The GBP/USD pair also continued its rise on Tuesday, adding a total of 170 pips in just one day. Do you remember the volatility in the market just two weeks ago? But as soon as the euro broke free from the sideways channel, the entire market revived and shot up. For the dollar to continue its decline, there is no need for local macroeconomic reports or other news. Just this week, Donald Trump has been issuing threats to Canada and South Korea, promising to raise tariffs for both countries. In Canada's case, it's due to a possible trade agreement with China. For South Korea, it's about the prolonged ratification of the trade agreement with the US. Traders who have not yet accustomed themselves to this should get used to it. From now on, Trump will threaten tariffs or raise tariffs for any reason. The entire world is expected to live as the leader of the White House sees fit, and the establishment of a "Council of Peace," which will be chaired for life by Trump himself, essentially indicates that the US president appoints himself as the president of the entire world.

On the 5-minute timeframe, the first buy signal was formed very late on Tuesday. However, it could still yield profit. It's important to remember that strong trending movements have their downsides. Specifically, the movement is nearly devoid of pullbacks, so the price rarely returns to levels or areas during pullbacks for traders to re-enter the market after a pause. The movement simply continues both day and night.

On the hourly timeframe, the GBP/USD pair has turned upward, suggesting the British pound will rise in the coming weeks. There are no global grounds for mid-term dollar growth, so in 2026, we anticipate the continuation of the global upward trend from 2025, which could push the pair to the 1.4000 mark soon. Trump's policies continue to indicate a lack of strength for the US currency.

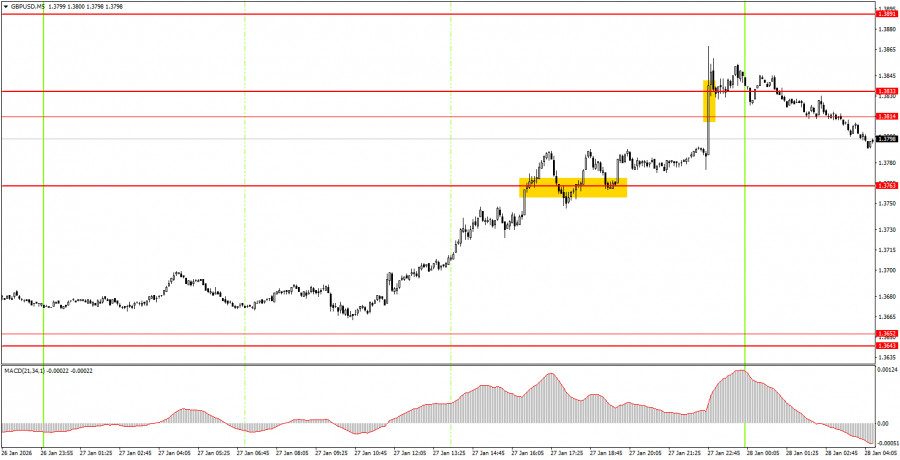

On Wednesday, novice traders may consider short positions, as the pair has settled below the 1.3814-1.3833 area, with a target of 1.3763 and below. A consolidation above the area of 1.3814-1.3833 would allow for new longs targeting 1.3891-1.3912 and higher.

On the 5-minute timeframe, the following levels can currently be traded: 1.3259-1.3267, 1.3319-1.3331, 1.3365, 1.3403-1.3407, 1.3437-1.3446, 1.3484-1.3489, 1.3529-1.3543, 1.3574-1.3590, 1.3643-1.3652, 1.3763, 1.3814-1.3832. On Wednesday, no significant events are scheduled in the UK, while the results of the first Fed meeting of the year will be announced in the US. We believe that even the Fed meeting will be overshadowed by the flow of news from the White House.

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.