Inflation is slowing, interest rates are decreasing, and corporate profits are rising. What could be better for the S&P 500? The US stock market has entered a sort of Goldilocks mode and is poised to restore its upward trend. However, its distinctive feature at the start of winter is the absence of leaders. Diversification of investment portfolios and a move away from tech stocks have become the hallmark of recent weeks.

The market sees only what it wants to see. The increase in business activity in the services sector to a 9-month high was perceived by investors as a sign of optimism due to the end of the shutdown, which could, by the way, begin again at the end of January. On the other hand, the ADP reported a reduction of 32,000 jobs in the private sector in November. This indicator's dynamics have confirmed the cooling of the labor market and brought the Fed closer to an interest rate cut in December, especially since the purchasing managers' index in the non-manufacturing sector fell to its lowest level since April.

Dynamics of US Private Sector Employment from ADP

Such a combination of data increased the chances of easing monetary policy in December to 89%, but small-cap stocks benefited from this. Among all stock indices, the Russell 2000 performed the best. In contrast, the Big Tech sector remained in the red. The S&P 500 has nearly recovered from the downturn from the October record highs to the November lows. The same cannot be said for the information technology index, which is down 4.2%, with many companies in the Magnificent Seven, including NVIDIA and Microsoft, not rushing back to their records.

This trend among tech giants suggests that investors are still cautious about artificial intelligence. Will the enormous expenses pay off? Thanks to the Magnificent Seven, the S&P 500 managed to soar after the April sell-off. Now we are witnessing a process of leader rotation. In October, the tech sector had a record 36% weight in the stock index structure, while its fundamental valuations continue to be at 20-year highs.

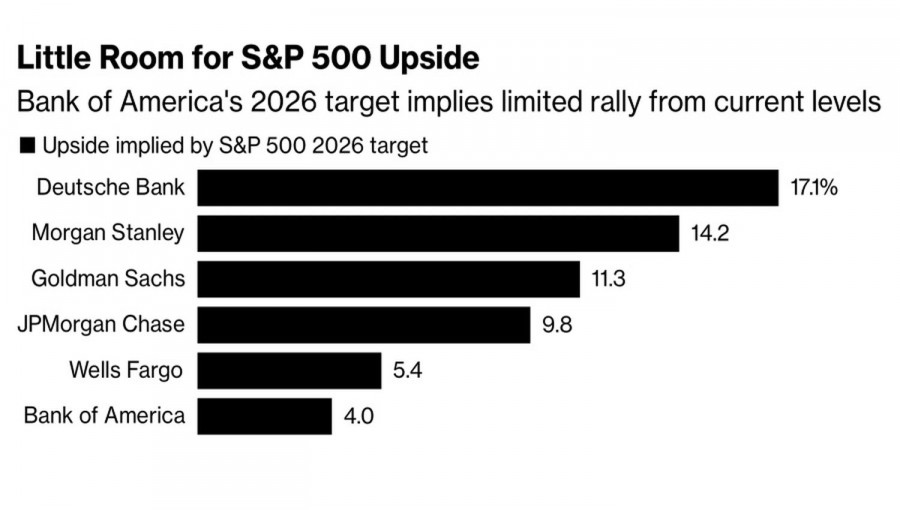

S&P 500 Growth Forecasts from Leading Banks

Doubts about the return on investment in artificial intelligence have led Bank of America to establish a rather modest forecast for S&P 500 growth in 2026. The firm believes it will rise to the 7,100 mark, representing a 4% rally. After a 16% surge in 2025 and at least a 23% increase in each of the previous two years, such a forecast looks lackluster, especially compared to other banks. JP Morgan and Goldman Sachs see the broad stock index at 7,500 and 7,600, respectively, while Morgan Stanley forecasts 7,800 and Deutsche Bank cites a figure of 8,000.

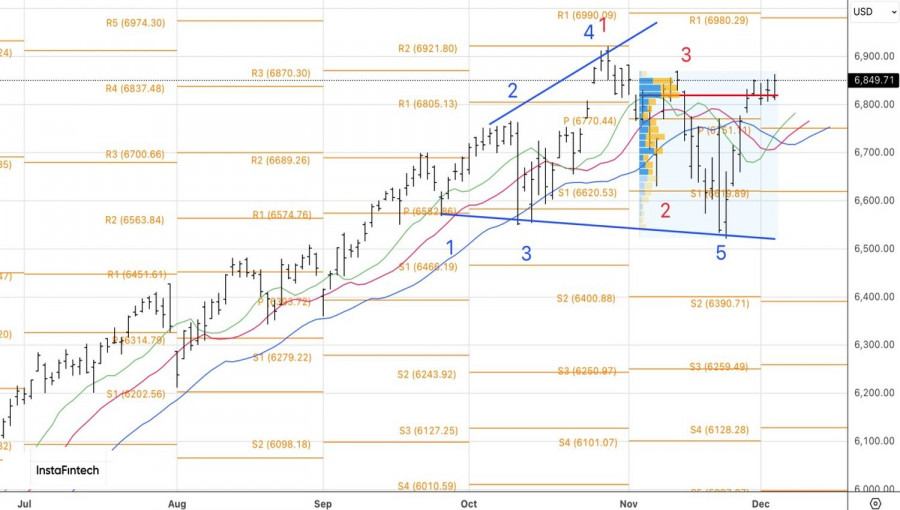

Technically, the rally continues on the daily S&P 500 chart. Long positions set at 6,770 should be held and gradually increased over time.

SZYBKIE LINKI