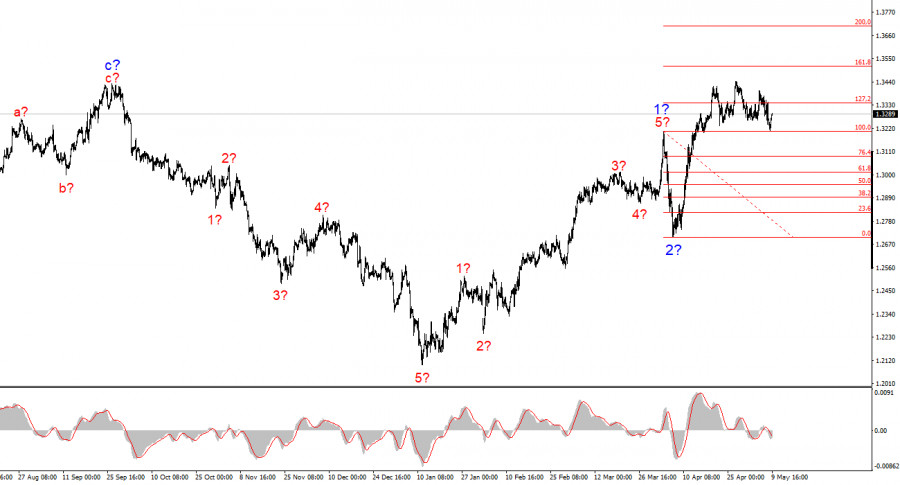

The wave pattern for the GBP/USD instrument has also shifted into a bullish, impulsive structure—"thanks" to Donald Trump. The wave picture is almost identical to that of EUR/USD. Until February 28, we observed a convincing corrective structure that raised no concerns. However, demand for the U.S. dollar began to fall sharply afterward. The result was the formation of a five-wave bullish structure. Wave 2 took the form of a single wave and is now complete. Therefore, we can expect strong growth in the pound as part of wave 3, which has already been developing over the past three weeks.

Considering the fact that news from the UK had no significant impact on the pound's strong growth, one might conclude that it is Donald Trump who is effectively controlling currency rates. If (theoretically) Trump's trade policy changes, the trend may also shift—to a bearish one. Thus, in the coming months (or even years), close attention should be paid to every move made by the White House.

The GBP/USD rate rose by 50 basis points on Friday. The instrument is recovering fairly quickly from the drop following the meetings of two central banks, whose outcomes, in my view, favored the U.S. dollar. Even without delving into details, the key message to the market is clear: the Fed did not alter its monetary policy, while the Bank of England cut interest rates for the second time this year.

In addition, Jerome Powell sees no serious issues in the U.S. economy, does not anticipate a recession, and sees no signs of a "cooling" labor market. At the same time, the Fed Chair admits that inflation might rise soon and that the FOMC may maintain a wait-and-see stance until the end of 2025. This suggests that the Bank of England will likely conduct more rounds of easing than the Fed.

However, the dollar's celebration was short-lived. Even the trade deal between the U.S. and the UK, announced with full pomp by Donald Trump, didn't help. The U.S. president called the agreement a "historic event" and a "very favorable deal for both sides." But he didn't reveal any details, prompting American journalists to question whether Trump was overstating its significance—just one deal out of a potential 75.

Even U.S. journalists sense that Trump is trying to sell them something worth $1 for $100. In reality, the deal with the UK may not be as advantageous for the U.S. as advertised, but Trump needs to present some result to the American public to justify his trade aggression. In truth, this agreement is likely to have a minor positive effect on the U.S. economy. Much more important are deals with the EU and China—neither of which is in sight. So, if the market was briefly uplifted, it was only for a short while.

The wave pattern for GBP/USD has shifted. We are now seeing a bullish, impulsive trend section. Unfortunately, under Donald Trump, markets may face many more shocks and reversals that defy wave patterns and all forms of technical analysis. Wave 3 of the upward trend is still forming, with immediate targets at 1.3541 and 1.3714. Ideally, we'd like to see a convincing corrective wave 2 of 3—but it seems the dollar cannot afford such luxury.

On a higher wave scale, the structure has also turned bullish. We may now assume the formation of a broader upward trend section. The next targets are 1.2782 and 1.2650.

Core Principles of My Analysis: