The test of the price level at 155.74 coincided with the MACD indicator moving significantly below the zero mark, limiting the pair's downside potential. For this reason, I did not sell the dollar and missed out on all the downward movement.

The Japanese yen strengthened against the US dollar yesterday after data showed that the weekly number of initial jobless claims in the United States exceeded economists' forecasts. The released data caused the dollar to weaken, as investors interpreted this as yet another signal of cooling in the US labor market. This, in turn, may affect the Federal Reserve's future interest rate decisions. Weaker employment data may prompt the Fed to maintain its dovish stance on rate cuts, potentially weakening the dollar's appeal. The yen's strengthening is also connected to expectations of possible changes in the Bank of Japan's monetary policy. It is anticipated that the central bank will raise interest rates next week, making the yen even more attractive for purchases.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

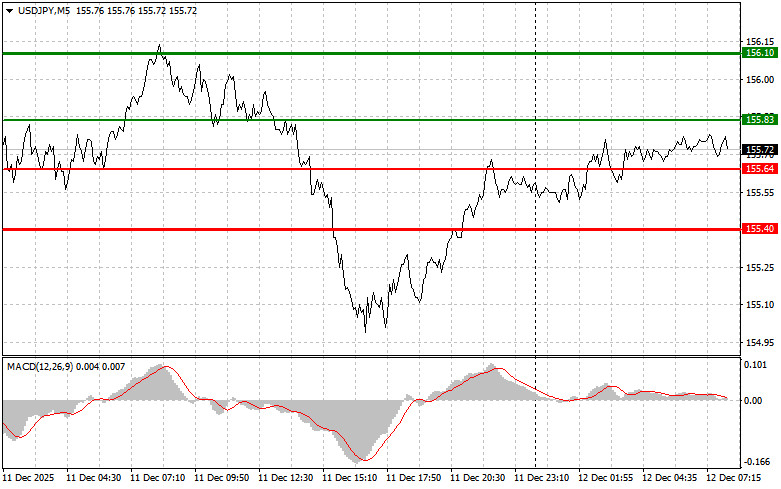

Scenario #1: I plan to buy USD/JPY today at the entry point around 155.83 (green line on the chart), with a target of 156.10 (thicker green line on the chart). At 156.10, I plan to exit my long positions and open short positions in the opposite direction (anticipating a move of 30-35 pips back from that level). It is best to resume buying the pair on corrections and significant dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting its climb from there.

Scenario #2: I also plan to buy USD/JPY today if the 155.64 level is tested twice in a row while the MACD indicator is oversold. This will limit the pair's downside potential and lead to an upward market reversal. A rise towards opposite levels of 155.83 and 156.10 can be expected.

Scenario #1: I plan to sell USD/JPY today only after it breaks the 155.64 level (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 155.40 level, where I intend to exit my shorts and immediately open longs in the opposite direction (anticipating a 20-25-pip move back from that level). It is better to sell as high as possible. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today if the 155.83 level is tested twice consecutively while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline towards opposite levels of 155.64 and 155.40 can be anticipated.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.

SZYBKIE LINKI