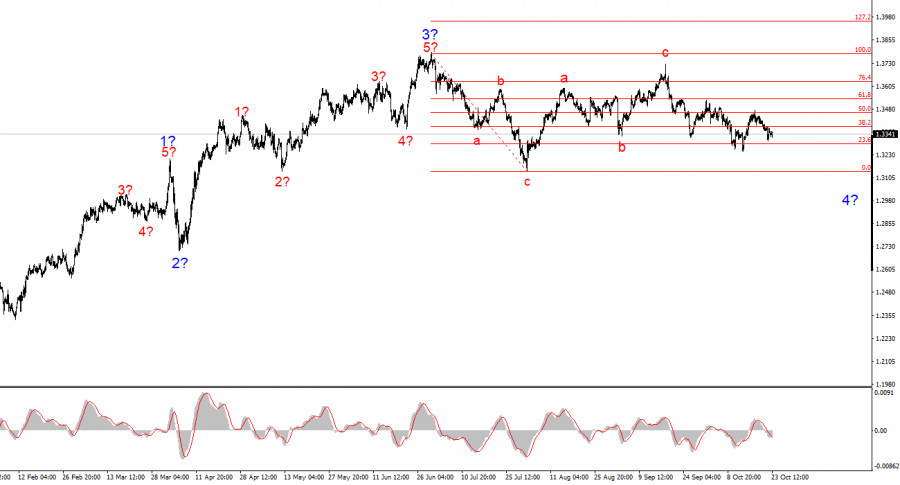

The wave pattern for GBP/USD continues to indicate the formation of an upward sequence, but over the past few weeks, the pattern has become complex and ambiguous. The pound has fallen too sharply, so the trend segment that began on August 1 now looks unclear. The first thought that comes to mind is a complication of the presumed wave 4, which is taking on a three-wave form, with each of its sub-waves also consisting of three smaller waves. In this case, the pair could decline toward the 1.31 and 1.30 levels.

However, the downward wave structure that started on September 17 has already taken on a three-wave form. From here, either it will develop into a five-wave structure, or a new upward sequence will begin. In any case, I expect only a rise in quotations regardless of the internal wave pattern. In my opinion, the news background is currently so one-sided that it's hard to expect any other outcome. Nevertheless, in recent weeks, buyers have shown no initiative.

At present, much in the currency market depends on the policies of Donald Trump. The market fears a softening of the Federal Reserve's stance due to labor market weakness and political pressure from Trump himself, who continues to impose new tariff packages—signaling the continuation of the global trade war. Therefore, the news background remains unfavorable for the dollar.

The pound has already weathered the inflation report, but its position has not improved. The GBP/USD pair remained unchanged during Wednesday's session. Although by the end of the day the pair could still move either way, this entire week leaves many questions unanswered — not only this week, but the whole month.

Let's recall that as of October 1, a government shutdown began in the U.S., and many important economic reports stopped being published because the U.S. Bureau of Labor Statistics and several other government agencies went on unpaid leave. It would seem there could be no better backdrop for a new decline in the U.S. dollar. However, instead of a natural fall, we have been observing its steady growth for three weeks.

Demand for the U.S. currency is rising slowly but surely, while economists continue to search for explanations for the decline in EUR/USD — a pair that, by all logic, should be moving upward. The only key day left this week is Friday, when the U.S. will release PMI and inflation data.

In my opinion, if market participants have ignored the news background over the past few weeks, then tomorrow's reports are unlikely to have much impact. Selling the pair now seems questionable, as the formation of an upward trend segment continues, and many factors do not support further dollar strength. Tomorrow's session will bring plenty of reports, and no one can predict their results in advance. The pair needs a push — one that can direct it onto the right path: upward.

The wave pattern for GBP/USD has evolved. We are still dealing with an upward impulsive section of the trend, but its internal wave structure has become more complex. Wave 4 is taking on a three-wave form, and its structure is now much longer than that of wave 2. The latest three-wave corrective decline appears to be complete. If that is indeed the case, the instrument's upward movement within the broader wave structure could continue, with initial targets near the 1.38 and 1.40 levels.

The higher-scale wave layout looks almost perfect, even though wave 4 has surpassed the high of wave 1. However, let's remember that perfect wave patterns exist only in textbooks — in practice, things are much more complicated. At this point, I see no reason to consider alternative scenarios to the ongoing bullish trend segment.

Key Principles of My Analysis:

SZYBKIE LINKI