Last Friday, US stock indices closed mixed. The S&P 500 fell by 0.22%, and the Nasdaq 100 lost 0.55%, while the industrial Dow Jones gained 0.08%.

Today, futures for European indices declined, while oil prices rose, as traders brace for a possible response from Tehran after Washington struck Iran's nuclear facilities over the weekend. The escalation of tensions in the Middle East, especially following reports of strikes on Iran's nuclear sites, has raised concerns about the stability of oil production and transportation in the region. Traders and analysts are closely monitoring Tehran's reaction. Any retaliation could lead to further destabilization and have a significant impact on global financial markets.

The US dollar Index rose by 0.3%, while global oil benchmark Brent gained just 1% after previously surging 5.7%. S&P 500 futures declined by 0.2%, and US Treasury yields moved higher.

Oil remained in the spotlight, as any disruption to the flow through the Strait of Hormuz, the world's most critical artery for oil and natural gas, triggered fears of a spike in energy prices. Although Iranian Foreign Minister Abbas Araghchi said that the country reserves all options for response, there have been no actual signs of disruptions in physical oil flows so far.

Such uncertainty is quickly becoming the new normal for markets, which explains their relatively muted reaction. However, even without immediate consequences, the combination of oil volatility and renewed geopolitical uncertainty is likely enough to dampen risk appetite. According to Goldman Sachs Group Inc., if oil flows through the Strait of Hormuz were halved for one month and remained 10% lower for the next 11 months, Brent prices could briefly spike to $110 per barrel.

As noted earlier, market reaction was generally restrained following Israel's initial strike earlier this month. Even after the pullback over the past two weeks, the S&P 500 is still only about 3% below its all-time high reached in February. The dollar has rebounded just over 1% since hitting a three-year low earlier this month.

The odds are that Iran will likely respond to the United States in some form, and in that regard, the market is expected to react very sharply to any military developments in the region. If the cycle of retaliatory actions continues, increased US fiscal spending could lead to a rise in Treasury yields and stock prices.

Today, traders will analyze macroeconomic data from Europe and the US to assess whether the trade war has already reduced industrial output ahead of the July 9 deadline for the implementation of mutual tariffs. European Central Bank President Christine Lagarde is also scheduled to speak.

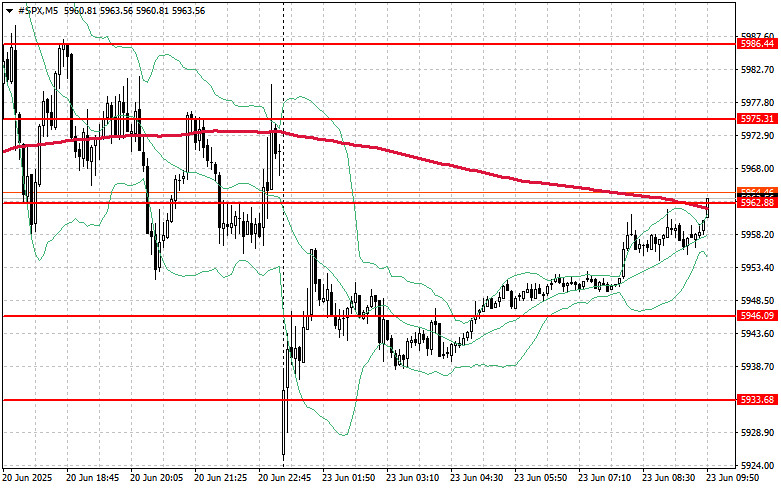

From a technical perspective on the S&P 500, the main task for buyers today will be to break through the nearest resistance at 5,962. This would support further upward movement and open the way for a push toward the next level at 5,975. Just as important is maintaining control above 5,986, which would strengthen the bullish case. On the downside, if risk appetite weakens, buyers must defend the 5,946 area. A break below this level could quickly send the index down to 5,933, opening the path to 5,925.