453. The gap between long and short positions is now essentially: 94 thousand vs. 98 thousand—almost perfectly balanced.

In my view, the pound still appears less "dangerous" than the dollar. In the short term, the US currency is in demand on the market, but I believe this is only temporary. Donald Trump's policies caused a sharp deterioration in the labor market, and the Federal Reserve is forced to ease monetary policy to stop rising unemployment and stimulate job creation. Thus, while the Bank of England may cut rates one more time, the FOMC could continue easing throughout 2026. The dollar weakened significantly in 2025, and 2026 may offer no improvement.

News Calendar for the US and the UK:

On November 26, the economic calendar contains three entries. The influence of the news background on market sentiment on Wednesday will appear in the second half of the day.

GBP/USD Forecast and Trader Recommendations:

Sales of the pair are possible today during a rebound from the 1.3186–1.3214 level on the hourly chart, with a target of 1.3119–1.3139. Purchases may be opened if the price consolidates above 1.3214, with targets at 1.3240 and 1.3294.

Fibonacci grids are plotted from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

QUICK LINKS