Yesterday, after a sudden sell-off, gold partially recovered its losses as buyers took advantage of lower prices, actively purchasing the metal ahead of the release of key U.S. inflation data.

Today, gold has already risen by 1.5%, having lost 3.2% on Thursday. The decline was accompanied by turmoil on Wall Street, as prices across asset classes fell amid concerns about AI's impact on corporate profits. Margin requirements and algorithmic trading may have amplified the drop in gold prices.

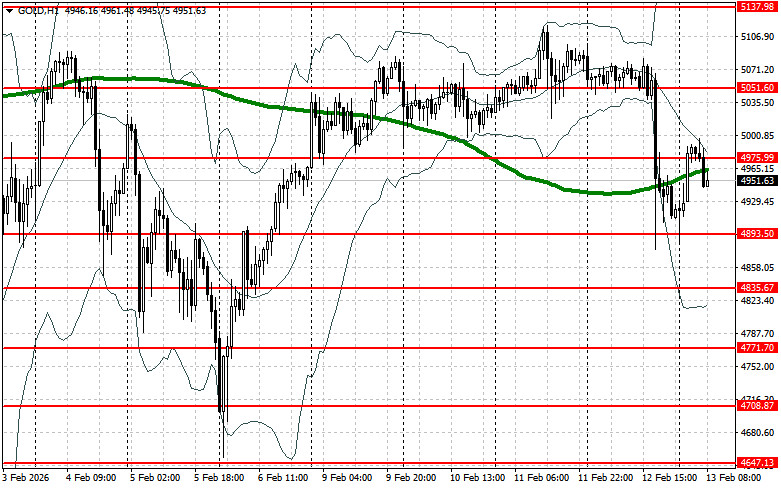

Currently, gold is trading below $5,000, which continues to exert psychological pressure on traders.

However, despite the recent fall, the long-term outlook for gold remains positive. Geopolitical uncertainty, inflationary pressures, and investors' quest for safety should support demand for the precious metal. Additionally, the trend toward portfolio diversification and declining confidence in traditional financial assets also favors gold.

The hype surrounding artificial intelligence, while causing short-term volatility, is unlikely to undermine the fundamental drivers of gold price growth. Part of the recent sell-off of gold and silver, which fell nearly 11% on Thursday, was likely also due to profit-taking. Precious metals recovered some of their losses following the historic plunge earlier this month, and trading has since shown unusual volatility. Despite sharp price fluctuations, gold is likely to finish the week at a relatively stable level.

Today, many traders are awaiting the release of U.S. inflation data, which may affect expectations for the Federal Reserve's future actions. A decline in inflation would be favorable for gold. The employment data released this week for January reduced the necessity for another rate cut by the Fed mid-year. Lower rates benefit the precious metals market, which does not yield interest.

Regarding the current technical picture for gold, buyers need to overcome the nearest resistance at $4,975. This will enable targeting $5,051, above which it will be quite problematic to break through. The longer-term target remains around $5,137. In the event of a decline in gold, bears will attempt to take control of $4,893. If successful, the range breakout will deliver a significant blow to bullish positions and push gold down to a low of $4,835, with potential to reach $4,771.