(Reuters) – Americký soudce ve Washingtonu v pátek zrušil výkonný příkaz prezidenta Donalda Trumpa namířený proti advokátní kanceláři Jenner & Block, čímž zasadil další ránu tvrdému postupu jeho administrativy proti prominentním firmám, které zastupovaly Trumpovy politické protivníky nebo zaměstnávaly právníky, kteří ho v minulosti vyšetřovali.

Trumpův příkaz pozastavil bezpečnostní prověrky právníků firmy Jenner a omezil jim přístup do vládních budov, k úředníkům a k federálním zakázkám.

Americký okresní soudce John Bates, jmenovaný republikánským prezidentem Georgem W. Bushem, rozhodl, že příkaz porušuje základní práva zakotvená v americké ústavě, a potvrdil tak rozhodnutí z 2. května, které zrušilo podobný příkaz proti advokátní kanceláři Perkins Coie.

Trumpův příkaz, napsal Bates, „nedává nijak najevo, proč si vybral svůj cíl: vybral si Jennera kvůli kauzám, které Jenner hájí, klientům, které Jenner zastupuje, a právníkovi, kterého Jenner kdysi zaměstnával.“„Takovéto pronásledování advokátních kanceláří je dvojnásobným porušením Ústavy,“ uvedl soudce a shledal, že porušuje Jennerovo právo na svobodu projevu a snaží se „ochladit právní zastoupení, které se vládě nelíbí, a tím izolovat výkonnou moc od soudní kontroly, která je základním prvkem oddělení moci.“

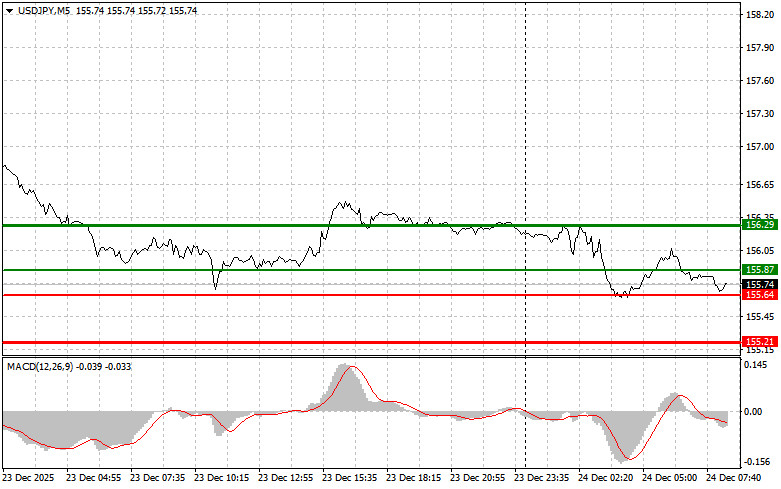

The price test at 156.18 coincided with a period when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the dollar and missed a slight upward movement of the pair.

Yesterday's news that the U.S. economy posted the most significant growth led to a strengthening of the dollar and a decline in the yen. However, the correction did not last long, and pressure on the pair returned.

Today, the Bank of Japan released the minutes of its monetary policy meeting, which helped the yen stabilize against the U.S. dollar, increasing pressure on the USD/JPY pair. I would like to remind you that at the BOJ's last meeting this year, interest rates were raised. Higher interest rates in Japan make Japanese currency assets more attractive to investors, potentially leading to capital outflows from other countries.

Regarding the intraday strategy, I will rely more on implementing scenarios No. 1 and No. 2.

Scenario No. 1: I plan to buy USD/JPY today upon reaching an entry point around 155.87 (green line on the chart), with a target of rising to 156.29 (thicker green line on the chart). Around 156.29, I intend to exit the long positions and open shorts in the opposite direction (expecting a movement of 30-35 pips in the opposite direction from the level). It is best to resume buying the pair during corrections and serious USD/JPY pullbacks. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in case of two consecutive tests of the price at 155.64, when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. One can expect a rise to the opposite levels of 155.87 and 156.29.

Scenario No. 1: I plan to sell USD/JPY today only after updating the 155.64 level (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the level of 155.21, where I intend to exit the shorts and also open longs immediately in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from the level). It is better to sell from as high a point as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today if the price tests 155.87 twice, when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. One can expect a decline to the opposite levels of 155.64 and 155.21.

Important. Beginner Forex traders need to make very cautious decisions about entering the market. Before important fundamental reports are released, it is best to stay out of the market to avoid falling into sharp fluctuations in rates. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose the entire deposit, especially if you do not use money management and trade large volumes.

And remember, to trade successfully, you need to have a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.