Podle analytiků společnosti Capital Economics je i přes vlnu úlevy po oznámení obchodní dohody mezi USA a Čínou na začátku tohoto měsíce stále na místě opatrnost investorů.

V poznámce pro klienty analytici pod vedením Neila Shearinga argumentovali, že nedávné náznaky uvolnění globálních obchodních napětí jsou ‚křehké‘ a že před námi je několik „ohnisek“.

Americký prezident Donald Trump na začátku dubna oznámil zavedení rozsáhlých cel na řadu zemí, čímž ještě více prohloubil obavy o výhled globálního růstu. Bílý dům však nedávno ustoupil od svých přísnějších opatření a odložil Trumpova takzvaná „vzájemná“ cla o 90 dní.

Trumpova administrativa také oznámila obchodní příměří s Čínou, která čelila prudkému zvýšení cel o nejméně 145 %. Peking reagoval vlastními cly ve výši 125 %.

Today, the GBP/JPY pair is attracting sellers, trading above the round 210.00 level. The Japanese yen received a short-term boost after the publication of the minutes from the Bank of Japan's October meeting, which emphasized consensus on the need to continue raising rates if economic forecasts are met. At its December meeting, the Bank of Japan raised the policy rate to 0.75%, a 30-year high, while leaving the door open for further monetary tightening. At the same time, persistent geopolitical uncertainty strengthens the yen's status as a safe-haven asset, thereby weighing on the GBP/JPY pair.

On the British pound side, the Bank of England cut interest rates last Thursday. The narrow 5–4 vote in favor of a 25-basis-point cut in the benchmark rate to 3.75% points to divisions within the committee, especially following last week's surprise inflation data. This reduced expectations of more aggressive policy easing next year and had a positive impact on the pound sterling. In addition, a favorable risk appetite may limit gains in the Japanese yen and support GBP/JPY.

Therefore, before confirming that spot prices have reached a near-term peak and opening bearish positions, it would be prudent to wait for further selling, especially given sluggish year-end trading.

Market participants are now focused on a speech by Bank of Japan Governor Kazuo Ueda on Thursday, which may provide clues about the future direction of monetary policy. In addition, the release of the Tokyo Consumer Price Index on Friday and other key macroeconomic data from Japan will play a crucial role in the short-term dynamics of the yen and could significantly affect the GBP/JPY cross rate.

From a technical perspective, oscillators on the daily chart remain positive but are in overbought territory, confirming a bullish outlook with a corrective pullback. Nevertheless, the path of least resistance for the GBP/JPY pair remains to the upside.

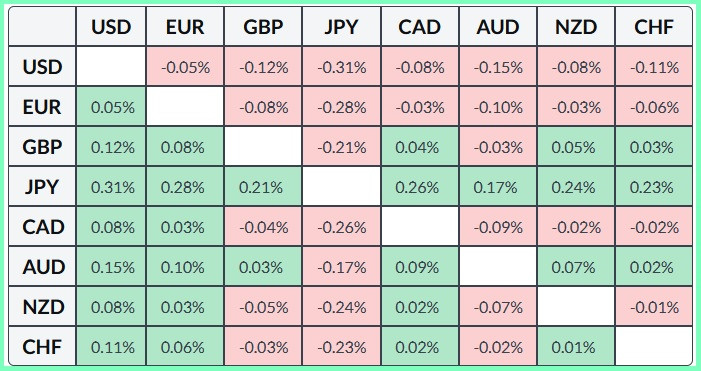

The table below shows the percentage changes of the Japanese yen (JPY) against major currencies for the current day. Among the strongest performances, the yen stands out against the U.S. dollar.