Akcie společnosti Alphabet ve středu poklesly o více než 7 % poté, co agentura Reuters informovala, že výkonný ředitel společnosti Apple (NASDAQ:AAPL) Eddy Cue vypověděl, že společnost „aktivně zvažuje“ přidání poskytovatelů umělé inteligence do svého prohlížeče Safari jako možnost vyhledávání.

V reakci na tuto zprávu analytici společnosti Stifel uvedli: „Dnešní výpověď pana Cue podpořila pesimistický scénář, že rychlý pokrok v oblasti umělé inteligence může mít bezprostřední dopad na společnost Google a tradiční vyhledávače.“

The GBP/USD currency pair continued to show a downward bias on Thursday, despite the absence of fundamental or macroeconomic drivers. Ironically, the only day this week when the British pound had justifiable reasons to decline — Wednesday, due to a weak inflation report — it didn't drop at all; in fact, the pair rose during the second half of the session. This further proves that recent market movements lack logic. The ongoing flat trend on the daily timeframe, which we've identified as the primary driver of irrational moves over the past three weeks, is even more evident in the euro's case.

This means the dollar might continue to rise in the coming weeks, even though there are few valid reasons for such a move. The next Federal Reserve meeting is scheduled for next week, when the interest rate is expected to be cut by 25 basis points — a scenario already priced in with 99% probability. And yet, the dollar has now been strengthening for more than a month. If this anticipated policy easing is already in the price, then when did that market reaction occur?

Additionally, inflation remains high in the United Kingdom, which casts serious doubt on whether the Bank of England will risk another rate cut before the end of the year. Trump's trade war continues, and the U.S. government shutdown remains unresolved. There are no clear reasons for dollar strength.

Today's release of the U.S. Consumer Price Index is the second key macroeconomic report of the week. However, CPI data — especially under current conditions — has limited relevance. If inflation surpasses 3.1% (last month's figure), the Fed's dovish stance might soften. But how can such conclusions be made with confidence when the market has not seen a Non-Farm Payrolls report or updated unemployment figures in almost two months? If September NFP confirms a negative dynamic in the labor market, or if unemployment continues to rise, the Fed may have no choice but to cut rates again in December — or even early next year. In such a scenario, inflation becomes far less relevant.

We believe today's CPI release will trigger a market response, but it will be a one-off. The dollar might strengthen or weaken, but over the last three weeks, we've seen little correlation between news and price action. Only a breakout from the flat range on the daily chart — or at least a test of the lower boundary near 1.3140 — will allow more confident technical assumptions about the pair's direction.

Of course, this flat won't last forever. It can break at any moment and not necessarily near 1.3140. But given current levels, we're focused on the most probable outcomes. If fundamentals and macroeconomics were even a minor driver of price action right now, we would already be calling for GBP/USD to rise from current levels. However, in this environment of total irrationality, the dollar could continue climbing.

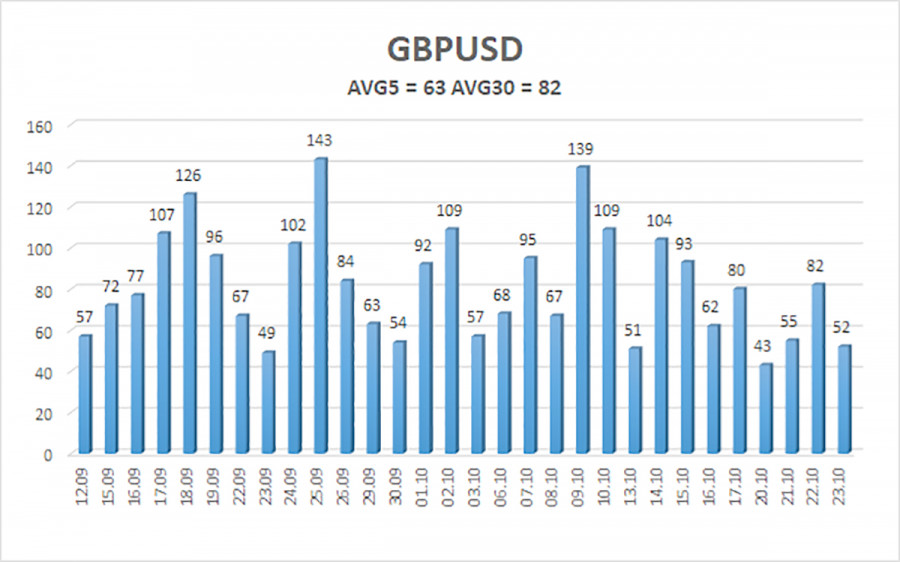

The average volatility for GBP/USD over the last five trading days is 63 pips— an average figure for this pair. For Friday, October 24, we expect the pair to trade between 1.3257 and 1.3383. The upper linear regression channel remains upward, reinforcing the view of a prevailing bullish trend. The CCI indicator has entered oversold territory three times recently — a possible signal of an impending upward rebound.

S1 – 1.3306

S2 – 1.3245

S3 – 1.3184

R1 – 1.3367

R2 – 1.3428

R3 – 1.3489

GBP/USD is attempting to resume the broader uptrend established in 2025, and its longer-term outlook remains intact. Donald Trump's policies will likely continue to weigh on the dollar, so we do not expect sustained greenback strength. Therefore, long positions targeting 1.3672 and 1.3733 remain more relevant if the price moves above the moving average.

At the same time, positioning below the moving average allows for modest short positions, with targets at 1.3257 and 1.3245, based solely on technical factors. While the dollar may experience occasional corrections, any trend-based appreciation will require meaningful signs of an end to the trade war or other major positive developments.

QUICK LINKS