Asijské akcie rostly a hongkongské indexy si vedly lépe poté, co setkání čínského prezidenta Si Ťin-pchinga s podnikateli vyvolalo očekávání větší podpory soukromého sektoru.

Regionální benchmark akcií vzrostl na nejvyšší úroveň od začátku listopadu, přičemž ukazatel hlavních technologických akcií kótovaných v Hongkongu se obchodoval na tříletém maximu. Australské akcie rozšířily ztráty poté, co tamní centrální banka snížila základní úrokovou sazbu. Futures na americké akciové indexy ukazovaly na růst, zatímco kontrakty pro Evropu zůstaly beze změny.

Dolar posílil vůči všem svým protějškům ze skupiny 10 a výnosy desetiletých amerických státních dluhopisů vzrostly o čtyři bazické body na 4,5 %, když se v úterý po svátku prezidenta znovu otevřel trh s dluhopisy. Již dříve guvernér Federálního rezervního systému Christopher Waller uvedl, že nedávné ekonomické údaje podporují ponechání úrokových sazeb, dokud nebude vidět větší pokrok v oblasti inflace.

Optimismus kolem Číny se v pondělí ještě zvýšil po setkání Si s vedoucími představiteli podniků, včetně spoluzakladatele Alibaba Group Holding Ltd. Jacka Ma. Několik analytiků považovalo toto konkláve za možný konec léta trvajícího potlačování soukromého sektoru. Čínské akcie od průlomu společnosti DeepSeek v oblasti umělé inteligence přidaly více než 1 bilion dolarů.

„Je to dobré oživení, ale než se skutečně vyvine v mnohaletý rostoucí trend, je třeba udělat ještě hodně,“ řekl Hao Hong, partner a ekonom ve společnosti Grow Investment Group, v rozhovoru pro televizi Bloomberg. „Pokud chcete opravdu udržitelný býčí trh, chcete opravdu udržitelný model růstu do budoucna.“

Siova setkání se zúčastnila řada největších jmen čínského byznysu posledních deseti let, která zastupovala odvětví od výroby čipů a elektromobilů až po umělou inteligenci. Summit ukázal mírnější postoj Pekingu vůči společnostem, které pohánějí většinu ekonomiky, právě v době, kdy Washington stupňuje potenciálně oslabující kampaň globálních cel.

Výnosy čínských státních dluhopisů se posunuly vpřed, přičemž desetileté dluhopisy vzrostly o 4 bazické body na 1,73 %, což je nejvyšší hodnota od prosince, protože napjaté peněžní podmínky na místním trhu a růst akcií snížily poptávku po dluhu.

Guvernér Fedu Waller mezitím uvedl, že pokud se inflace v USA bude chovat stejně jako v roce 2024, mohou se tvůrci politiky vrátit ke snižování „někdy v tomto roce“.

Mezitím australský dolar krátce stoupl, než zisky snížil poté, co tamní centrální banka uvedla, že po snížení oficiální hotovostní sazby zůstává opatrná ohledně budoucího uvolňování.

V komoditním sektoru ropa ustálila nárůst, když delegáti OPEC+ uvedli, že skupina zvažuje odklad obnovení těžby, a ukrajinské drony zaútočily na čerpací stanici ropy v Rusku.

Zlato si udrželo zisk poté, co v pondělí vzrostlo o 0,5 %. Analytici Goldman Sachs Group Inc. zvýšili svůj cíl pro zlato na konci roku na 3 100 USD za unci díky nákupům centrálních bank a přílivu peněz do burzovně obchodovaných fondů krytých zlatem.

Některé hlavní pohyby na trzích:

Akcie

Měny

Kryptoměny

Dluhopisy

Komodity

In my morning forecast, I focused on the level of 1.0356 and planned to make trading decisions from there. Let's look at the 5-minute chart and analyze what happened. A decline and the formation of a false breakout around 1.0356 provided a buying opportunity for the euro, but significant growth did not follow. The breakout and retest of 1.0356 with an entry point for a sale also failed to yield substantial profits, as trading remained centered around 1.0356. The technical outlook has been revised for the second half of the day.

The drop in the ZEW economic sentiment index prevented euro buyers from establishing themselves at 1.0362, even though other reports were somewhat positive. Unfortunately, with no significant U.S. economic data today, don't be surprised if the euro continues to lose ground against the dollar, as the inauguration of U.S. President Donald Trump offers no favorable prospects for Europe. For this reason, I won't rush into purchases. A false breakout near the new support at 1.0328 will provide a good entry point for a rise toward resistance at 1.0362. A breakout and retest of this range would confirm a buying opportunity with a target of 1.0398. The furthest target is the 1.0433 level, where I'll take profits.

If EUR/USD declines further, which seems more likely, and no activity is seen around 1.0328, selling pressure on the pair will intensify. Sellers could push the pair toward 1.0298. Only after forming a false breakout there will I consider buying the euro. Direct long positions on a rebound are planned from 1.0268 with a 30-35 point intraday correction target.

Sellers are finally doing what they should have done yesterday, exerting notable pressure on the euro despite rumors that Trump does not plan to impose immediate tariffs on EU and Chinese goods. However, the situation could change quickly, so remain cautious and keep an eye on announcements from Trump's administration. If the euro rises, only a false breakout near 1.0362 will convince me of the presence of major players in the market, offering a short-entry point targeting 1.0328. A breakout and consolidation below this range, followed by a retest from below, would provide another short-selling opportunity targeting 1.0298. The furthest target would be the 1.0268 level, where I'll take profits.

If EUR/USD rises in the second half of the day and sellers don't appear around 1.0362, where moving averages currently favor sellers, I'll postpone short positions until the next resistance at 1.0398. There, I'll also consider shorting only after an unsuccessful breakout. If there's no downward movement there, I'll look for short positions on a rebound around 1.0433, aiming for a 30-35 point intraday correction.

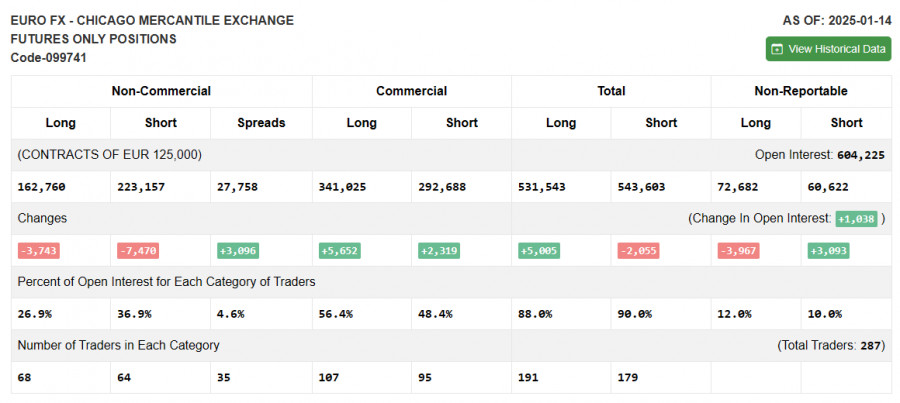

The COT report for January 14 showed a reduction in both short and long positions. With growing uncertainty surrounding the Federal Reserve's future policy, traders scaled back some positions. Trump's inauguration added pessimism, but the overall positioning hasn't changed significantly. The report showed that long non-commercial positions fell by 3,743 to 162,760, while short non-commercial positions declined by 7,470 to 223,157. The gap between longs and shorts increased by 3,096.

Moving AveragesTrading is occurring near the 30- and 50-period moving averages, indicating further euro declines.

Note: The period and prices of moving averages are based on the hourly H1 chart and differ from traditional daily moving averages on the D1 chart.

Bollinger BandsIn case of a decline, the lower boundary of the indicator around 1.0354 will act as support.

LINKS RÁPIDOS