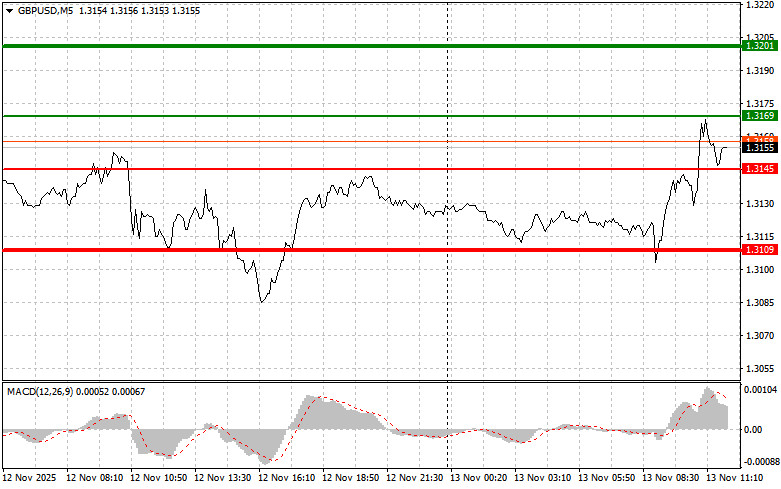

The price test at 1.3111 occurred when the MACD indicator had just begun to move downward from the zero mark, confirming a correct entry point for selling the pound. Together with weak U.K. data, this suggested the possibility of a strong decline in the pair. nHowever, that decline never materialized, and losses were eventually recorded. Then, a price test at 1.3131 coincided with the MACD starting to move upward from the zero mark, providing a buy signal, after which the pair rose toward the target level of 1.3170.

As mentioned earlier, the pound fell following news that the U.K. GDP shrank by 0.1% in September. Industrial production also declined. Against this backdrop, concerns over the outlook for the British economy have intensified amid high inflation and elevated interest rates. The contraction in GDP and slowdown in industrial production are clear signs that a recession is becoming increasingly likely. Investors, fearing further deterioration of the economic situation, began selling the pound sterling, leading to a sharp drop — though a large-scale sell-off has not yet occurred.

Later today, in the absence of key U.S. economic data, market attention will once again shift to speeches by FOMC members Alberto Musalem and Beth M. Hammack. It is important to note that internal divisions within the Federal Reserve have been growing, making it difficult to form a unified view on the future path of interest rates. In such an environment, even a slight adjustment in tone from Fed officials can trigger market volatility. Traders will scrutinize every remark, seeking signals about the regulator's next moves. Particular attention will be paid to comments regarding current inflation levels, labor market conditions, and economic growth forecasts.

As for intraday strategy, I will focus primarily on Scenarios #1 and #2 below.

Buy Signal

Scenario #1: I plan to buy the pound today once the price reaches the 1.3169 level (green line on the chart), targeting a rise to 1.3201 (thicker green line on the chart). Around 1.3201, I intend to exit long positions and open short trades in the opposite direction, aiming for a 30–35 point reversal. A pound rally today can be expected within the framework of the current uptrend in the pair.Important: Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if the 1.3145 price level is tested twice in a row while the MACD is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the 1.3169 and 1.3201 levels can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after the price breaks below 1.3145 (red line on the chart), which should trigger a quick drop in the pair. The key target for sellers will be 1.3109, where I plan to exit short positions and open buy trades in the opposite direction, aiming for a 20–25 point rebound. Selling pressure on the pound will return if Fed officials adopt a hawkish stance.Important: Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the pound if the 1.3169 price level is tested twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a downward market reversal. A decline toward the 1.3145 and 1.3109 levels can then be expected.

Chart Legend:

Important Note for Beginner Traders:

Beginner traders in the Forex market should be extremely cautious when making trading decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid being caught in sharp price swings.

If you decide to trade during news events, always place stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit — especially if you don't use money management and trade large positions.

And remember: successful trading requires a clear and structured trading plan, like the one presented above. Spontaneous trading decisions based on current market movements are a losing strategy for any intraday trader.

QUICK LINKS