WASHINGTON (Reuters) – Senátní výbor pro obchod si možná předvolá americkou armádu, aby si vyžádal zprávu, která podrobně popisuje, proč armáda běžně nepoužívá bezpečnostní systém známý jako ADS-B při letech vrtulníků v okolí Reaganova washingtonského národního letiště, uvedl ve středu jeho předseda.

Armádní vrtulník Black Hawk neměl tento systém v provozu během rutinní výcvikové mise, když se 29. ledna poblíž letiště srazil s regionálním letadlem společnosti American Airlines (NASDAQ:AAL) a zabil 67 lidí.

Armáda minulý týden odmítla žádost senátorů o poskytnutí této zprávy.

Předseda výboru, republikánský senátor Ted Cruz, a senátorka Maria Cantwellová, hlavní demokratka ve výboru, požadovali, aby armáda zprávu předala do pátku.

The market has absorbed the news of U.S. strikes on Iran's nuclear facilities quite resiliently. Why did this happen, and why was the reaction relatively muted? These questions are unlikely to have definitive answers. Market reactions are always governed by human behavior since it is people—not robots or AI—making the decisions. Therefore, if the reaction was weak, it means the Iran-Israel war is no longer the sole focus of investors' attention.

In my view, this is fairly logical, as the likelihood of de-escalation between the U.S. and Iran in the near future is high. The Iran-Israel conflict, on the other hand, is a localized dispute that has persisted for years or even decades. The market has learned to respond calmly to tensions in this region. I don't believe America will continue striking Iran's nuclear facilities. A war involving direct U.S. participation would be highly disadvantageous for America and especially for Donald Trump personally. During his first five months as U.S. President, Trump's record has been rather unimpressive. For the most part, the Republican leader has caused more disruption than improvement. Recall that in two and a half months of negotiations, only one trade deal has been signed.

Given this, the U.S. carried out a strike on nuclear sites and declared that Iran's nuclear program had been destroyed, and that's it. Why launch more strikes? Even if Iran retaliates by targeting U.S. military bases in Syria, Washington can choose to stay silent and avoid further escalation. This creates a "1–1" situation: the U.S. strikes, claims success, Iran responds, and it ends there.

Undoubtedly, there's no complete certainty that the nuclear facilities in Fordow, Natanz, and Isfahan have been completely destroyed. But no one needs that certainty. The world fears a "nuclear threat" from Iran, but the planet has seen more than enough threats over the past decade, with or without Iran. The European Union, for example, has never publicly demanded the destruction of Iran's nuclear developments. This allows the interpretation that the conflict is between the U.S. and Iran, not Iran and the rest of the world.

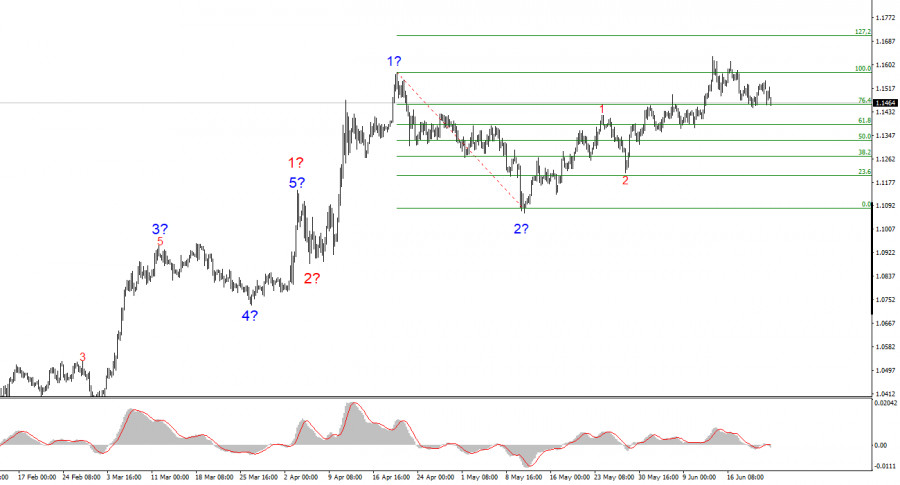

Based on the analysis of EUR/USD, I conclude that the instrument continues to develop a bullish trend segment. The wave structure remains heavily influenced by news events, especially Trump's decisions and U.S. foreign policy. The targets of wave 3 may extend to the 1.25 level. Therefore, I continue to favor buying, with the initial targets around 1.1708, corresponding to 127.2% Fibonacci. De-escalation of the trade war could reverse the upward trend, but there are no signs of reversal or de-escalation. The Iran-Israel war has halted the dollar's decline, but I don't believe it will reverse it.

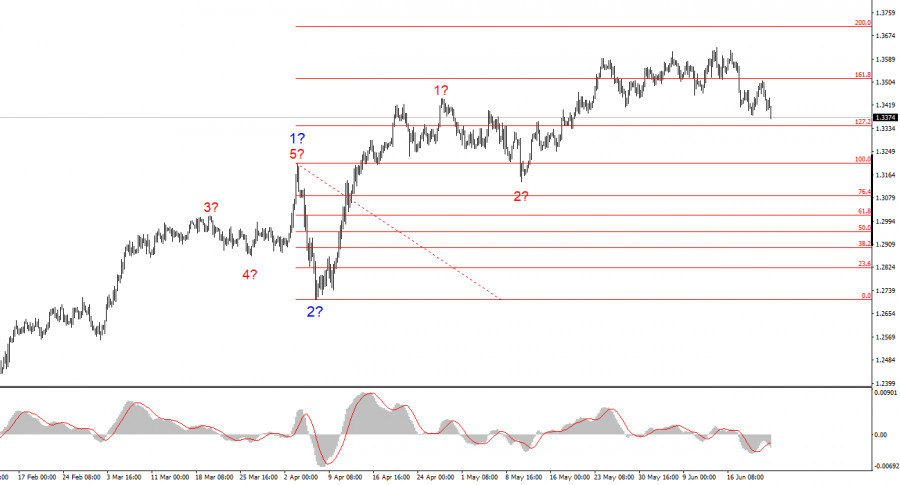

The wave pattern of GBP/USD remains unchanged. We are dealing with a bullish, impulsive trend segment. Under Trump, the markets may face numerous shocks and reversals, which could significantly alter the wave picture, but the working scenario remains intact at this point. Trump continues to act in ways that weaken demand for the dollar. The targets for the third upward wave are around 1.3708, corresponding to 200.0% Fibonacci from the assumed global wave 2. Therefore, I continue to favor buying, as the market shows no inclination to reverse the trend.

SZYBKIE LINKI