Trade Review and Guidance on Trading the Japanese Yen

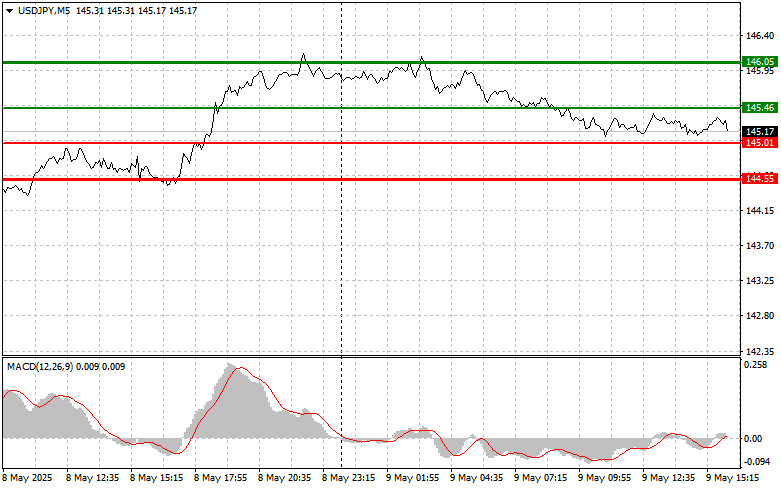

The test of the 145.31 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential.

During the U.S. session, there are no major economic releases, so the market's focus will shift to speeches by FOMC members John Williams and Christopher Waller. Their hawkish stance could rekindle demand for the USD/JPY pair. The market will closely scrutinize every word from these key Federal Reserve figures. In an environment where inflation remains elevated and growth prospects are clouded by tariff uncertainty, hawkish signals from Williams and Waller could serve as a catalyst for strengthening the U.S. dollar against the yen. A perceived more aggressive Fed approach to maintaining high interest rates will undoubtedly enhance the dollar's appeal as an investment asset. The interest rate differential between the U.S. and Japan—where the Bank of Japan recently indicated no plans to tighten policy—will continue to play a key role in USD/JPY dynamics.

As for intraday strategy, I will focus on executing Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today at the entry point around 145.46 (green line on the chart), targeting a rise to 146.05 (thicker green line). At 146.05, I will exit long positions and open shorts in the opposite direction (targeting a 30–35 point reversal from the level). The pair is likely to continue its upward trend today. Important! Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY if the price tests the 145.01 level twice in a row, at a time when the MACD indicator is in oversold territory. This will limit downward potential and could lead to a bullish reversal. A move toward 145.46 and 146.05 can then be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a break below 145.01 (red line on the chart), which should lead to a quick drop in the pair. The key target for sellers will be 144.55, where I plan to exit short positions and immediately open longs in the opposite direction (expecting a 20–25 point bounce from the level). Downward pressure on the pair is unlikely to return today. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning to drop from it.

Scenario #2: I also plan to sell USD/JPY if the price tests 145.46 twice in a row while the MACD indicator is in overbought territory. This would limit upward potential and could spark a bearish reversal. A move toward the opposite levels of 145.01 and 144.55 can be expected.

Chart Legend

Important Note

Beginner Forex traders should be extremely cautious when entering the market. It's best to stay out of the market before important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without them, you could lose your entire deposit quickly—especially if you're not using money management and are trading large volumes.

And remember, successful trading requires a clear trading plan like the one presented above. Spontaneous trading decisions based on current market moves are an inherently losing strategy for intraday traders.

SZYBKIE LINKI