Several strong U.S. indicators could have led to a significant strengthening of the dollar. However, this did not happen. EUR/USD closed the previous week virtually unchanged and began the new week without notable movement. Market participants continue searching for a trend despite positive news regarding the state of the U.S. economy.

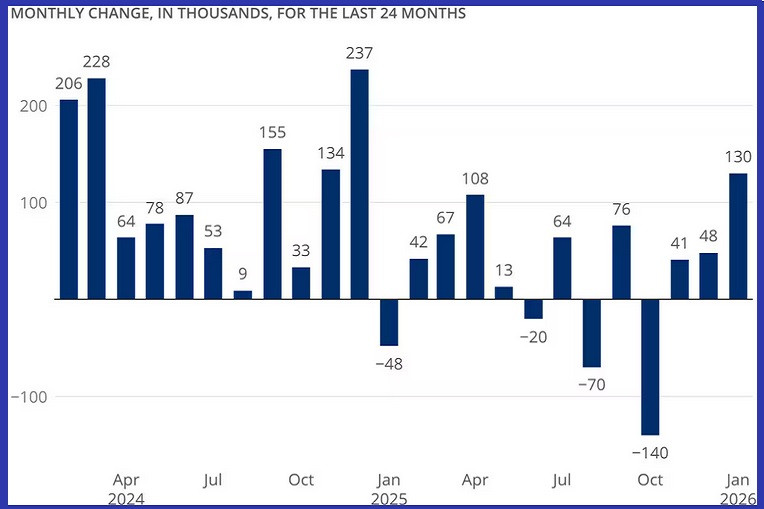

The United States released a series of key macroeconomic indicators, but they triggered only moderate dollar gains. On the one hand, the January nonfarm payrolls report showed the creation of 130,000 new jobs, nearly double the forecasts. The unemployment rate declined to 4.3% from the previous 4.4%, also 0.1 percentage points better than expected. In January, annual inflation in the U.S. slowed to 2.4%, down from 2.7% in December and below market expectations of 2.5%. On a monthly basis, the consumer price index rose by a modest 0.2% compared to the previous 0.3%.

Core monthly inflation stood at 0.3%, while annual core inflation reached 2.5%, both in line with expectations. U.S. nonfarm payrolls increased at the fastest pace in more than a year. Why, then, did the positive U.S. data fail to produce sustained dollar strengthening? Partly because their release was delayed due to the temporary U.S. government shutdown, reducing their timeliness. In addition, the figures still leave room for a potential rate cut. However, it should be clarified that no one expects Federal Reserve Chair Jerome Powell to cut rates before leaving office in May. The likelihood of policy easing is deferred to June or July, when Kevin Warsh is expected to take the position.

Warsh will face significant pressure: U.S. President Donald Trump selected him with the expectation of substantial rate cuts below the current 3.50%–3.75% range. This will be a difficult task if the labor market weakens while inflationary pressures persist. In any case, the main takeaway of recent days is the resilience of the U.S. economy and the inevitability of future rate cuts. This combination influences financial markets and keeps the U.S. dollar in a state of uncertainty.

On the European side, there are no major changes. The view that the euro lacks strong appeal is not new. A scarcity of significant data and the European Central Bank's "comfortable position," without urgency to alter monetary policy, dampen speculative interest. The probability of surprises from Europe is too low to revive strong demand for the single currency. The revision of fourth-quarter GDP confirmed quarterly growth of 0.3% and annual growth of 1.4%. There were no surprises. The eurozone economy remains stable and is expected to continue expanding at a slow but steady pace.

From a technical perspective, the pair is trading above all moving averages. The nearest resistance ahead of the round 1.1900 level is 1.1890. If these levels are broken, the pair will challenge the February high on its way toward the yearly high. If it fails to hold above the confluence of the 20-day SMA and the 14-day EMA, the pair may weaken and head toward the round 1.1800 level. However, as long as daily oscillators remain positive, the bulls maintain the advantage.

The upcoming week will be less eventful in terms of macroeconomic data. Germany will publish the final reading of January's Harmonized Index of Consumer Prices (HICP) on Tuesday, along with the February ZEW Economic Sentiment survey. The U.S. will release updated durable goods orders data on Wednesday. Friday promises somewhat more activity: S&P Global, together with local banks, will publish preliminary February Purchasing Managers' Index (PMI) data for most major economies. The U.S. will release the December Personal Consumption Expenditures (PCE) index—the Federal Reserve's key inflation indicator—as well as a preliminary estimate of fourth-quarter GDP. In addition, market participants should pay attention this week to speeches by influential officials from both the U.S. and the ECB.