Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Americké státní dluhopisy ve středu rozšířily velké ztráty, což je znamením, že investoři se zbavují i těch nejbezpečnějších aktiv, protože globální tržní krize, kterou rozpoutala americká cla, nabírá zneklidňující směr k nuceným výprodejům a úprku do bezpečí hotovosti.

„Tohle je teď mimo fundamenty. Jde o likviditu,“ řekl Jack Chambers, hlavní stratég pro úrokové sazby ve společnosti ANZ v Sydney.

Desetiletý výnos amerických státních dluhopisů, celosvětová referenční kotva bezpečného přístavu, se odrazil a dlouhé dluhopisy se staly předmětem intenzivního prodeje ze strany hedgeových fondů, které si půjčily peníze na sázky na obvykle malé rozdíly mezi cenami hotovosti a futures.

Vystřelily vzhůru, i když obchodníci zvýšili očekávání snížení úrokových sazeb v USA a v dalším signálu rozkolísanosti trhů dolar klesl vůči euru a jenu.

Na úrovni 4,46 % vzrostl desetiletý výnos v Asii o 20 bazických bodů a přibližně o 60 bazických bodů oproti pondělnímu minimu.

Třídenní nárůst 30letých výnosů o téměř 60 bazických bodů, který se vyšplhal nad 5 %, by znamenal – pokud by se udržel – nejsilnější výprodej od roku 1981. Velký, ale menší nárůst výnosů zasáhl státní dluhopisy v Japonsku a Austrálii.

There are no macroeconomic reports scheduled for Monday. Let us recall that last week, there were also no significant reports, speeches, or any other notable events in either the European Union or the United States. Only Donald Trump continued to raise tariffs and introduce new duties almost daily. However, for some reason, the market chose to ignore these developments. Both currency pairs are continuing to correct based purely on technical factors. On Monday, euro and pound movements will not be influenced by any economic reports.

As for fundamental events on Monday, again, there is absolutely nothing worth noting. We've stated many times before that speeches by European Central Bank, Federal Reserve, or Bank of England representatives currently have virtually no influence on the market. The monetary policy stance of all three central banks is crystal clear. No questions are remaining, and monetary policy itself has almost no effect on currency movements. Let us remind that in 2025, both the euro and the pound have been performing well and steadily rising, despite ongoing monetary easing by the European and British central banks.

The key concern for the market remains the trade war, which still shows no signs of resolution. The situation continues to escalate, as Trump has managed to sign only three trade agreements — one of which is highly questionable. Moreover, the market is unsure what there is to be optimistic about, given that all tariffs remain in effect. Last week, the U.S. president once again decided to raise tariffs for countries that are in no hurry to negotiate with Washington (essentially all of them), while simultaneously increasing import duties on copper, pharmaceuticals, and semiconductors. As we can see, the situation is not improving over time. Therefore, we still see no reason for dollar growth.

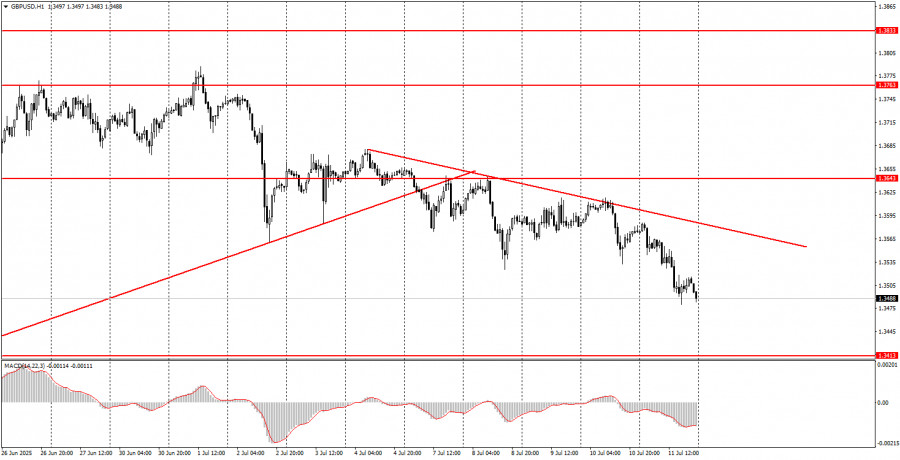

On the first trading day of the new week, both currency pairs may exhibit very sluggish performance, as there are no important events or reports scheduled. Technical corrections are ongoing, but they may end at any moment. Both pairs have formed descending trendlines — breaking through them would indicate a potential resumption of the upward trend.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

SZYBKIE LINKI