Wingstop zveřejnil výsledky za první čtvrtletí, které překonaly očekávání Wall Street, avšak akcie klesly o 4 %, protože firma snížila výhled růstu srovnatelných tržeb v USA pro rok 2025.

Řetězec specializovaný na kuřecí křídla vykázal zisk na akcii 0,99 USD za čtvrtletí končící 30. března, což překonalo průměrný odhad analytiků ve výši 0,87 USD.

Tržby činily 171,1 milionu USD, mírně pod konsenzem 172,5 milionu USD.

Společnost nyní očekává přibližně 1% růst domácích srovnatelných tržeb v roce 2025, což je pokles oproti dřívějšímu odhadu v rozmezí nižších až středních jednotek procent.

Wingstop (NASDAQ:WING) zvýšil odhad globálního růstu počtu poboček na 16 % až 17 % z původních 14 % až 15 %, v rámci mezinárodní expanze.

Zároveň snížil odhad čistých úrokových nákladů na rok 2025 na přibližně 40 milionů USD z předchozích 46 milionů USD.

Obecné a administrativní výdaje se odhadují na přibližně 140 milionů USD, včetně 4,5 milionu USD na implementaci nového systému.

On Wednesday, the EUR/USD pair traded more calmly than on Tuesday, when euro quotes were rising throughout the day in geometric progression. Of course, this applies only to the time before the Fed's meeting results and Powell's press conference. As usual, we won't review either the meeting outcome or the post-event market movements here. We continue to believe that such important events require time for thorough analysis. Moreover, markets often trade impulsively and emotionally on those days, so technical conclusions cannot be drawn from the immediate moves. Quite often, the Fed's meeting swings don't fit into the overall technical picture at all, and are better ignored afterwards. Sometimes the pair flies in one direction only to return to its starting point the very next day. We will make conclusions once the dust settles.

For now, we can say that the "dovish wing" inside the Fed is expanding, albeit very slowly. Currently, only three members are ready to vote for a rate cut at every meeting—Stephen Mirran, Christopher Waller, and Michelle Bowman. Notably, all three were appointed by Donald Trump. Here, one can see Trump's influence at play. The Fed may not be a "fly-by-night operation," but in practice, it could start looking like one.

Three doves are too few. Next year, there will definitely be four, once Jerome Powell leaves his post. That's still not enough for the 3% rate cut Trump wants. Therefore, I am almost certain that Trump will continue his attacks on the "hawks" within the FOMC, trying either to dismiss them or to pressure them. Everyone understands that Mirran, Waller, and Bowman are not voting for drastic cuts because they believe it is right or consistent with the Fed's dual mandate, but because Trump demands it. The Fed risks losing not only its independence, but also its own "thinking." Trump would do the thinking, and the Fed would merely broadcast his decisions.

Thus, the outlook for the Fed and the dollar is even worse than many currently assume. At first, this trio may simply be ignored by the rest of the committee—perhaps even seated together so as not to disturb others. But in the longer term, everything will depend on how many more officials Trump manages to sway. We know Trump's methods well. Hawks could be branded "fraudsters" for trivial reasons or subjected to investigations that dig up skeletons in their closets. For now, however, the Fed remains a politically independent body.

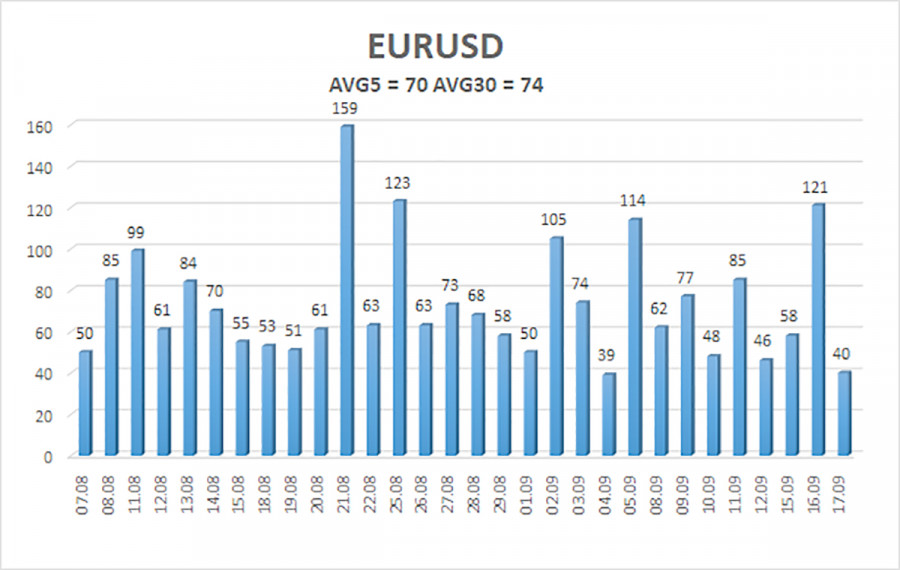

Average volatility of EUR/USD over the past five trading days as of September 18 is 70 pips, which is "average." We expect the pair to move between 1.1784 and 1.1924 on Thursday. The linear regression channel's upper band points upward, indicating a continued uptrend. The CCI indicator has entered oversold territory three times, warning of trend resumption, and a bullish divergence has also been formed. Currently, the indicator is in overbought territory, but in an uptrend, this only signals a correction.

S1 – 1.1841

S2 – 1.1780

S3 – 1.1719

R1 – 1.1902

R2 – 1.1963

R3 – 1.2024

EUR/USD may resume its uptrend. The U.S. dollar remains under strong pressure from Donald Trump's policies, and he clearly has no intention of "stopping here." The dollar rose as much as it could (not for long), but now appears poised for another extended decline. If the price settles below the moving average, small shorts can be considered toward 1.1719 as part of a corrective move. Above the moving average, long positions remain relevant with targets at 1.1902 and 1.1963 in continuation of the trend.

QUICK LINKS