The GBP/USD pair again gravitated toward decline throughout Wednesday but failed to settle below the level of 1.3107, which still gives the British currency a chance for growth. However, today reports on GDP and industrial production will be published in the UK, which may present another stumbling block for the pound. On a global scale (on the daily timeframe), a downward correction against the upward trend continues, so we still expect growth from the pair. Let's remind ourselves that corrections or flats can take considerable time, especially on the daily chart. Therefore, the current illogical downward movement of the pound does not surprise us too much. It does not correspond to the global fundamental background and contradicts many events. At the same time, the market and its major players have mechanisms for opening/closing positions that do not always align with the expectations of the majority of traders.

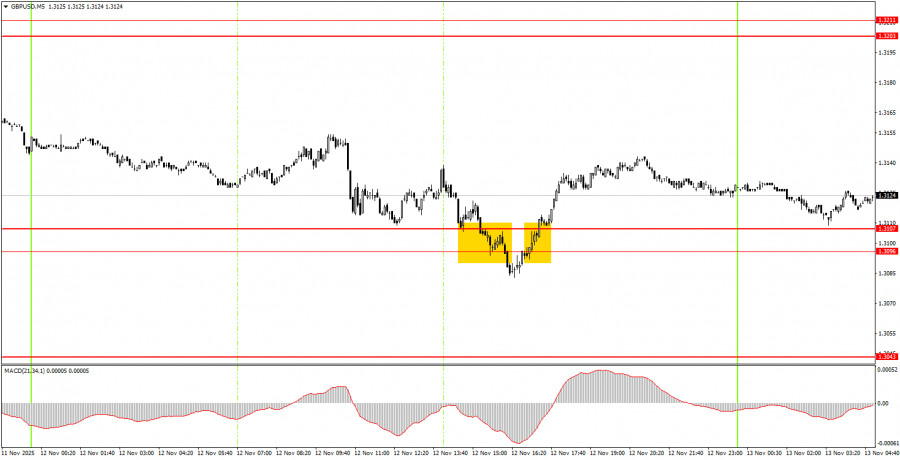

On the 5-minute timeframe, two trading signals were formed on Wednesday. Initially, the pair settled below the 1.3096-1.3107 area, but this signal proved to be a false signal. The pair then returned above this area, allowing novice traders to open long positions. Overall volatility was again weak, so projecting high profits was not realistic.

On the hourly timeframe, the GBP/USD pair continues to form a new downward trend, as evidenced by the trend line. As mentioned previously, there are no global grounds for a prolonged increase in the dollar. Therefore, we expect movement only to the upside in the medium term. However, the flat (or correction) factor in the long term continues to pull the pair down, which is an absolutely illogical development from a macroeconomic and fundamental perspective.

On Thursday, novice traders can expect new trading signals to form in the 1.3096-1.3107 range. If a rebound occurs, new longs can be opened with a target of 1.3203. If the area is breached, shorts can be considered, targeting 1.3043.

On the 5-minute timeframe, current trading levels to consider are 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. On Thursday, important reports on Q3 GDP and industrial production are scheduled for publication in the UK. These reports may trigger market reactions that do not align with the current technical picture. It is advisable to exercise caution in trading on Thursday morning.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.

QUICK LINKS