Even if new tariffs have a positive impact on the US trade balance, the trade war itself, much like a prolonged storm, may cause more damage than benefit. The S&P 500 index plummeted following reports that the White House is considering introducing restrictions on the export of technology and software to China. This move could mark yet another escalation, like a new wave of an old storm.

After months of steady growth, the stock market appears to be entering a natural pause. Profit-taking phases are considered healthy and necessary for maintaining resilience. The stock market is currently in a state of division as investors digest corporate earnings amid the ongoing government shutdown.

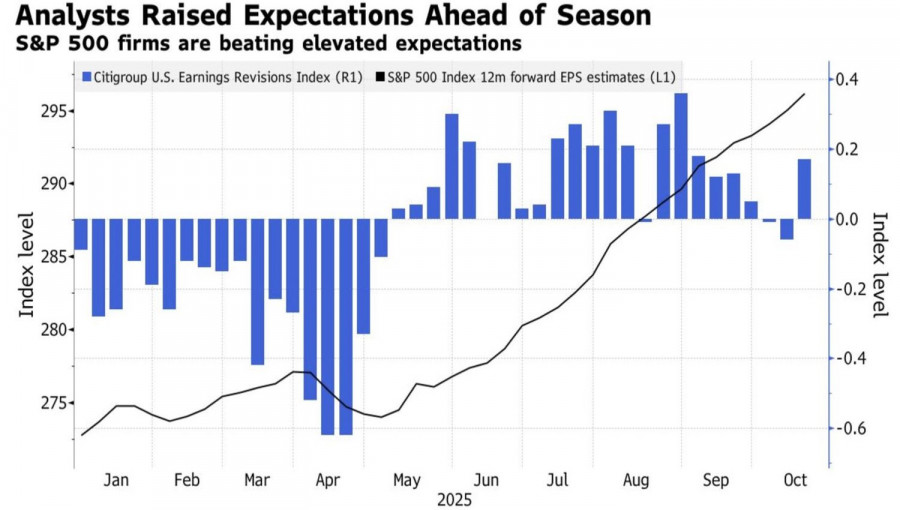

S&P 500 corporate earnings performance

Corporate results are instilling cautious optimism. About 85% of the companies in the S&P 500 have already reported third-quarter earnings that exceeded analyst expectations, marking the best performance since 2021. Although only one-fifth of companies have reported so far, the trend points to resilient corporate profitability despite tariff pressures and economic uncertainty.

JPMorgan analysts expect S&P 500 companies to end the quarter with earnings growth of approximately 12%. This is noticeably higher than the market consensus forecast, which anticipates an increase of just 7.7%.

Corporate earnings revision trend

Meanwhile, political uncertainty persists in Washington. The US government shutdown has lasted 22 days, making it the second longest in history — close to the record-setting 35-day shutdown during Trump's first term. The deadlock between parties over healthcare funding has reached an impasse, and the president's upcoming trip to Asia only heightens concerns that the crisis may drag on into November.

Additional pressure on the S&P 500 index came from a drop in Tesla shares. Despite record electric vehicle sales, the company's third-quarter profit merely met expectations, causing the stock to fall by about 1% in after-hours trading. According to Bloomberg, Tesla's earnings have declined by approximately 25% compared to the previous year.

At the same time, inflation concerns are rising. Forecasts suggest that annual CPI growth will reach 3.1%, the highest level since May 2024. However, unlike previous price acceleration episodes, the Fed does not seem in a hurry to change its course. Like a seasoned navigator, it favors a gradual approach: a base case scenario remains a fed funds rate cut on October 29, followed potentially by another reduction in December. Nevertheless, strong macroeconomic data could prompt the regulator to adjust its stance already in 2025.

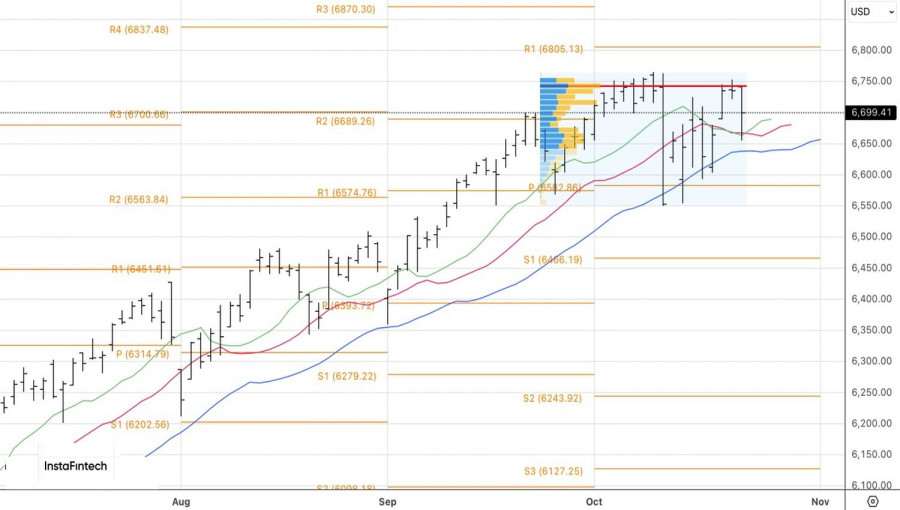

Technically, a doji bar was recorded on the daily S&P 500 chart. Short positions opened from the 6,720 level should be held and periodically increased.