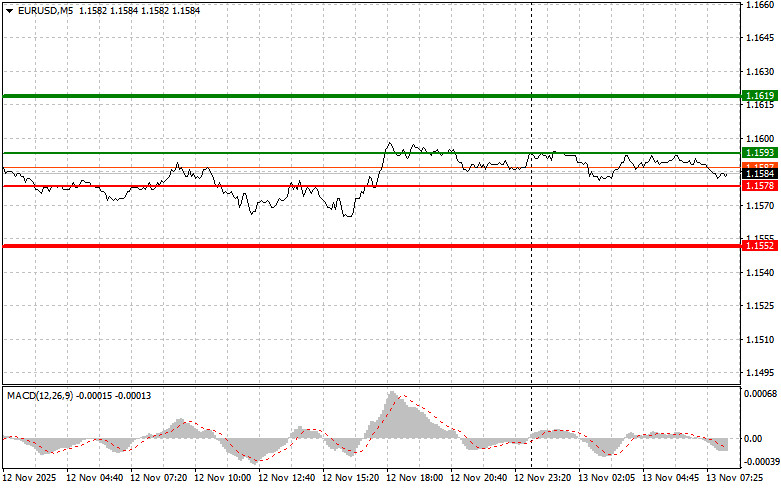

The price test at 1.1580 occurred as the MACD indicator began to move above the zero mark, confirming the correct entry point for buying euros. As a result, the pair rose by more than 20 pips.

As it was announced, the US government resumed operations yesterday after Donald Trump signed the H.R. 5371 bill. However, the US dollar's reaction to this event was minimal since the market had largely anticipated this outcome. The apparent stability of the currency, despite political turbulence, is explained by the good state of the US economy. Nevertheless, potential risks should not be ignored. Ongoing political conflicts and the rising US national debt erode confidence in the dollar. In the medium term, if political uncertainty is not resolved, the currency may face serious problems.

For today, figures on changes in industrial production in the Eurozone and the European Central Bank's economic bulletin are expected. These data typically have a certain impact on the currency market, particularly on the euro. Investors and analysts will closely examine the industrial production figures to assess the state of the Eurozone economy and its ability to recover from recent shocks. Strong growth in industrial production may indicate a robust economic recovery, which in turn could strengthen the euro. Conversely, weak figures could raise concerns about an economic slowdown and weaken the currency.

The ECB's economic bulletin is also an important source of information on the Bank's views of the current economic situation and its future monetary policy. The bulletin will cover the ECB's latest economic forecasts, assessments of inflationary pressures, and plans for interest rates. Any unexpected statements or hints of policy changes could cause volatility in financial markets.

Regarding the intraday strategy, I will rely more on the implementation of Scenario #1 and Scenario #2.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

QUICK LINKS