Trade Analysis and Euro Trading Tips

The test of the 1.1344 price level occurred at a time when the MACD indicator had already moved far below the zero line, which limited the pair's downward potential. For this reason, I didn't sell the euro. A similar situation occurred with the buy signal at 1.1381.

Despite expectations, yesterday's speech by Federal Reserve Chair Jerome Powell didn't spark the anticipated interest in the U.S. dollar. Contrary to logic, the market ignored his remarks about a potential interest rate hike in the near future if necessary. Powell noted that the Trump administration's economic policy could hinder the Fed's objectives. He also mentioned the possibility of keeping rates unchanged until the end of the year, while not ruling out a future hike.

Today, traders will focus on the ECB's key rate decision. A rate cut is expected, including a reduction in the deposit rate, which could weaken the euro. The ECB decision will be the key driver of the euro's short-term movement. The markets have already priced in some probability of a rate cut, so the actual impact will depend on the size of the cut and, more importantly, the accompanying statement. If Christine Lagarde signals a readiness for further easing, the euro may face additional pressure. On the other hand, unexpectedly hawkish rhetoric or a lack of clear hints about further cuts could trigger a euro rally.

As for intraday strategy, I will continue to focus on Scenarios #1 and #2.

Buy Signal

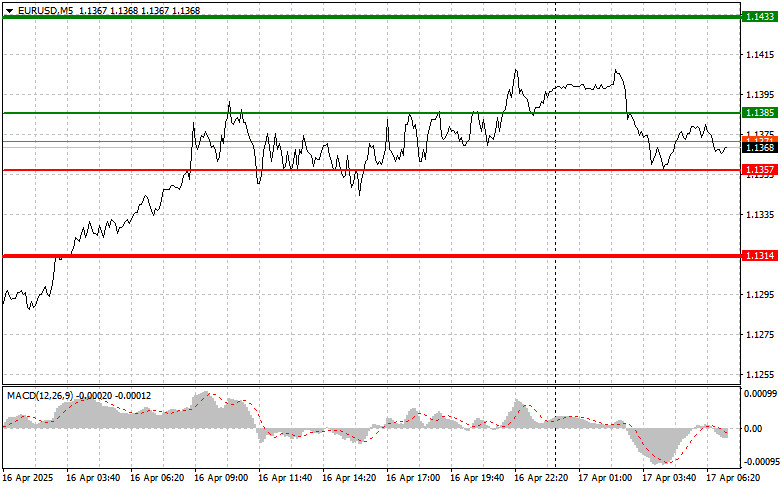

Scenario #1: I plan to buy the euro today upon reaching the 1.1385 level (green line on the chart) with a target of 1.1433. I will exit the trade at 1.1433 and consider selling the euro from that point, expecting a 30–35 point correction. Expect euro growth in the first half of the day as part of the ongoing uptrend following the ECB decision. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1357 price level, at a time when the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a reversal upward. A rise to the opposite levels of 1.1385 and 1.1433 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.1357 level (red line on the chart). The target will be 1.1314, where I will exit the trade and immediately open a buy position (expecting a 20–25 point rebound from that level). Downward pressure on the pair may return in the case of weak data and a dovish ECB stance. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1385 level, at a time when the MACD is in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.1357 and 1.1314 can be expected.

Chart Notes:

Important: Beginner Forex traders must exercise great caution when entering the market. It is best to stay out of the market before the release of important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, your entire deposit could be lost quickly — especially if you don't use proper money management and trade with large volumes.

And remember: to trade successfully, you need a clear trading plan — like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.