The U.S. dollar has regained leadership – especially after it became clear that the much-anticipated key U.S. labor market statistics would not be released this week.

Yesterday's statements from Federal Reserve representatives Logan and Goolsbee, noting that the U.S. economy is in good shape, also increased demand for the dollar. Traders interpreted these comments as a sign of a cautious approach to future interest rate cuts, making the U.S. currency more attractive for investment.

Ahead, markets await data on the Eurozone Services PMI, Composite PMI, and the Producer Price Index. Weak numbers will only increase pressure on EUR/USD, reinforcing the bearish outlook for the near term. Expectations for the upcoming PMI releases are relatively low, given the weak growth rates in most European economies. If the data comes in worse than forecasts, the euro will inevitably face a wave of selling. Special attention will be paid to the Composite PMI, as it reflects the overall state of the economy and helps assess the scale of potential slowdown.

The Producer Price Index is also a key indicator that could influence EUR/USD dynamics. Higher readings, indicating stronger inflationary pressures, could prompt the European Central Bank to adopt a more cautious stance on monetary policy.

As for the pound, the UK will also release Services PMI and Composite PMI data. In addition, Bank of England Governor Andrew Bailey is scheduled to speak. During his remarks, the market will carefully analyze every word in an attempt to understand the central bank's future interest rate plans. Given the difficult economic situation in the UK, any divergence between market expectations and Bailey's rhetoric may lead to sharp currency market fluctuations.

If the data aligns with economists' expectations, it is advisable to employ a Mean Reversion strategy. If the data significantly exceeds or falls short of forecasts, the Momentum strategy is preferable.

Momentum Strategy (Breakout Strategy):

For the EURUSD pair:

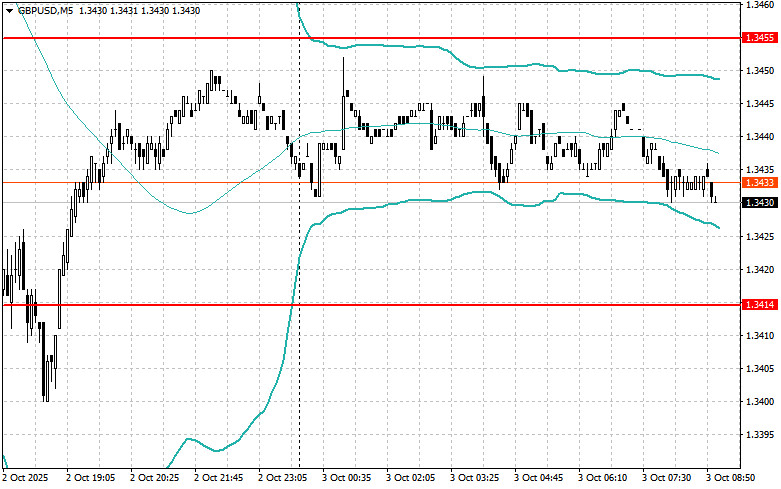

For the GBPUSD pair:

For the USDJPY pair:

For the EURUSD pair:

For the GBPUSD pair:

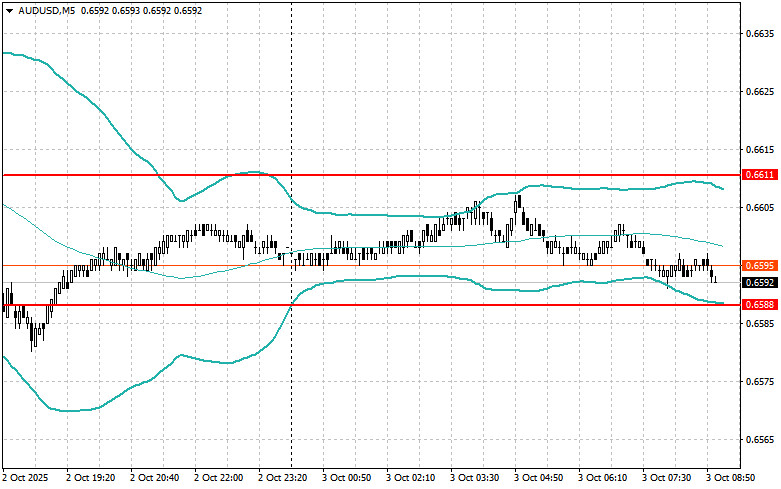

For the AUDUSD pair:

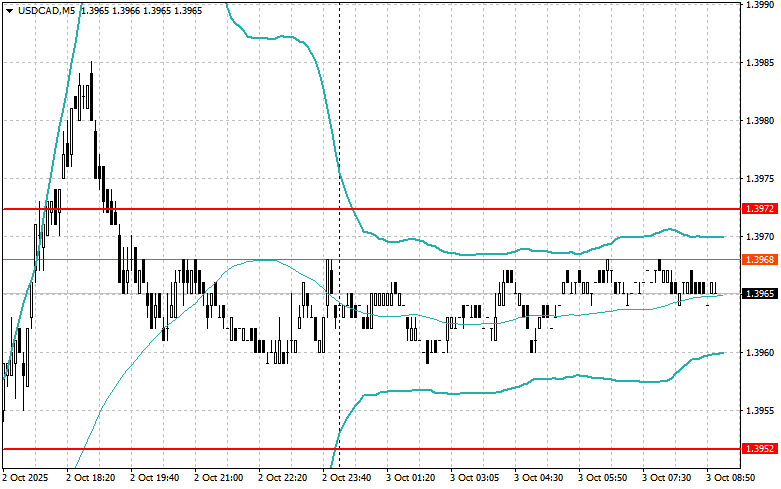

For the USDCAD pair: