Bitcoin vzrostl spolu s asijskými akciemi a posilujícím dolarem po zprávách, že USA a Čína plánují obchodní jednání.

Největší digitální aktivum vzrostlo ve středu ráno v Singapuru o 3,2 % na 97 500 USD, než své zisky o něco snížilo, zatímco druhá nejvýznamnější kryptoměna Ether vzrostla až o 4,2 %.

V 6:52 londýnského času se bitcoin obchodoval za 96 387 USD a ether za 1 828 USD.

US stock indexes closed the New York session on Friday with their biggest plunge in a year. The S&P 500 fell by 2.71%, while the Nasdaq 100 sank by 3.56%. The Dow Jones Industrial Average lost 1.90%.

During today's Asian trading session, futures on US stock indexes edged higher after President Donald Trump signaled readiness to strike a deal with China, which improved market sentiment following the shock from a sharp escalation in trade tensions.

Futures on the S&P 500 rose by 1.3%, and Nasdaq 100 contracts gained 1.8% after the administration softened its rhetoric following Trump's threat to impose 100% tariffs on China in response to Chinese export control measures. US Treasury bond futures fell, and oil climbed by 1.5%. Silver hit its highest level in decades, while gold continued its upward trend.

Last Friday's market crash was triggered by the Trump administration's announcement that it was ready to impose 100% tariffs on China in retaliation for Beijing's export control measures. The announcement came like a bolt from the blue, sparking a panic sell-off across all major stock indexes, from Wall Street to the Tokyo Stock Exchange. Investors, shocked by the renewed prospect of a full-scale trade war, rushed to dump risk assets, with a massive flight to "safe havens" ensuing. The consequences of the crash were swift. The US dollar plunged as capital fled the country, while oil prices collapsed amid fears of a global economic slowdown. Gold, on the other hand, soared, reaffirming its status as a reliable safe haven in times of uncertainty.

Recently, sharp declines in risk assets have been rare, which in itself may have contributed to the strong market reaction to the escalation in trade tensions. After the tariff-driven drop in April, the S&P 500 had rebounded sharply on optimism around artificial intelligence and hopes for a Federal Reserve rate cut.

In response to Trump's actions, China stated that the US must stop threatening to raise tariffs and called for further negotiations to resolve unresolved trade issues. Beijing also emphasized that it would not hesitate to take retaliatory measures if Washington continued to act against China.

Just yesterday, the US administration indicated that it is open to reaching a deal with China, while Trump hinted at a possible refusal by Xi Jinping to continue negotiations, simultaneously issuing a veiled threat that a full-scale trade war would harm China. This suggests that the US intends to step up pressure on China to reverse its recent trade decisions, while also trying to reassure jittery markets that further escalation is not inevitable.

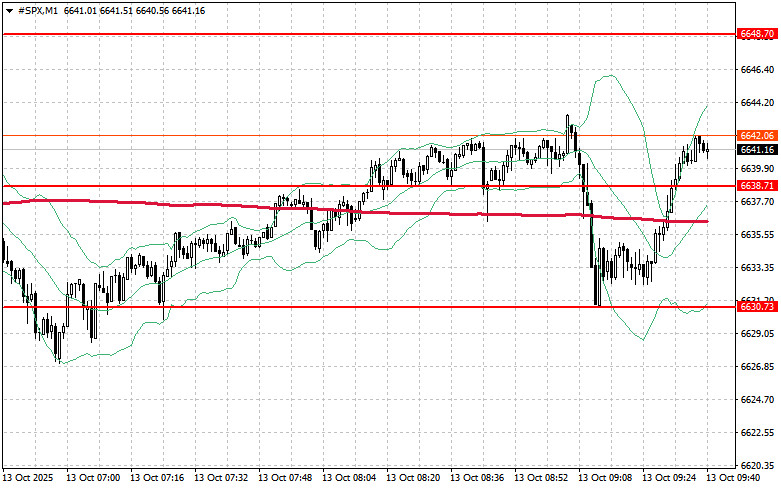

As for the technical picture of the S&P 500, the main task for buyers today will be to break through the nearest resistance at 6,648. Achieving this would allow for further gains and open the path to a push toward the next level at 6,660. An equally important objective for the bulls is to maintain control above 6,672, which would strengthen their position.

In case of a downward move amid weakening risk appetite, buyers must step in around the 6,638 area. A break below this level would quickly push the instrument down to 6,630 and open the road to 6,616.