Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

Everyone sees what they want to see. For Donald Trump, the S&P 500 rally to record highs is proof that the market likes tariffs. For investors, it's a sign of faith that the U.S. president will eventually back down. The "TACO" trade—or "Trump Always Caves Option"—is thriving. This allows greed to dominate and fear to vanish. Sellers have become a rarity in the stock market, signaling euphoria. Everyone knows how that can end.

At first glance, the market appears full of paradoxes. Trump is threatening 200% tariffs on pharmaceutical imports, yet the NYSE Arca Pharmaceutical Index rose 1% last week, outperforming the S&P 500, which posted almost no gains. For investors, the timeline of tariff implementation matters more than the tariff size itself. The White House's willingness to grant a year to a year and a half to restructure supply chains inspires optimism. Markets are expecting increases in supply volumes and inventories, as well as improvements in corporate performance.

Tariffs of 30–50% against Canada, Mexico, Brazil, and the European Union haven't caused fear either. There's still plenty of time before they go into effect. There's a strong likelihood of trade deals being signed before August 1. As a result, the escalation of the trade conflict is seen as yet another postponement. And there's no guarantee that Trump won't change his mind again in a few weeks and extend the deadline.

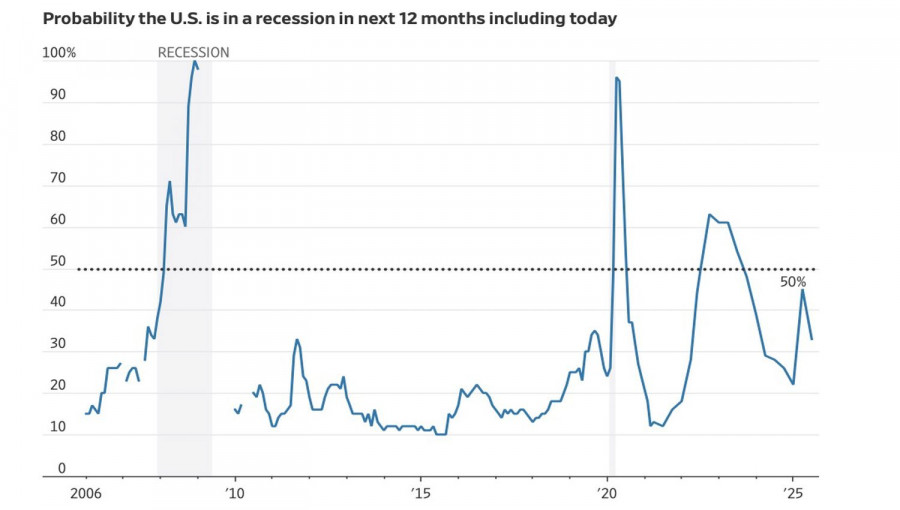

The S&P 500 is also being supported by the surprising resilience of the U.S. economy to high interest rates and tariffs. According to a consensus estimate by The Wall Street Journal, the U.S. economy is expected to grow by 1% in 2025, faster than the 0.8% expected in April. The probability of a recession in the next 12 months has been reduced from 45% to 33%.

The devil turned out not to be as fearsome as he was painted. The previous forecast was made in April, during a market storm driven by tariffs, but the situation now looks much better. Hence, GDP estimates are being revised upward, while inflation forecasts are being lowered. The Wall Street Journal experts now see inflation at 3% by year-end instead of 3.6%. In this context, the release of June's Consumer Price Index data is critically important for the S&P 500.

Market calm could be shattered in an instant if inflation suddenly accelerates. The idea of a federal funds rate cut would be dashed, and recession risks in the U.S. economy could flare up again. That could send the broad equity index plunging.

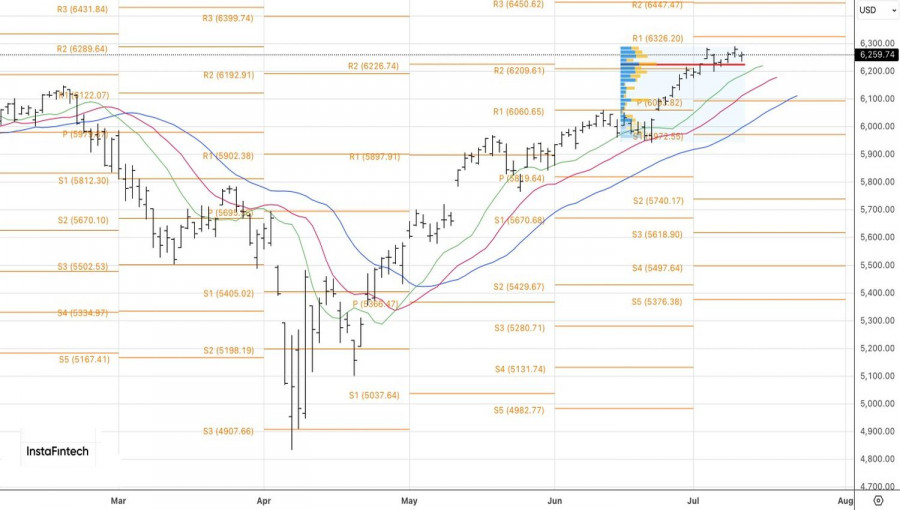

Technically, the S&P 500 daily chart shows a short-term consolidation. Is it a sign of the accumulation of long positions or the distribution of shorts? The answer will be revealed soon. For now, as long as the index remains above its fair value of 6,225, the sentiment stays bullish. Long positions established from the 6,051 level should be held.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.