The test of the price level at 1.1715 occurred when the MACD indicator had moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the euro.

Contrary to analysts' expectations, the number of new jobless claims in the United States exceeded forecasted figures. This situation led to a decline in the value of the US currency and a strengthening of the euro's position.

Today, market participants will focus on the consumer price index reports from leading Eurozone countries. Special attention will be paid to the German inflation data release. Unexpected deviations from forecasts in German data may provoke significant fluctuations in currency markets, affecting both the euro and related currencies. Data from France and Italy will also be released. The difference between expectations and actual data can lead to a slight spike in volatility. Rising inflation across all countries will also support the euro's growth.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

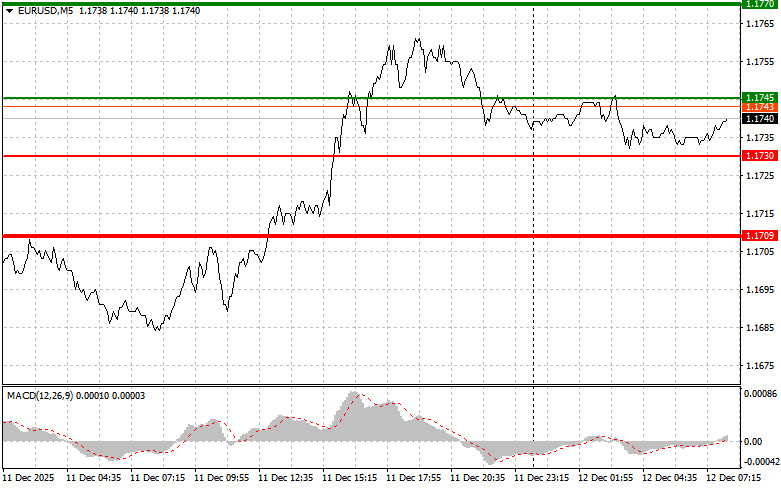

Scenario #1: Today, I plan to buy the euro at around 1.1745 (green line on the chart), with a target of 1.1770. At point 1.1770, I plan to exit the market and sell the euro in the opposite direction, anticipating a movement of 30-35 pips from the entry point. Expecting growth for the euro can only happen after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting its climb from there.

Scenario #2: I also plan to buy the euro today if two consecutive tests of the 1.1730 price level occur while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise towards opposite levels of 1.1645 and 1.1770 can be expected.

Scenario #1: I plan to sell the euro once it reaches 1.1730 (red line on the chart). The target will be 1.1709, where I intend to exit the market and buy immediately in the opposite direction (anticipating a move of 20-25 pips back from that level). Pressure on the pair will return with weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if two consecutive tests of the 1.1745 price level occur while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline towards the opposite levels of 1.1730 and 1.1709 can be anticipated.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.

LINKS RÁPIDOS