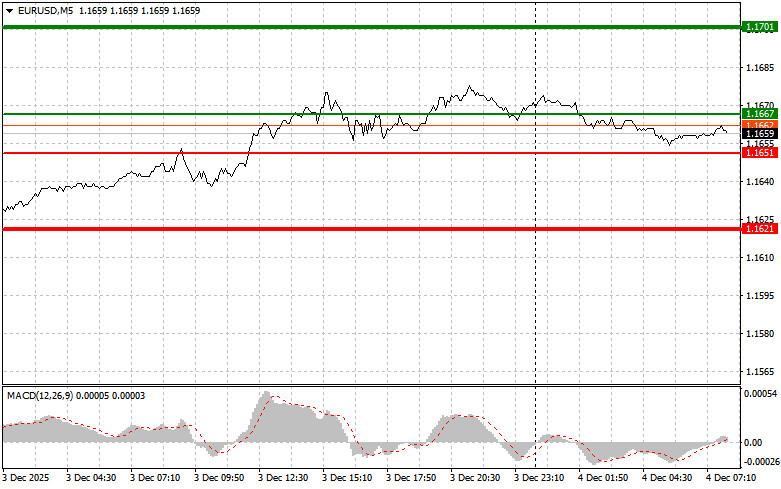

The test of the price at 1.1674 coincided with the moment when the MACD indicator had been in the overbought area for quite some time and was declining toward the zero mark, allowing for entering short positions on the euro. As a result, the pair dropped nearly 20 pips.

Following the release of unexpected ADP data showing a decline in U.S. private-sector employment, the U.S. currency lost ground against the euro. The November figures showed a 32,000-job reduction, an unpleasant surprise for experts who had expected an increase. Traders, concerned about a potential worsening of the economic situation, began to shed dollar-denominated assets, leading to downward pressure on the dollar's exchange rate. In contrast, the euro strengthened amid prevailing circumstances.

Today, the euro may continue to grow in the first half of the day, but strong data on changes in Eurozone retail sales for October is needed. It is expected that this indicator will remain unchanged compared to September. If the forecast holds true, it will signal a further deceleration in consumer spending in the region, which could apply additional pressure on the European Central Bank regarding further monetary easing. However, even with stagnating retail sales, some experts highlight the resilience of the Eurozone labor market, which may support consumer demand in the medium term. Nevertheless, if the actual data falls short of expectations, it could trigger a wave of concern about a slowdown in economic growth. In this case, pressure on the ECB will increase significantly, and the central bank will likely be forced to consider additional stimulus measures, such as lowering interest rates next year.

Regarding the intraday strategy, I will primarily rely on the implementation of Scenarios #1 and #2.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.