Gold continued to slide today after last Friday's steepest decline in more than a decade, which pushed the metal back below $5,000. Silver also collapsed, reversing a record run that, in hindsight, moved too far and too fast.

Spot gold has fallen about 8% and is down nearly one?fifth from the record high reached last Thursday. Silver plunged a further 14.6% on Monday following an intraday drop of 23% in the prior session — the sharpest move on record.

A growing reluctance to assume new risk is reducing market liquidity. Many participants believe that, even at current levels, the metals remain significantly overbought and that more reasonable support levels are required before buyers will return in force.

As noted above, precious?metal prices hit record highs last week, surprising even experienced traders. The rally accelerated sharply in January as investors piled into gold and silver amid renewed fears over geopolitical instability, currency debasement, and threats to the Federal Reserve's independence. Buying from Chinese speculators further fueled the advance.

Speculative dynamics on the market must not be ignored. Algorithmic trading and hedge?fund activity seeking to exploit short?term price swings are amplifying volatility and adding risk for investors. In these conditions, it is essential to remain calm and to rely on fundamental analysis rather than succumbing to panic or euphoria.

The near?term outlook is uncertain. Further developments in geopolitics, central?bank decisions, and macroeconomic data will materially affect precious?metal prices. The extent to which Chinese investors step in on dips will also be a key determinant of the market's next direction.

Last Friday's sell?off was triggered primarily by news that President Donald Trump intends to nominate Kevin Warsh as Fed chair. That report lifted the dollar and dented investor expectations that the administration would tolerate a weaker currency.

In silver's case, speculative buying in China had exacerbated a supply shortage in the domestic market, but that trend may ease as the market rout reduces investment demand.

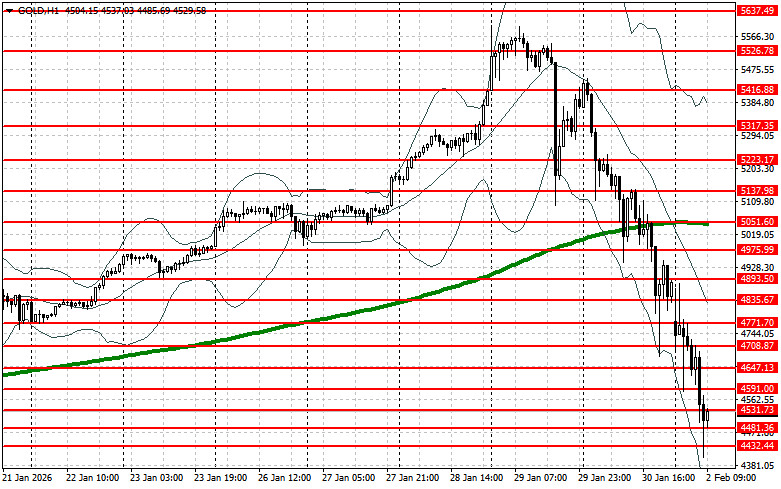

A technical outlook for gold suggests that buyers should look to reclaim the nearest resistance at $4,591. A breakout of that level would allow a move toward $4,647, above which a breakout would be difficult. The extended target is around $4,708. On the downside, bears will try to seize control at $4,481. If they succeed, a break of that range would deal a serious blow to bullish positions and could push gold down to $4,432 with scope to extend to $4,372.