A considerable number of macroeconomic reports are scheduled for Friday. In fact, today is the first day this week when traders will have anything significant to focus on. Therefore, there is no doubt that today's movements will be more volatile. The nature of movement for both currency pairs will depend on the actual reports. Business activity indices (PMIs) in the services and manufacturing sectors will be released in Germany, the Eurozone, the United Kingdom, and the United States. The UK will also publish retail sales data, and in the U.S., the most critical report of the week—CPI (Consumer Price Index) inflation data—will be announced. All of these reports are expected to influence the movement of currency instruments to varying degrees.

No fundamental events are scheduled for Friday, but they won't be necessary given the volume of macroeconomic reports due for release today. It's also worth noting that the Federal Reserve has entered its pre-meeting "quiet period," with the next policy meeting scheduled for next week. At the European Central Bank, Christine Lagarde has spoken ten times over the past few weeks, yet none of her remarks have provided the market with anything particularly important. Thus, central bank officials' speeches currently offer little value to traders.

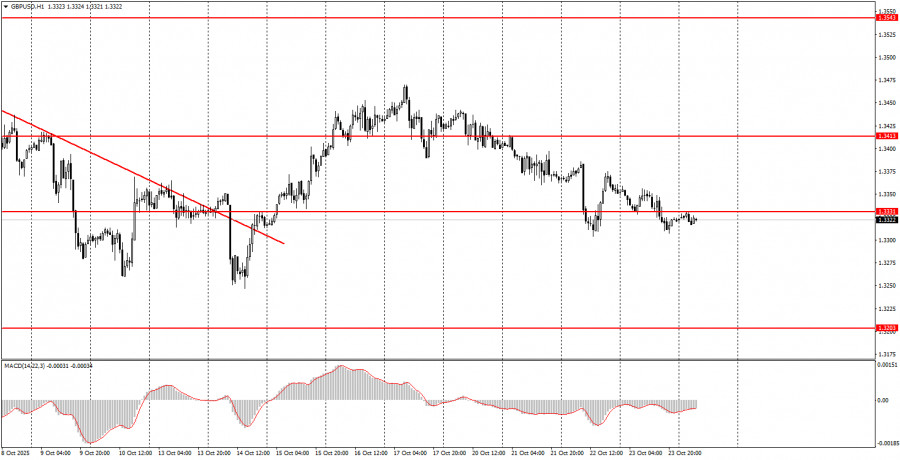

On the final trading day of the week, both currency pairs may experience significantly higher volatility and erratic price movements. The euro has a favorable trading zone at 1.1571–1.1584, from which both long and short positions can be considered. The British pound is near the 1.3329–1.3331 area, which also serves as a valid trading zone.

Support and resistance price levels – levels that serve as targets when opening buy or sell trades. Take Profit levels can be placed near them.

Red lines – channels or trendlines that show the current trend and indicate the preferred trading direction.

MACD (14,22,3) indicator – histogram and signal line – a supporting indicator that can also be used as a signal source.

Important speeches and reports (always listed in the economic calendar) can significantly affect the movement of currency pairs. Therefore, during their release times, trading should be highly cautious, or it's better to exit the market to avoid sharp reversals against the preceding movement.

Beginner traders on the Forex market should remember that not every trade will be profitable. Developing a clear strategy and sound money management are the keys to long-term success in trading.

LINKS RÁPIDOS