Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

What is happening in the financial markets right now can only be described as a paradox, and many economists are noting it. Take the U.S. stock market, for example: initially, it plunged sharply, but has been rising for several consecutive months and recently hit new highs. Why, if tariffs are becoming broader and tougher by the day? I initially assumed the reason was the low valuation of many stocks after the February–March drop. Investors saw attractive prices for shares of global companies and turned a blind eye to Donald Trump's policies, assuming that businesses would find a way to deal with the situation and that company profits wouldn't suffer. Perhaps that's true, but the U.S. stock market continues to rise, while the bond market, for instance, is falling.

The bond market is not in its best shape because, unlike private companies, trust in the U.S. government is currently at zero. Even assuming Trump somehow resolves all the problems he created himself, investors are still wary of buying U.S. Treasury bonds. There are plenty of other stable countries that do not show political aggression and offer what investors value most: stability and confidence in the future.

The growth of the U.S. stock market may also be due to investor confidence that Trump's threats are empty. I mean that Trump may impose tariffs and sanctions and endlessly raise them (as with China), but in the end, he always backs down, leaving at best minimal tariffs or endlessly extending the negotiation deadlines. Just last week, Trump raised tariffs for 22 countries, but set the start date for the new duties as August 1. If countries manage to reach an agreement with Washington before August 1, they can avoid high tariffs. However, as we all know, tariffs will remain in any case—because it's about money. Trump needs money.

The White House claims that U.S. revenue will grow due to economic growth and tariffs.

Perhaps investors believe Trump, but then how do you explain the decline of the U.S. dollar? You can't believe in a bright future for the U.S. that Trump supposedly guarantees while simultaneously selling off the dollar. It's simply illogical. Therefore, in my view, there is currently no correlation between markets and instruments. Investors are thinking each in their way, which is why we're seeing seemingly illogical movements overall. One thing I can say for sure: the U.S. dollar is reacting the most logically to what's happening in the world. Therefore, I expect the dollar to continue declining.

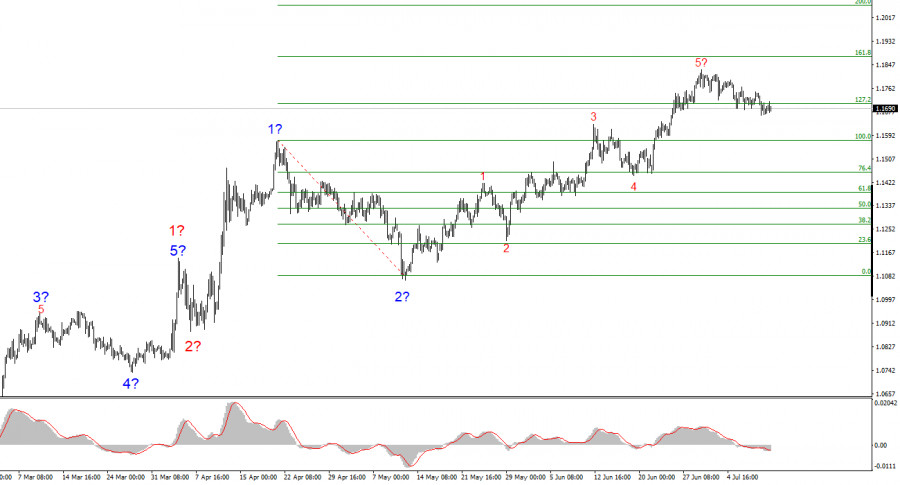

Based on the analysis of EUR/USD, I conclude that the instrument continues to form an upward section of the trend. The wave structure still entirely depends on the news background related to Trump's decisions and U.S. foreign policy, and there are still no positive changes. The targets of this trend section may extend as far as the 1.25 level. Therefore, I continue to consider buying with targets near 1.1875, which corresponds to the 161.8% Fibonacci level. A corrective wave set is expected in the near future, so new euro purchases should be made after this corrective structure is completed.

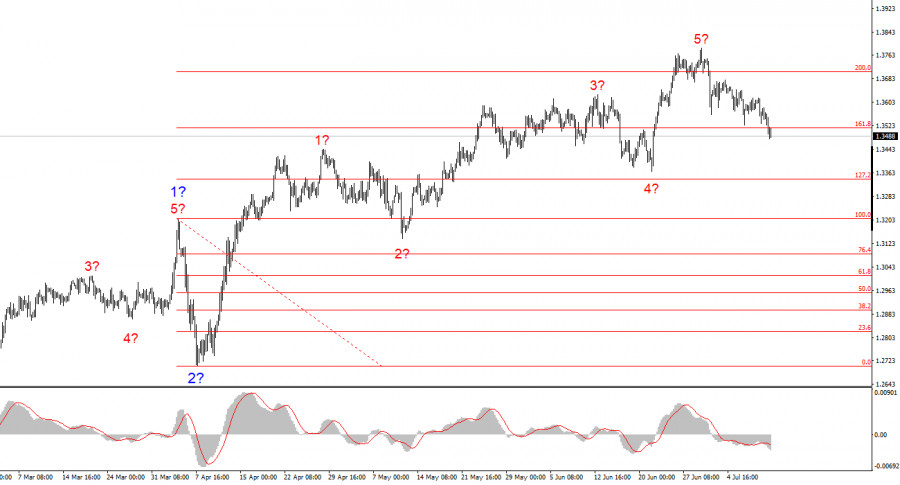

The wave structure of the GBP/USD instrument remains unchanged. We are dealing with an upward, impulsive section of the trend. Donald Trump, the markets may face many more shocks and reversals, which could seriously affect the wave picture, but at the moment, the main scenario remains intact. The targets of the upward trend section are now located near 1.4017, which corresponds to the 261.8% Fibonacci level of the presumed global wave 2. It is assumed that a corrective wave set has begun. Classically, it should consist of three waves.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

SZYBKIE LINKI