Today, Tuesday, the EUR/USD pair is under selling pressure for the second day in a row, trading near the confluence of three moving averages around 1.1850, above the psychological level of 1.1800. However, the overall fundamental backdrop calls for caution from sellers before opening short positions.

The U.S. Dollar Index (DXY), which reflects the dollar's performance against a basket of currencies, is maintaining the previous day's moderate gains, trading above the 97.00 level and continuing to pressure EUR/USD.

The single currency is losing ground due to the growing likelihood of another key rate cut by the European Central Bank, prompted by a slowdown in eurozone inflation to its lowest level since September 2024. At the same time, the upward potential for the U.S. dollar is limited by expectations of monetary easing from the Federal Reserve. After weak U.S. consumer inflation data were released last Friday, market participants increased their expectations of a Fed rate cut, which may occur in June. These expectations are compounded by ongoing discussions about the Fed's independence, which could dampen dollar bullish sentiment and prevent a sharp decline in EUR/USD.

Underlying market optimism may also restrain safe-haven demand for the dollar. At present, it is advisable to refrain from decisive moves while awaiting further clarification on the Fed's rate-cut trajectory and to shift focus to the FOMC meeting minutes on Wednesday. In addition, preliminary U.S. fourth-quarter GDP data, the Personal Consumption Expenditures (PCE) price index, and global preliminary PMI readings will set the tone for the second half of the week.

From a technical perspective, the pair is attempting to break above the confluence of three moving averages around 1.1850. If successful, the path would open toward the psychological level of 1.1900, with interim resistance near 1.1890. If the pair fails to overcome current resistance, it may head toward the 1.1800 level, with interim support around 1.1810. Daily chart oscillators show mixed signals, and the Relative Strength Index is near neutral, suggesting that bullish momentum has weakened significantly.

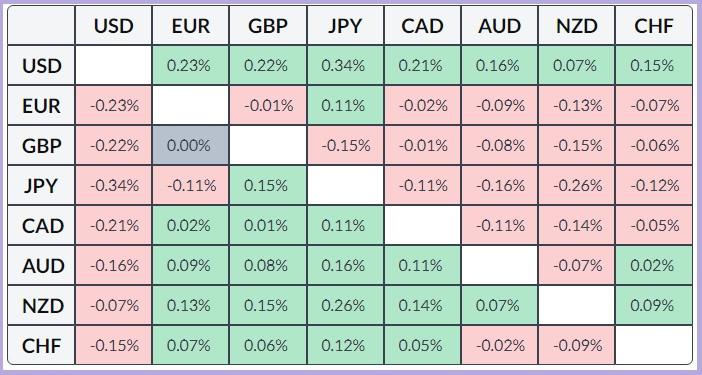

The table below reflects the percentage change of the U.S. dollar against major currencies this week. The dollar has shown the strongest performance against the Japanese yen.

LINKS RÁPIDOS