The price test at 142.69 occurred just as the MACD indicator was beginning to move up from the zero line, confirming a proper entry point for buying the dollar. As a result, the pair rose by only 15 points.

Today, the speech by the Federal Reserve Chair is expected to reveal the regulator's current views on inflation, interest rates, and the outlook for economic growth. Given the recent market instability and persistent uncertainty in the U.S. economy, Powell's remarks could significantly impact trader sentiment and market dynamics. Traders are especially focused on any signs of a potential monetary policy adjustment, which could substantially influence USD/JPY movement. The gradual slowdown in inflation benefits the Fed, encouraging further monetary easing, which in turn supports the Japanese yen, considering the Bank of Japan's policy of raising interest rates.

Additionally, today's U.S. reports on changes in retail sales and industrial production may influence USD/JPY direction—but only if the data significantly diverge from economists' expectations.

As for the intraday strategy, I will mainly rely on Scenarios #1 and #2.

Buy Signal

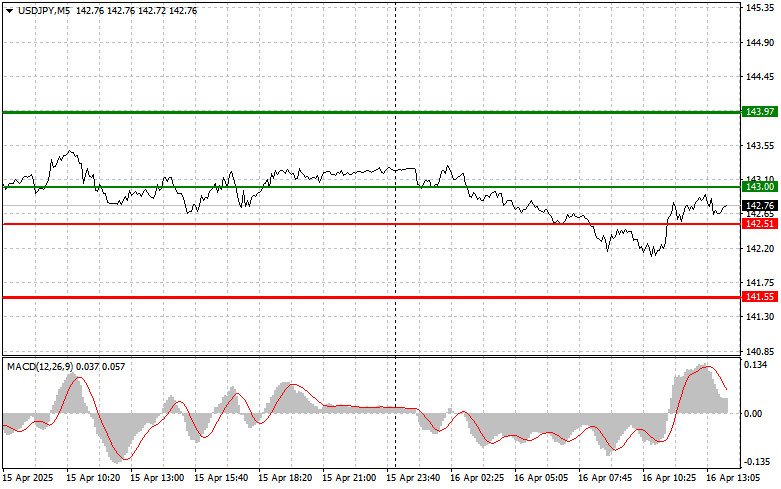

Scenario #1: I plan to buy USD/JPY today at the entry point near 143.00 (green line on the chart), targeting a rise to 143.97 (thicker green line). Around 143.97, I will exit long positions and open short positions in the opposite direction, aiming for a 30–35 point pullback. A rise in the pair can be expected only after strong U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy USD/JPY today if the price tests the 142.51 level twice in a row while the MACD is in oversold territory. This will limit the pair's downward potential and could trigger a reversal upward. A rise to the opposite levels of 143.00 and 143.97 is likely.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a breakout below 142.51 (red line on the chart), which could lead to a rapid decline in the pair. The main target for sellers will be 141.55, where I'll exit short positions and immediately open long positions in the opposite direction, targeting a 20–25 point bounce. Selling pressure on the pair may occur at any moment today. Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today if the price tests the 143.00 level twice in a row while the MACD is in overbought territory. This will limit the pair's upward potential and may lead to a reversal downward. A drop to the opposite levels of 142.51 and 141.55 is likely.

Chart Key:

Important Note:

Beginner Forex traders must make market entry decisions with extreme caution. It's best to stay out of the market before important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit—especially if you don't use money management and trade large volumes.

And remember, successful trading requires a clear trading plan—like the one I've outlined above. Making spontaneous decisions based on the current market situation is fundamentally a losing strategy for an intraday trader.