Praha – Kryptoměna bitcoin se vzhledem k možnosti dohledat transakce používá ke kriminální činnosti relativně málo. S nelegálními činy je podle odhadů expertů celosvětově spojeno necelé procento, spíše však jen desetiny procenta, všech transakcí v kryptoměnách. To je výrazně méně než u běžných peněz. Díky uchovávané historii transakcí v tzv. blockchainu je každý přesun bitcoinu veřejně zjistitelný a většinou jde zjistit, zda pochází z trestné činnosti. Uvedli to odborníci oslovení ČTK.

*) see also: InstaForex Trading Indicators for S&P 500 (SPX)

The outcome of the January Fed meeting and the nomination of Kevin Warsh create supportive conditions for further dollar strengthening, especially given expectations of tougher measures to contain inflation. However, the market remains cautious ahead of key economic releases, including the Non?Farm Payrolls report (on Friday) and the ISM PMI indices for the US manufacturing and services sectors, underscoring the need for careful assessment of the Fed's next steps, as well as the impact of ongoing geopolitical events and mostly unexpected actions by Trump and the White House — as noted in our today's review "USD in bullish correction."

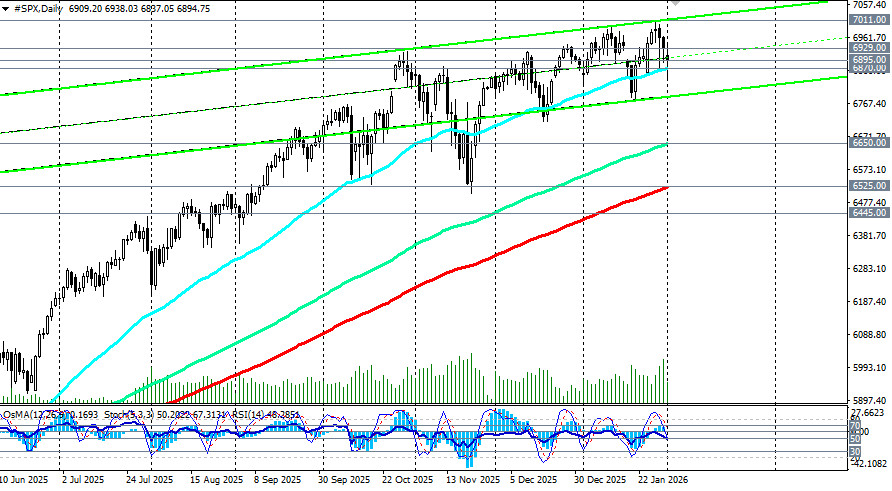

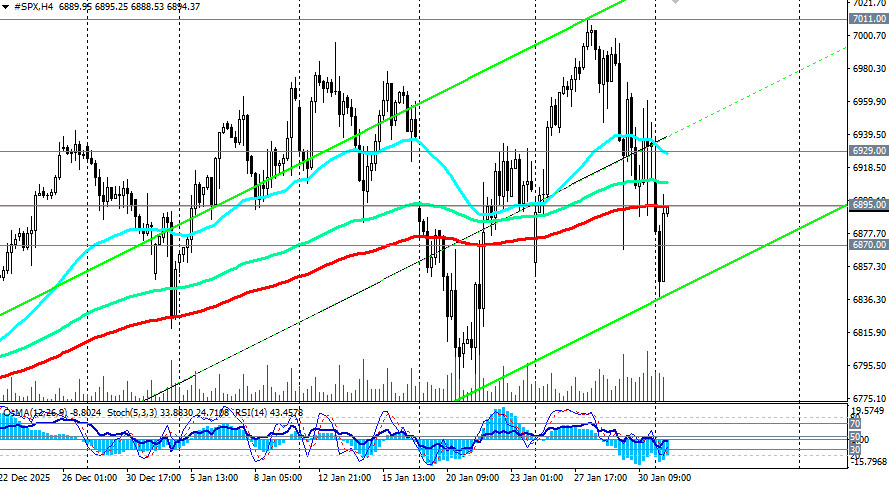

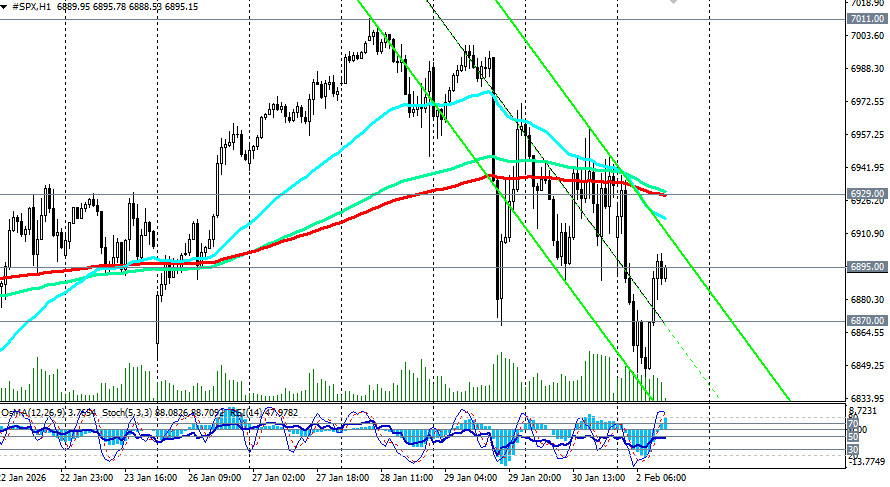

The leading barometer of the US economy — the S&P 500 index — is undergoing a local correction, trading before the opening level of Monday's US session around 6,895.00 (the 200?period moving average on the 4?hour chart). The week opened with a decline, and investor sentiment remains cautious.

The S&P 500 is traditionally viewed as a key gauge of the US equity market and the economy as a whole. It covers the largest US companies across sectors, from technology and finance to energy and industry, and reflects investors' expectations for corporate profits, monetary policy, and macroeconomic conditions.

Current dynamics are being shaped chiefly by three forces: staffing decisions at the Fed, the corporate earnings season, and rising macroeconomic uncertainty. The index remains sensitive to any shifts in rhetoric from regulators and policymakers.

Current dynamics: phase of local correction

The S&P 500 has entered a phase of a local correction, falling to an 8?day low near 6840.0 today.

Pressure on the market has intensified against the backdrop of several factors.

Expectations for a modest improvement in the manufacturing PMI to around 48 points indicate that the sector remains in contraction (values below 50), although the pace of decline is slowing. Economists note that manufacturing weakness contrasts with relative resilience in services, producing a mixed economic picture. Weaker PMI readings would increase concerns about economic slowing. Conversely, strong labor market data would support the dollar and strengthen the Fed's case for maintaining rates, which could cap equity upside. A weak jobs report would raise hopes for earlier easing but simultaneously stoke recession fears.

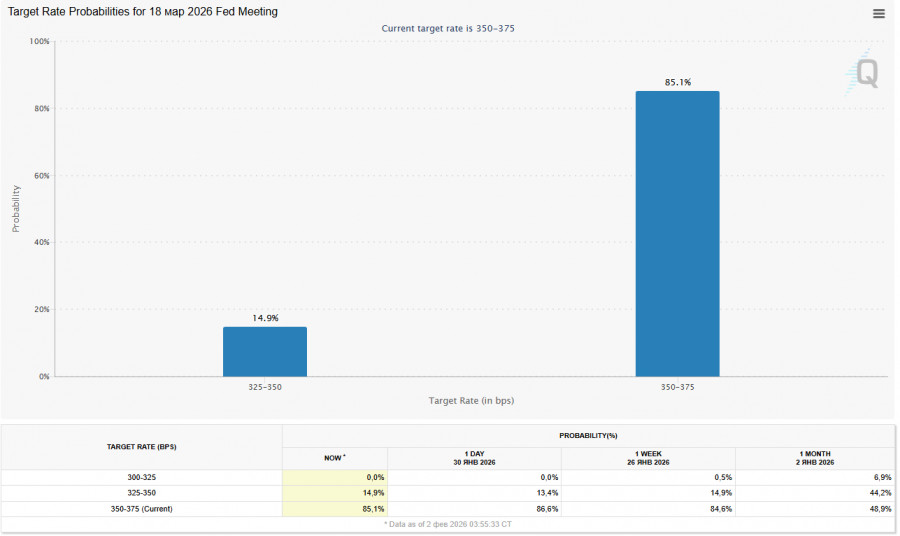

The fall in yields is accompanied by expectations that the Fed will keep policy rates on hold at least through upcoming meetings.

The CME FedWatch Tool shows the market is largely pricing a pause in rate changes until clearer signals on inflation and the labor market appear.

Technical analysis

Futures on the S&P 500 index (SPX on the trading platform) opened with a gap down and have settled in the "red" zone.

An important support area remains around 6,870.00 — close to the 50?day moving average. Holding this level is critical to prevent a deeper correction.

The nearest resistance is near 6,930.00 (200?period moving average on the 1?hour chart). A deepening correction scenario would be triggered by a break of the 6,870.00–6,800.00 support zone, targeting a move to 6,700.00–6,650.00 (144?period moving average on the daily chart).

Possible scenarios for the S&P 500:

Conclusion

Rising trade tensions, the risk of expanded sanctions, and a partial US government shutdown are increasing capital outflows from risk assets. Historically, such periods of uncertainty tend to produce elevated volatility and sectoral capital reallocation — toward defensive sectors and companies with resilient cash flows — rather than a prolonged market collapse.

The current S&P 500 dynamics also reflect a phase of heightened uncertainty and market adaptation to shifting expectations on monetary policy and political risks. A local correction looks logical after the prior advance and does not necessarily signal the start of a long?term downtrend.

In the medium term, the fate of the US equity market will depend on the balance between inflation, the labor market, and Fed actions. For investors, this implies a need for a more measured approach, diversification, and heightened attention to macroeconomic signals that will shape the future path of the S&P 500.

LINKS RÁPIDOS