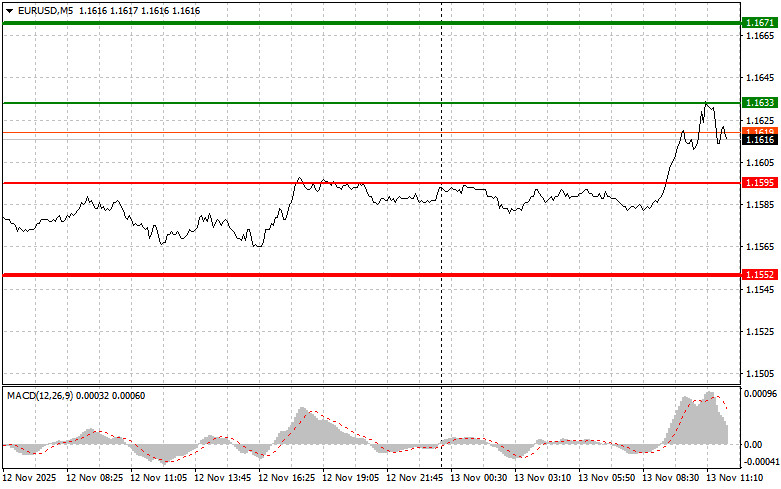

The price test at 1.1593 occurred when the MACD indicator had just begun to move upward from the zero mark, confirming a correct entry point for buying the euro, which resulted in growth toward the target level of 1.1619.

The resumption of U.S. government operations has reduced uncertainty in financial markets, leading to a weaker dollar. Investors who had previously avoided risk due to concerns about the U.S. economy have once again shown interest in higher-yielding but riskier assets. The euro, in particular, benefited from this shift in sentiment.

An additional supportive factor for the euro is the completion of the European Central Bank's rate-cutting cycle. In the near term, the EUR/USD pair's dynamics will depend on a variety of factors — including U.S. and Eurozone inflation and employment data, as well as potential statements from Federal Reserve and ECB officials.

Later today, FOMC members Alberto Musalem and Beth M. Hammack are scheduled to speak. Under current conditions, even a slight change in tone in their remarks could provoke market volatility. Investors will carefully analyze every word for hints about the Fed's future policy. Special attention will be paid to comments regarding inflation, labor market conditions, and economic growth prospects.

It will be interesting to observe how Musalem and Hammack balance between the need to contain inflation and the risks of economic slowdown. On one hand, high interest rates may cool economic activity and provoke a recession. On the other hand, insufficient tightening of monetary policy could lead to further price increases and destabilize the financial system.

As for intraday strategy, I will rely primarily on Scenarios #1 and #2 below.

Buy Signal

Scenario #1: Buy the euro today when the price reaches the 1.1633 level (green line on the chart) with a target of 1.1671. At 1.1671, I plan to exit the market and open a short position in the opposite direction, aiming for a 30–35 point retracement. A rise in the euro today will only be possible if the Fed officials' rhetoric turns dovish.Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro if the 1.1595 price level is tested twice in a row while the MACD is in the oversold zone. This will limit the pair's downward potential and trigger a market reversal upward. A rise toward 1.1633 and 1.1671 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1595 level (red line on the chart). The target will be 1.1552, where I intend to exit the market and buy in the opposite direction, expecting a 20–25 point upward correction. Selling pressure on the pair will return today if Fed representatives adopt a hawkish stance.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro if the 1.1633 price level is tested twice in a row while the MACD is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward 1.1595 and 1.1552 can then be expected.

Chart Legend:

Important Note for Beginner Traders:

Beginner traders in the Forex market should be extremely cautious when deciding to enter trades. Before the release of important fundamental reports, it's best to stay out of the market to avoid sudden price swings.

If you decide to trade during news events, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade with large position sizes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Making spontaneous trading decisions based on current market movements is a losing strategy for any intraday trader.

QUICK LINKS