The test of 1.2648 in the first half of the day coincided with the MACD indicator having already moved significantly below the zero level, limiting the pair's downward potential. As a result, I did not sell the pound at that moment. However, a second test of 1.2648 with the MACD in the oversold zone confirmed Scenario #2, leading to a buying opportunity. Nevertheless, the expected strong upward movement was hindered by weak U.S. economic data.

The pound declined following disappointing Manufacturing PMI data, which came in worse than expected and remained below the 50-point threshold. This reinforced concerns about a potential slowdown in the UK economy and the risk of recession. Investors reacted with pound sell-offs, shifting their focus to safer assets.

Additionally, growing uncertainty surrounding the Bank of England's policy stance added pressure on the pound. Many traders anticipate that the BoE will adopt a more dovish approach, possibly avoiding further rate hikes due to weak economic indicators. A potential rate cut would weaken the pound further.

In the second half of the day, strong U.S. PMI data could further strengthen the dollar and push GBP/USD lower. Key reports include the Manufacturing PMI, Services PMI, and Composite PMI for February, with positive expectations from economists. If the actual data exceeds forecasts, downward pressure on GBP/USD will intensify.

For today's trading session, I will primarily rely on Scenario #1 and Scenario #2.

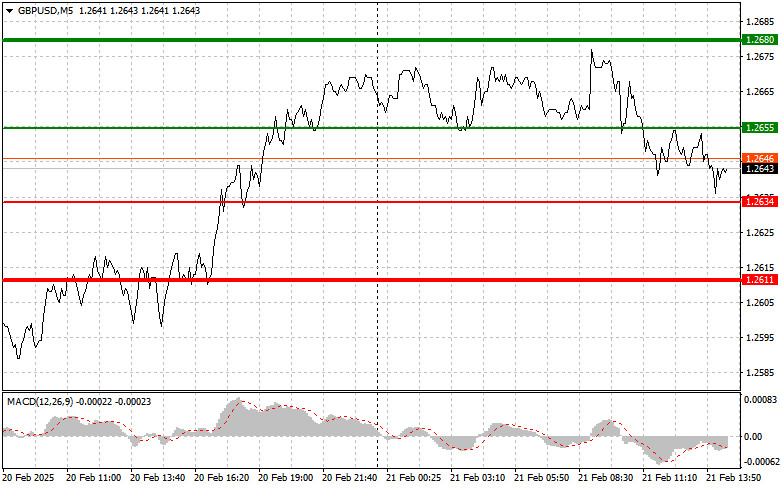

Scenario #1: Buy GBP/USD at 1.2655 (green line on the chart) with a target of 1.2680. At 1.2680, I plan to exit long positions and sell the pound in the opposite direction, anticipating a 30-35 point correction.The pound's rise will depend on weak U.S. data.Important! Before buying, ensure the MACD indicator is above the zero level and just starting to rise.

Scenario #2: Another buying opportunity arises if GBP/USD tests 1.2634 twice, with MACD in the oversold zone. This will limit downward potential and trigger a market reversal upward, targeting 1.2655 and 1.2680.

Scenario #1: Sell GBP/USD upon breaking below 1.2634 (red line on the chart), targeting 1.2611, where I will exit short positions and immediately buy in the opposite direction, aiming for a 20-25 point rebound.Sellers will gain momentum if PMI data from the U.S. is strong.Important! Before selling, ensure the MACD indicator is below the zero level and just beginning to decline.

Scenario #2: Another selling opportunity arises if GBP/USD tests 1.2655 twice, with MACD in the overbought zone. This will limit the pair's upward potential and trigger a downward reversal toward 1.2634 and 1.2611.

QUICK LINKS