Yesterday, US stock indices ended mixed. The S&P 500 rose by 0.06%, while the Nasdaq 100 declined by 0.26%. The Dow Jones Industrial Average jumped by 0.68%.

Global index futures continued their three-day rally, approaching record highs after President Donald Trump signed legislation to end the longest government shutdown in US history. This move breathed new life into the markets, weary from the political uncertainty prevailing in Washington. Investors, who had long stayed on the sidelines due to concerns over the impact of the partial government closure on the economy, rushed back into the market, causing a surge in demand for stocks and other risk assets. The optimism, bolstered by the resumed operations of federal agencies, extended beyond US markets. European and Asian indices also saw strong gains, indicating a global improvement in investor sentiment. The end of the shutdown not only alleviates the immediate threat to the US economy but also reduces uncertainty that negatively affects global trade and investments.

Asian stocks and the MSCI All Country World Index fluctuated between slight gains and losses as investors remained cautious ahead of the upcoming release of economic data from the United States, which plays a key role in shaping the Federal Reserve's interest rate outlook. Gold continued to rise for the fifth consecutive day, fueled by expectations for further rate cuts following the return of Washington to work.

With the earnings season in the US coming to an end, markets are shifting their focus to the Fed and the prospects of rate cuts as the next catalyst for growth since the April lows. The absence of key indicators such as unemployment data and the consumer price index for October has heightened uncertainty regarding monetary policy.

The resumption of all missed economic data releases could significantly shake the market, so this should be taken very seriously. The government may begin to resume normal operations, and federal employees are expected to return to work as early as today. However, federal bureaucracy may still require days or even weeks to fully restart and address the backlog of tasks after the suspension that began on October 1.

In the commodities market, oil stabilized after its steepest decline since June, as OPEC stated that crude oil supply had surpassed demand sooner than expected. The price of Brent crude fell to $62 per barrel after losing nearly 4% in the previous session, while West Texas Intermediate (WTI) prices approached the $58 mark.

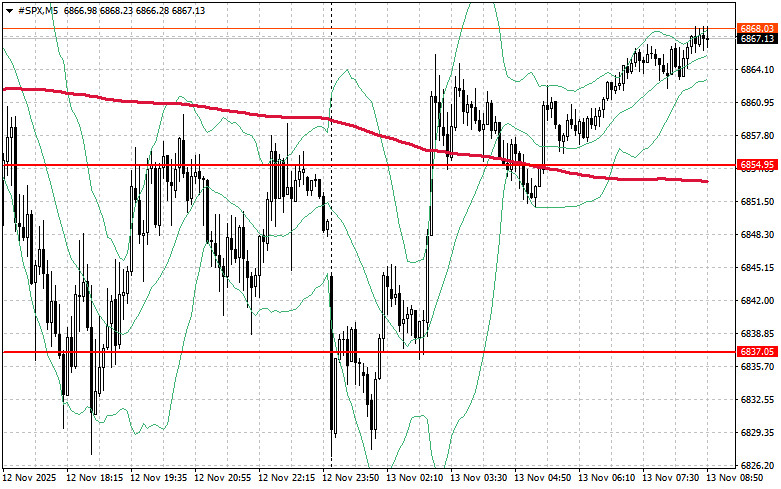

Regarding the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,874. This would help the index gain ground and pave the way for a potential surge to the new level of $6,896. An equally important objective for bulls will be to maintain control above $6,914, which would strengthen buyers' positions. In the event of a downward move driven by reduced risk appetite, buyers must assert themselves around $6,854. A break below this level would quickly push the trading instrument back to $6,837 and open the path toward $6,819.