The start of 2026 brought a powerful wave of volatility to global financial markets. A sharp drop in Bitcoin, a crash in prices of precious metals and crude oil, and a major investment push by Oracle — all occurred against the backdrop of one key event: President Donald Trump's unexpected nomination of Kevin Warsh as Fed chair. A bet on tighter monetary policy instantly shook market confidence, triggering mass liquidations and a rebalancing between risk and safe?haven assets.

This article brings together four core storylines, showing how shifting rate expectations, geopolitical signals and investment strategies are driving price action in the crypto market, precious metals, oil and tech stocks.

Bitcoin endures the worst stretch since 2018 — analysts debate where the bottom may be

The crypto market began 2026 in turmoil: Bitcoin finished January down 10.17%, marking its fourth consecutive monthly loss — the longest losing run since 2018, when the market experienced a deep bear phase.

Over the weekend, Bitcoin fell to $75,600, the lowest level since April 2025, before recovering slightly to around $78,000. But pressure on the market remains elevated.

One key driver of the recent crash was a wave of long?futures liquidations: according to Coinglass data, liquidations totaled about $2.56 billion on January 31. Long contract holders took the brunt of that, suffering about $2.42 billion in losses — the tenth?largest liquidation event in crypto?futures history.

The political intrigue around the Fed nomination added fuel to the sell?off: President Trump unexpectedly named Kevin Warsh (a former Fed official) as his choice for Fed chair. Although Warsh once called Bitcoin "a good policeman for monetary policy," his reputation as a proponent of tighter monetary policy immediately worried investors. Markets fear stricter financial conditions, which weigh on risk assets.

Institutional flows added further pressure. Spot Bitcoin ETFs continued to see large outflows: on January 30 BlackRock's iShares Bitcoin Trust recorded net redemptions of $528.3 million. Total outflows for two weeks in January amounted to $2.82 billion, and the month ended with a net outflow of $1 billion. This is the third consecutive month of institutional retreat from crypto.

The backdrop remains unstable: spreading geopolitical risks, including a potential escalation between the US and Iran, and a partial US government shutdown are prompting market caution. Reuters reported Bitcoin at $78,719 on Saturday evening, down 6.53% intraday.

Analysts are divided. PlanC believes the move is the final stage of the correction, with a bottom forming in the $75k–$80k range — "there's a good chance we're seeing final capitulation now," he wrote on X.

More conservative voices disagree. Cryptoverse founder Benjamin Cowen says the market has entered a full bear phase that could last until mid?2026. Veteran trader Peter Brandt projects a drop to $60,000 by Q3 next year, while Fidelity's head of global macro research, Dr. Durrien Timmer, expects 2026 to be a "quiet" year with potential lows near $65,000.

Four months of declines, large liquidations and ETF outflows indicate severe investor distress. Yet periods of intense uncertainty also create trading opportunities: traders can exploit BTC volatility for short?term trades or long?term strategies, from buying bounces to shorting a further breakdown. Trading can be done on spot or via futures — counter?trend and momentum strategies both have a role when prices sit near potential bottoms and rumor?driven uncertainty is high.

All instruments mentioned — including Bitcoin and crypto indices — are available on the InstaForex platform. By opening an account, you get access to analytics and fast execution; the mobile app lets you monitor markets and trade anywhere.

Panic in precious metals: gold, platinum, and palladium plunge

The precious metals complex entered shock mode at the start of the week. On Monday, gold, platinum and palladium all plunged sharply — more than 3% intraday — continuing a sell?off that began late last week.

The sell?off was driven by politics, monetary expectations and exchange actions — factors that together produced the largest downturn since the year began.

The trigger: President Trump nominated Kevin Warsh to chair the Fed, replacing Jerome Powell whose term ends in May. Warsh is seen as a supporter of tighter policy, and his nomination strengthened the dollar, traditionally negative for dollar?priced precious metals.

Reuters reports platinum fell over 4% to about $2,074/oz (it had hit a record $2,918.80 on January 26). Palladium lost more than 3% to around $1,601/oz. The largest shock was gold, which plunged nearly 5% to about $4,600/oz per Bloomberg — the biggest one?day fall in gold in nearly 40 years.

CNBC analysts say Warsh's nomination matches Wall Street expectations: he's viewed as a credible figure who could strengthen the Fed's credibility. But markets immediately priced in tighter policy, prompting mass profit?taking after the record rallies earlier in the month.

Margin pressure amplified the move: CME Group raised margin requirements for precious?metal futures — the second hike in three days. As of the next trading day margin on gold rose from 6% to 8%, platinum from 12% to 15% and palladium from 14% to 16%. CME justified the increases as necessary to "ensure stability of trading in a highly volatile environment."

This draws a clear picture: a hawkish pivot at the Fed nomination strengthened the dollar and sparked a large correction across gold, platinum and palladium. But volatility also creates opportunities for traders: both short?term speculation and longer?term investment may be profitable, depending on strategy and risk tolerance. Watch Fed commentary and dollar moves closely — they will be key to precious?metal direction in coming days.

Oracle lines up a major AI?cloud financing drive: up to $50 billion Oracle is preparing a major investment push in cloud infrastructure for AI

In 2026, the company plans to raise up to $50 billion to scale out its cloud footprint. The cash will fund rising demand from AI giants such as Meta, NVIDIA, OpenAI and TikTok. If completed, the raise would rank among the largest corporate capital raises in history.

According to Oracle's press release, the company aims to secure $45–$50 billion to meet contractual obligations to large Oracle Cloud Infrastructure customers — including AMD, Meta, NVIDIA, OpenAI, TikTok and xAI. The focus is on GPU?based infrastructure and data center modernization to handle surging AI workloads.

Financing will be split between debt and equity. Oracle plans an at?the?market (ATM) equity program of up to $20 billion to raise capital flexibly at market prices, plus issuance of preferred convertible securities as a small part of the equity component. The remainder will come from senior, unsecured investment?grade bonds to be issued in early 2026. Oracle says it does not plan additional borrowing this year beyond this major issuance.

Goldman Sachs will lead the bond placement; Citigroup will handle the ATM equity program and convertible securities. Oracle has secured support from two major global investment banks.

The investment push follows a spike in AI demand. Oracle raised capex guidance for FY2026 to a record $50 billion, adding $15 billion to earlier plans. In Q2 alone, the company spent $12 billion on data centers and GPU hardware.

Oracle's customer roster is expanding rapidly. The Wall Street Journal reports OpenAI has agreed to buy about $300 billion of cloud resources from Oracle over roughly five years — one of the largest cloud agreements in history. Reuters says Meta is discussing a multiyear contract worth about $20 billion.

Despite aggressive plans, Oracle emphasizes it will preserve its investment?grade rating and maintain financial stability and transparency. Oracle shares have been volatile recently as investors weigh higher leverage and massive infrastructure spending. Still, the company is positioning to play a central role in the evolving AI landscape. Traders can use current volatility to find entry points in Oracle stock; the long?term strategy, marquee clients and infrastructure investment make the share attractive for both short?term trading and portfolio allocation. Monitor equity and debt placements and new AI contract announcements.

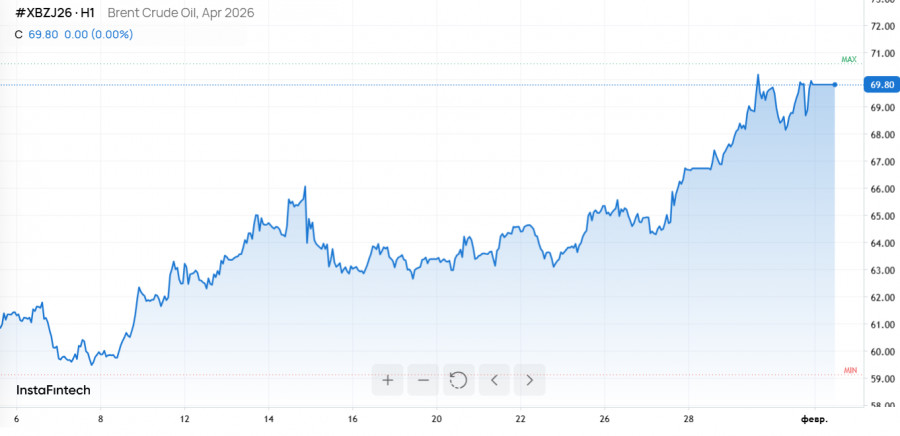

Oil retreats on hopes of de?escalation between the US and Iran

Oil markets plunged at the start of the week as investors took profits after an unexpected softening of rhetoric between Washington and Tehran. President Trump's remark that Iran is "seriously negotiating" with the US removed much of the geopolitical premium from oil prices and triggered a sharp correction.

Brent dropped nearly 5% to about $66/bbl, while WTI sank over 5% to around $62/bbl — the biggest one?day losses in more than six months.

The move followed Trump's comment to reporters that Iran was serious about talks, hours after a post on X by former Iranian national security official Ali Larijani indicating diplomatic engagement. Although Iran's Supreme Leader Ayatollah Khamenei warned Sunday that US aggression could spark a "regional war," Trump downplayed that rhetoric and expressed hope for a deal, particularly on Iran's nuclear program.

In the short term, this may mark the end of the oil rally driven by conflict fears in the Middle East. Traders should watch political statements on both sides to judge whether de?escalation is durable.

Volatility in oil creates trading opportunities: profit from short?term selling or rebounds if rhetoric turns hawkish. Combining technical analysis with news flow will be critical for success.

All instruments mentioned — including Brent and WTI futures — are available for trading on InstaForex. Open an account and use the mobile app for convenient, on?the?go trading.

LINKS RÁPIDOS