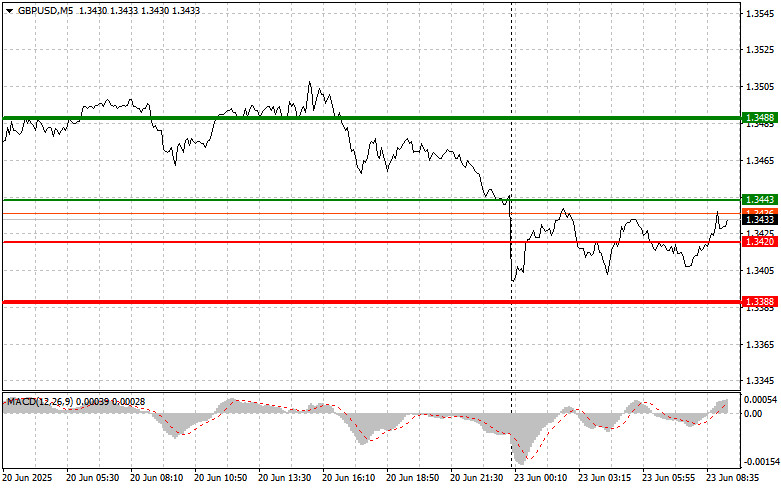

The test of the 1.3483 mark coincided with the moment when the MACD indicator had just started moving downward from the zero line, confirming a valid entry point for selling the pound. As a result, the pair dropped by more than 30 pips.

The British pound declined in response to U.S. involvement in the Israel-Iran conflict. However, pressure on risk assets soon eased as the market began anticipating Iran's potential response. The prospect of further escalation is undoubtedly the key source of uncertainty. If Iran chooses to retaliate—either through direct confrontation or proxy groups—it would inevitably trigger a new wave of risk aversion. Like other currencies sensitive to global conditions, the pound would come under pressure.

Investor attention today, particularly in the morning, will focus on the release of key UK macroeconomic indicators: the Manufacturing PMI, Services PMI, and the Composite PMI. These indicators act as a litmus test for the current state of the UK economy and could significantly impact the dynamics of the British pound. Weak manufacturing data could signal declining demand for British goods, which may negatively affect the country's economic growth rate. This could lead to a pound depreciation as investors revise their expectations regarding the Bank of England's future monetary policy.

However, the role of the services sector—which is highly significant in the UK economy—should not be underestimated. If the Services PMI shows steady growth, it could offset the negative impact from the manufacturing sector and support the pound. The Composite PMI, which combines data from both sectors, will provide the most comprehensive view of the UK economy. A reading above 50 indicates expansion in economic activity, while a reading below 50 signals contraction.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3443 (green line on the chart) with a target of rising to 1.3488 (thicker green line on the chart). Around 1.3488, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip reversal from that level). Buying the pound today is reasonable only after strong economic data.

Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.3420 price level when the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger an upward reversal. A rise toward 1.3443 and 1.3488 can be expected.

Scenario #1: I plan to sell the pound today after a breakout below the 1.3420 level (red line on the chart), which should lead to a rapid decline in the pair. The key target for sellers will be 1.3388, where I plan to exit short positions and open long positions in the opposite direction (expecting a 20–25 pip rebound from that level). Selling the pound is justified following weak economic data.

Important! Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3443 level while the MACD indicator is in the overbought zone. This would cap the pair's upward potential and lead to a reversal downward. A decline toward the 1.3420 and 1.3388 levels can be expected.

QUICK LINKS