Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

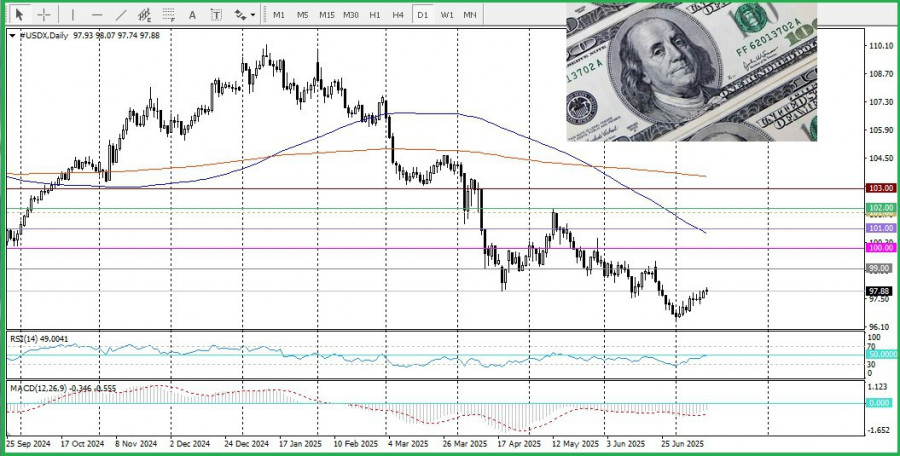

The USD/JPY pair remains in a consolidation phase near a three-week high, supported by U.S. dollar strength and mixed market signals.

The dollar is being bolstered by U.S. President Donald Trump's threat to impose 30% tariffs on imports from Mexico and the EU starting August 1, which is increasing demand for safe-haven currencies, including the Japanese yen. However, diminished expectations for a rate hike by the Bank of Japan are limiting aggressive yen gains.

From a technical perspective, the pair's confident breakout and daily close above the 100-day Simple Moving Average (SMA) last week — for the first time since February 2025 — indicate a bullish trend for USD/JPY. Oscillators on the daily chart are in positive territory and have not yet reached overbought levels, suggesting further upward movement.

If the pair moves above the 147.45 level, continued growth toward the psychological level of 148.00 or the June high can be expected. Further gains may extend toward the 148.65 level or the May high, followed by a possible test of the next key round level at 149.00.

At the same time, a corrective pullback may offer buying opportunities around the 146.50–146.55 range. Additional support is located at 146.25 and the round level of 146.00. A break below the 100-day SMA on the daily chart could lead prices down to the 145.50–145.45 level and further toward the psychological level of 145.00. Such a scenario would confirm a shift in market sentiment in favor of the bears, opening the way for a deeper decline in USD/JPY.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

QUICK LINKS